Roadmap update | Q1 2025

3 new blockchain connections, intent-based trades, and BALN goes cross-chain.

During the fourth quarter of 2024, the Balanced contributors launched BALN cross-chain, connected to Stellar, Solana, and Optimism, and released intent-based trades between Arbitrum and Sui. They also completed a second smart contract audit for Sui, added support for external liquidity rewards, and prepared for the release of cross-chain liquidity and Savings Rate.

Here’s what the contributors accomplished since the Q4 roadmap update:

Smart contracts

- Completed a second Sui smart contract audit with Hashlock

- Deployed intent contracts for Arbitrum and Sui

- Deployed a Proof of Liquidity contract to support external liquidity rewards

- Added afSUI, haSUI, vSUI, and mSUI as collateral types

- Deployed intent-based trades between Arbitrum and Sui

- Began work on intents for ICON, Polygon, Base, Solana, and Stellar

- Began work on an exact_out feature for intents

- Launched BALN and sICX cross-chain

- Upgraded the DEX contract to support cross-chain liquidity

- Updated the Rewards contract to support cross-chain rewards

- Deployed contract upgrades for the cross-chain Savings Rate

Front-end / back-end

- Launched Balanced on Stellar

- Launched Balanced on Solana

- Launched Balanced on Optimism

- Launched intent-based trades

- Launched BALN and sICX cross-chain

- Added support for the new ICX/sICX liquidity pool

- Added support for external liquidity rewards via the Proof of Liquidity contract

- Added the USD value to currency input fields on the Trade page

- Added USDC on Sui

- Added afSUI, haSUI, and vSUI collateral types

- Finalised the design for cross-chain liquidity and rewards

- Began implementing cross-chain liquidity and rewards

- Added trading support for afSUI, haSUI, vSUI, tBTC, weETH, and wstETH via intents

Quality of life & code improvements

- Added the ability to activate new Stellar wallets for free

- Fixed an issue with the XLM trend line

- Updated public packages on npm

- Updated the BNB Chain connection to work with the new cluster relay

- Added an empty state to the wallet dropdown

- Removed METX and FIN from the token list

- Added all core pools to the Liquidity Pools section (instead of just incentivised ones)

- Fixed formatting and decimal issues for various tokens

- Fixed an issue that prevented JitoSOL transfers from Solana to ICON

- Improved the cross-chain loan experience

- Enhanced a range of details on the Trade page

- Added handling for SOL sent to new Solana wallets

Website & marketing initiatives

- Published Balanced connects to Stellar

- Published Balanced connects to Solana

- Published BALN and sICX: now available cross-chain

- Published Balanced connects to Optimism

- Published Trade across chains with Balanced Intents

- Published Balanced 2024: A year in review

- Updated the Balanced X/Twitter handle from BalancedDAO > BalancedDeFi

- Continued regular social media posting

- Prepared for the launch of cross-chain liquidity and rewards

Cross-chain progress

During the last quarter of 2024, Balanced launched on Stellar, Solana, and Optimism. The number of connected chains now stands at 12.

BALN and sICX are now available on 10 blockchains. It started with Arbitrum, Avalanche, Base, BNB Chain, Optimism, and Stellar in December, and Injective, Solana, and Sui followed in January. This release unlocks cross-chain rewards, which will launch alongside cross-chain liquidity pools and Savings Rate this quarter.

Cross-chain governance is currently on pause due to the complexity of the smart contracts, but will be resumed later this year.

Work has begun to connect Balanced to Polygon, which will launch in a few weeks. Stacks and Nibiru are also incoming, but their launch timeline is not yet clear.

Intent-based trades

In December, Balanced launched a proof of concept for intent-based trades. Initially, it offered the ability to trade between Arbitrum ETH and SUI, thanks to connections to Uniswap and Cetus, respectively. Last week, we unlocked the ability to trade afSUI, haSUI, vSUI, tBTC, weETH, and wstETH – tokens which until then, were only available to use as collateral.

Intent-based trades are a major focus of 2025, with connections to ICON, Polygon, Base, Solana, and Stellar currently underway. Each of these connections will improve trading times and unlock the ability to trade a wide array of tokens which aren’t available via Balanced’s liquidity pools.

Balanced will use intent-based trades to connect to a range of decentralised exchanges, including big players like LI.FI. The goal: become a cross-chain aggregator that always provides you with the best price and settles trades in an average of 5 seconds.

Governance updates

Governance continued at a regular pace over the last 3 months, with 12 proposals submitted to a vote:

- BIP 98: Update rate and deposit limits, and fix an issue with Sui token addresses

- DFP 11: Send $50k from the DAO Fund to a community member who reported a critical bug in the Balanced protocol

- BIP 99: Take BALN cross-chain and fix an issue with bnUSD on Stellar and Optimism

- BIP 100: Add Mirai Staked SUI (mSUI) as a collateral type

- BIP 101: Increase the deposit limit for assets in the Stability Fund

- DFP 12: Fund 6 months of work on the Balanced app and website

- BIP 102: Enable cross-chain liquidity and rewards, and upgrade the router to support swaps for cross-chain tokens like BALN and sICX

- BIP 103: Borrow $10k of ETH and SUI liquidity to fund intent-based trades and configure various limits

- BIP 104: Add a Proof of Liquidity contract to incentivise pools with external rewards

- BIP 105: Add BALN to Injective, Solana, and Sui; introduce a cluster connection for BNB Chain

- BIP 106: Update withdrawal/deposit limits for several tokens, and allow cross-chain transfers from the DEX, Rewards, and Savings Rate contracts

- DFP 13: Use $18k of sICX and $3.5k of BALN to fund a marketing campaign on Sui (in progress)

DAO performance

Over the last 3 months, Balanced earned $82,053 from fees:

- 4,750 bnUSD from loans

- $56,990 from swaps

- $20,313 from Stability Fund swaps

$12,308 of that was distributed to bBALN holders, which gives BALN a 30-day trailing APR of 3.58%.

$41,027 was used to buy and burn ICX, fulfilling Balanced’s role in the economic enshrinement. Balanced’s net profit for the quarter was $28,719.

Balanced’s holdings decreased by $265,941. The DAO Fund saw an increase of $140,348, but protocol-owned liquidity fell by $406,290 due to DFP 12 (which funded 6 months of Balanced work) and the price performance of BALN and sICX.

13,143,004 BALN have been locked in 820 wallets. There’s a total of 6,611,130 bBALN, giving an average lock-up time of 2.01 years.

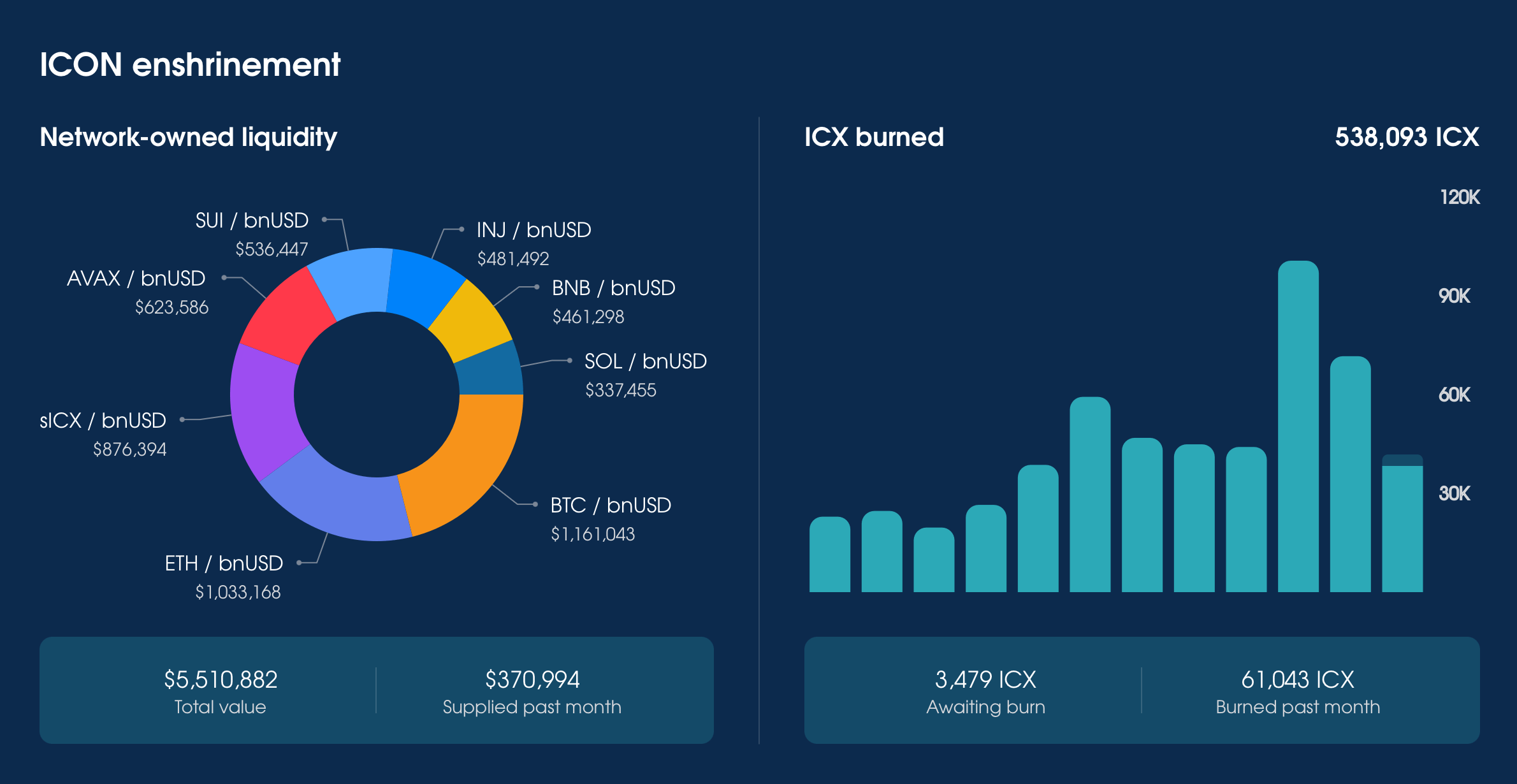

Enshrinement

In the 11 months that have passed since the economic enshrinement was enacted:

- Balanced has burned 538,093 ICX

- ICON has supplied ~$5.5M of liquidity for AVAX, BNB, BTC, ETH, INJ, sICX, SUI, and SOL

- ICON has provided ~498,180 sICX of incentives for the Balanced Savings Rate

Keep an eye on the enshrinement stats from burn.icon.community and the ICON enshrinement section on the Stats page.

Plans for Q1 2025

During Q1, the Balanced contributors plan to:

- Launch cross-chain liquidity pools, Savings Rate, and rewards

- Support alternative stablecoin deposits via the Savings Rate

- Launch support for intent-based trades on ICON, Polygon, Base, Solana, and Stellar

- Support additional tokens via intent-based trades

- Launch Balanced on Polygon

If you have any questions or want to discuss these updates, start a discussion on the Balanced forum or in the Balanced Discord channel.