Balanced: 2024 in review

10 blockchains, cross-chain loans, Savings Rate, intent-based trades, and an economic enshrinement.

During 2024, Balanced experienced an explosion of growth. From new features and blockchain connections to an enshrinement with ICON, it’s time to take a step back and celebrate how far we’ve come.

Savings Rate

The first major announcement of 2024 was the Balanced Savings Rate.

To incentivise people to borrow bnUSD or use other stablecoins to purchase some, Balanced released a Savings Rate feature so you can earn a return for bnUSD. Deposit bnUSD to earn interest in the form of BALN, bnUSD, and sICX, and withdraw whenever you need it.

Incentives come from borrower interest (bnUSD), ICON blockchain emissions (sICX), and 10% of the BALN emissions (125 BALN per day). The reward rate is variable, and will go up if the price of sICX and BALN increases, people take out more loans, and/or the amount of bnUSD deposited decreases.

In the 10 months since launch, the Savings Rate has seen an average return of 17%, with $100k of rewards distributed. At the time of publishing, the reward rate is 14% with 1.26M bnUSD deposited.

Economic enshrinement

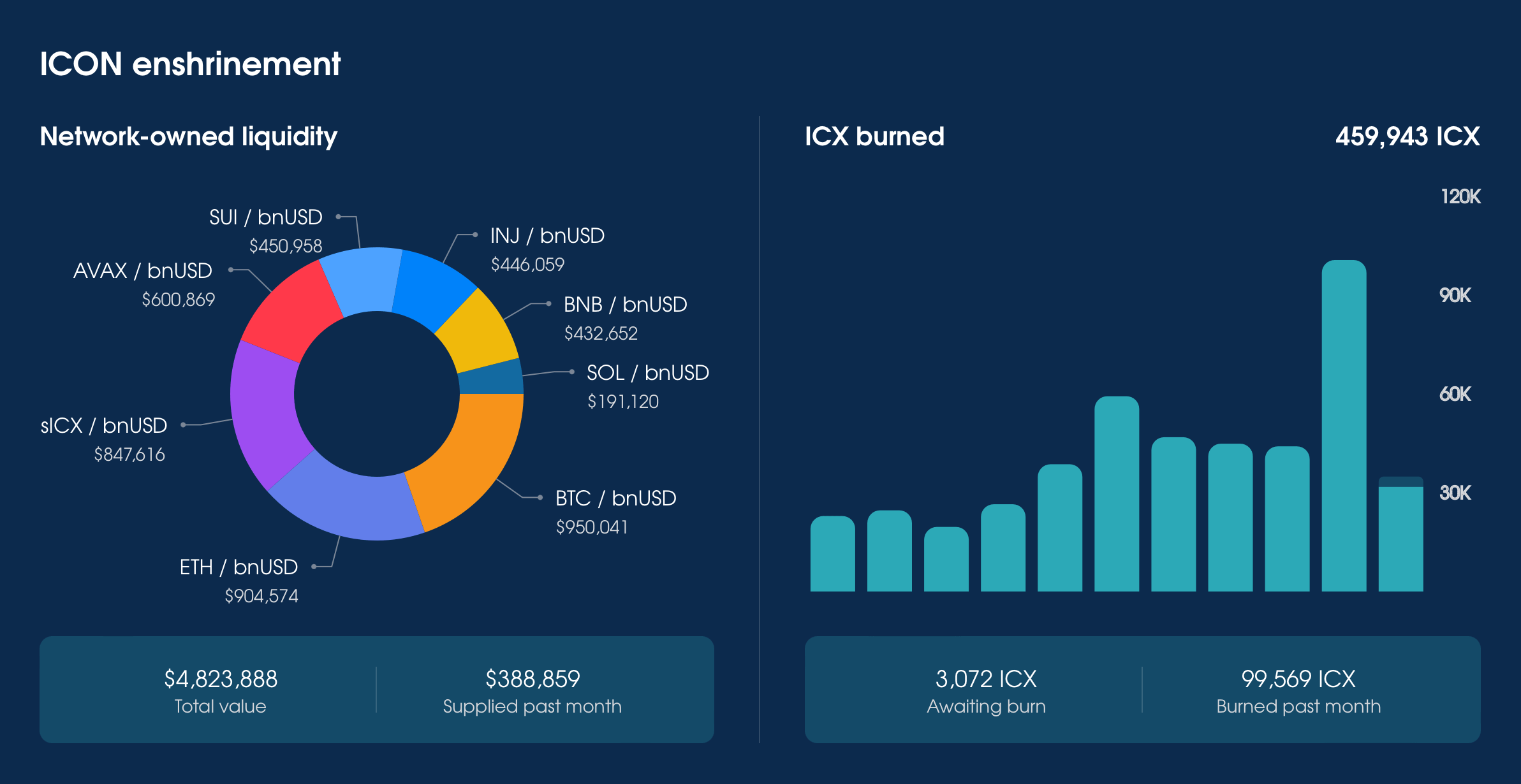

At the end of February, Balanced and ICON agreed to an economic enshrinement with the aim to make Balanced a leading cross-chain DeFi protocol.

In short: ICON would use blockchain emissions (ICX) to provide incentives and network-owned liquidity, and in return, Balanced would use 50% of its revenue to buy and burn ICX.

ICON has provided over $4.8M of liquidity to the Balanced exchange, 442k sICX of incentives for the Balanced Savings Rate, and funded the smart contract work required to add new blockchains and features to Balanced (including audits). The ICON Foundation also sent 1M sICX to the DAO Fund in exchange for 3.1M BALN.

In return, Balanced has burned ~460k ICX. The burn rate has sped up in recent weeks thanks to an increase in trading volume, with November burning more than double the average monthly amount.

bnUSD logo redesign

In April, bnUSD received a new logo in anticipation of more widespread use. The new logo has a stronger, more recognisable identity, which ties in with the brand whether you see it on Balanced or a third-party site.

Cross-chain connections

From two blockchains to 12, Balanced was aggressive in its cross-chain pursuit during 2024, with 10 chains connected since the end of May.

- May 30: Avalanche

- June 19: Arbitrum and BNB Chain

- June 27: Base

- July 22: Havah

- August 20: Injective

- October 10: Sui

- November 28: Stellar

- December 3: Solana

- December 12: Optimism

These connections saw an influx of native tokens to trade and new collateral types for bnUSD, including AVAX, BNB, ETH, INJ, SOL, SUI, and XLM.

Cross-chain loans

Balanced launched cross-chain loans in August, which made it possible for people to borrow bnUSD against crypto on their favourite blockchain.

It now supports 18 collateral types across 10 chains, making it the most flexible cross-chain stablecoin loan on the market. On some chains, bnUSD is the only over-collateralised stablecoin on offer.

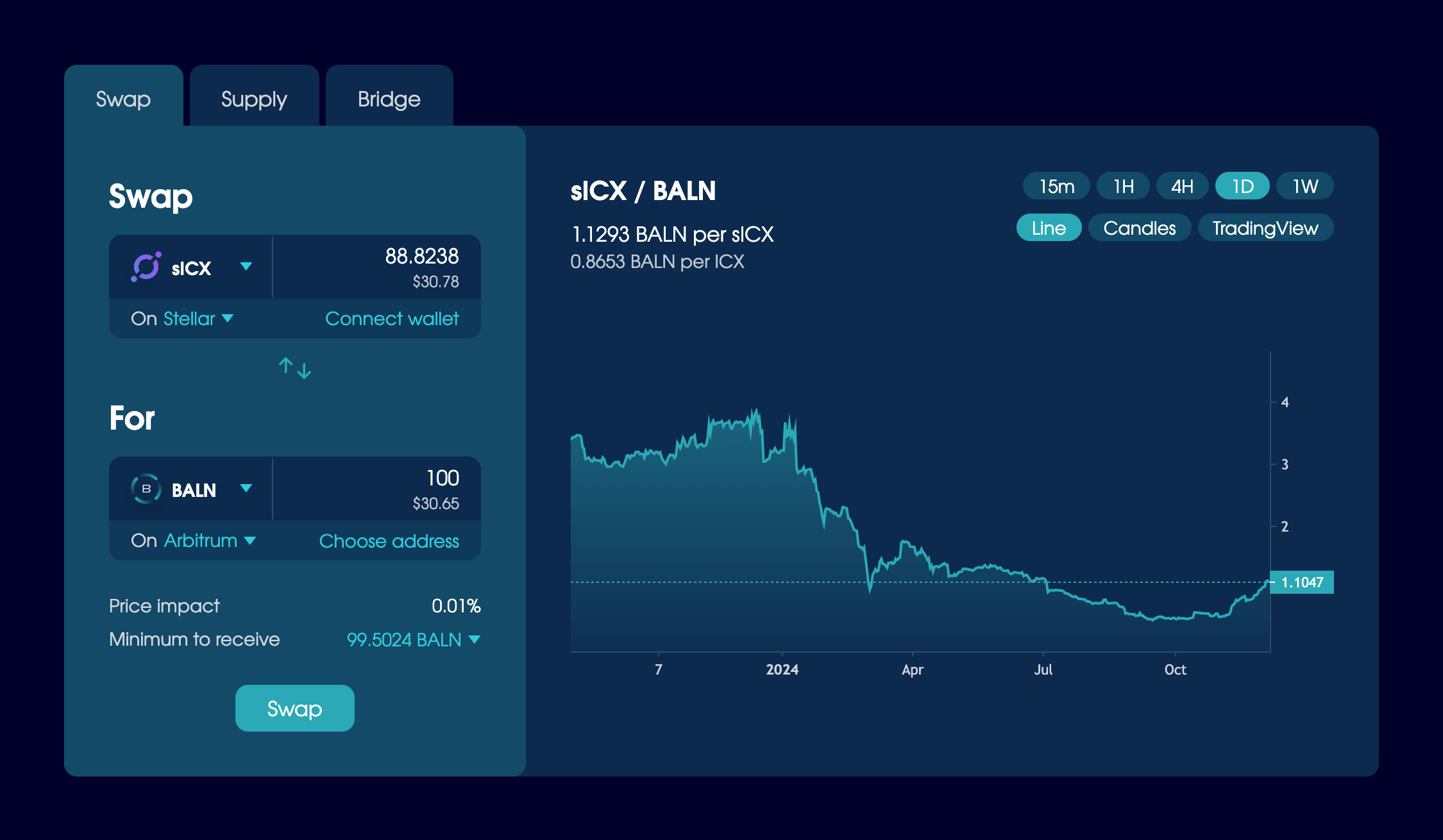

Cross-chain BALN & sICX

In December, BALN and sICX became cross-chain tokens. Available to use on Arbitrum, Avalanche, Base, BNB Chain, ICON, Optimism, and Stellar, with support for Injective, Solana, and Sui coming soon.

Thanks to this release, you no longer need an ICON wallet to hold BALN, which drastically reduces the friction to participate. You can hold, swap, and transfer both tokens wrapper-free, and you can use sICX as collateral to borrow bnUSD on supported chains.

The most important part about this release are the features it unblocks. BALN and sICX are reward tokens for the Savings Rate and liquidity pools, so from early 2025 you’ll be able to supply liquidity, deposit bnUSD into the Savings Rate, and earn rewards on your favourite chain.

Intent-based trades

December 12 saw the soft-launch of Balanced Intents, with an official release one week later. Intent-based trades provide a more efficient trading experience, with lower fees, zero slippage, and an average 5 second settlement time. Here’s how it works at a high-level:

- Traders submit a swap request (an “intent” to trade).

- A solver (market maker) immediately releases the funds to fulfil the swap, with no slippage risk borne by the trader.

- The solver finds the most cost-effective path to rebalance itself.

The app will default to an intent-based trade whenever it provides a better rate than the Balanced liquidity pools. To complete a trade, the solver (run by ICON) connects to external exchanges: Uniswap on Arbitrum and Cetus on Sui.

You can use intents to trade up to $5,000 between Arbitrum ETH and SUI, and restrictions will lower over time. Eventually, Balanced Intents will be able to handle trades of up to $80,000 with any token on supported blockchains. This will make it easier for Balanced to win a range of trades when it gets listed on DEX aggregators in early 2025.

Governance

The many features Balanced launched during 2024 would not be possible without extensive smart contract updates. These updates require approval from the Balanced community, making them largely responsible for the 64 votes proposed over the past year.

Thanks to our community of bBALN holders for your regular participation.

Smart contract audits

With countless updates and features shipped during 2024, increased due diligence through smart contract audits was essential.

Thanks to the support of ICON, Balanced has received audits for its contracts on EVM chains, Sui, Solana, and Stellar, with a second audit for Sui currently in progress.

View the final audit reports in the docs: docs.balanced.network/security.

Coming in 2025

Balanced has come a long way in the past year, but there’s more to come in 2025.

Cross-chain liquidity and rewards will be the first major release, allowing people to supply liquidity, earn rewards, and use the Savings Rate on any connected chain. To reduce the barrier to entry, the Savings Rate will also add support for other stablecoin deposits, which it will convert to bnUSD in the background.

Intent-based trading will heat up with support for Solana, increased trading sizes, access to external tokens, and listings on DEX aggregators.

2025 will also see more blockchain connections, like Polygon, Stacks, and Nibiru. And along with that, support for even more collateral types.

Thanks to everyone who’s joined Balanced on its cross-chain journey. We’ve accomplished a lot during 2024, and we’ll be here to do it all again next year.

To stay in the loop with everything that’s happening in the world of Balanced, join us on Discord and subscribe to receive blog posts via email: