Roadmap update | Q4 2024

Cross-chain loans, two blockchain connections, six collateral types, and a look at what’s coming next.

During the third quarter of 2024, the contributors launched cross-chain loans and connections to Injective and Sui. They also completed smart contract audits for Sui, Solana, and Stellar, took initial steps to make BALN cross-chain, moved to a “soft” liquidation model, and released a wave of new collateral types.

Here’s what the contributors have accomplished since the Q3 roadmap update:

Smart contracts

- Completed a Solana smart contract audit with Hashlock

- Completed a Sui smart contract audit with MoveBit

- Worked with CoinSpec to audit the Stellar smart contracts

- Upgraded the Loans contract to a “soft” liquidation model

- Deployed Balanced smart contracts on:

- Sui

- Solana

- Stellar

- Deployed a Pyth oracle to support our diverse range of collateral types

- Worked on cross-chain liquidity and rewards

- Performed integration testing for Stacks

- Completed a proof of concept for intent-based swaps

- Prepared to launch BALN and sICX cross-chain

- Added INJ, tBTC, cbBTC, weETH, wstETH, and SUI as collateral types

- Added support for USDT on Arbitrum and Avalanche

- Added support for USDC on Injective and Sui

Front-end / back-end

- Launched cross-chain loans

- Launched Balanced on Injective

- Launched Balanced on Sui

- Prepared to launch Balanced on Stellar and Solana

- Designed the interface for concentrated liquidity

- Added INJ, tBTC, cbBTC, weETH, wstETH, and SUI as collateral types

- Added support for USDT on Arbitrum and Avalanche

- Added support for USDC on Injective and Sui

- Added the ability to borrow and repay bnUSD loans on Archway and Havah

- Began work on a Balanced SDK

- Began the design for cross-chain rewards

- Began the design for a liquidity incentives dashboard

Quality of life and code improvements

- Improved the handling of multi-chain tokens

- Updated the demo and added it to the primary navigation on the website and Stats page

- Fixed bugs with the collateral chart on the Stats page

- Added asset colours to the pie charts on the Stats page

- Removed deprecated tokens (IUSDC, USDS, FIN) from the app and Stats page

- Fixed issues that affected specific wallets like Hana and Metamask

- Refactored various cross-chain components

- Merged the app & Stats page repositories

- Updated the app & Stats page for the change in BALN allocation

- Updated the list of tokens with withdrawal limits on the Stats page

- Removed the outdated white paper from the docs

- Added a contract interaction guide and DEX aggregator guide to the docs

- Made a number of enhancements to cross-chain loans

- Updated the docs for soft liquidations and the change in BALN allocation

Marketing initiatives

- Published bnUSD: now available to borrow cross-chain

- Published Balanced connects to Injective

- Published Balanced connects to Sui

- Published an updated version of the bnUSD stability article

- Began publishing SEO-driven content

- Published Pioneering the cross-chain loan design

- Helped the ICON team with a Balanced presentation for the Stellar conference

- Continued regular social media posting

- Prepared content for the Stellar and Solana launches

Cross-chain progress

Since the last roadmap update, the Balanced app connected to Injective and Sui, servicing a total of 9 blockchains.

Connections to Stellar and Solana are imminent, and Stacks, Optimism, and Polygon are also planned for Q4 so we can close out the year with 14 blockchain connections.

Aside from new blockchains, Balanced now supports cross-chain loans, so you can use a range of assets as collateral to borrow bnUSD on any connected chain.

BALN and sICX are expected to make their cross-chain debut on Avalanche in a matter of days. After thorough testing, they’ll be made available on every connected chain.

Cross-chain rewards will come next, including a cross-chain Savings Rate. And cross-chain governance is also in the works, which will allow you to lock up BALN on any connected chain.

Cross-chain liquidity and intent-based trading

We previously planned to launch concentrated liquidity before the end of the year, but due to a change in developer circumstances, this is now expected in early 2025. In the meantime, there are two core features in the works to improve the trading experience, both of which will launch this quarter.

The first is cross-chain liquidity pools, which will allow people to supply liquidity – and earn rewards – on any supported chain. Without the need to set up an ICON wallet and bridge tokens across, it reduces the friction for new Balanced users to participate.

The second is intent-based trading, which will allow near-instant settlement for trades of up to $80,000, at a fraction of the cost. Traders place an order for a certain price, labelled as an intent, then a solver (market maker) settles the trade and releases the funds.

Balanced is in a prime position for cross-chain intent-based trading. Few options exist outside the EVM ecosystem due to a lack of market makers. But ICON can use its network-owned liquidity to act as the solver, and the relays and other infrastructure it demands are already available through ICON’s cross-chain framework.

As there’s a lot of competition within the EVM ecosystem, we’ll start with intent-based trading for SUI/ETH as a proof of concept, which should allow Balanced to win all SUI<>ETH trades once listed on DEX aggregators. From there, we’ll release support for one new trading pair at a time.

If you trade on Balanced, the interface won’t change, but you will get to enjoy lower fees and near-instant transaction times for certain trades.

Governance updates

Governance remained active over the last 3 months, with 9 proposals submitted to a vote. In an attempt to reduce the burden for voters, most changes are now contained within a single weekly proposal.

- BIP 89: Add weETH and wstETH for internal testing, configure interest rate for BTC-backed loans, and allow bnUSD to be minted on Archway and Havah

- BIP 90: Connect to Sui and upgrade the Rewards contract to support proof of liquidity

- BIP 91: Add Injective USDC, upgrade the cross-chain contracts, and improve USDT pricing

- BIP 92: Add 10% interest to legacy BTCB-backed loans, and add cbBTC, tBTC, weETH, and wstETH as collateral types

- BIP 93: Adjust the BALN allocation, upgrade to soft liquidations, connect to Stellar, and add SUI collateral

- BIP 94: Connect to Solana, add XLM collateral, and add XLM and SUI to the pyth oracle

- BIP 95: Add Sui USDC, set a $100 minimum debt threshold for soft liquidations, and make SUI/bnUSD eligible for BALN rewards

- BIP 96: Add the SOL price feed to the pyth oracle

- BIP 97: Add SUI LSTs and SOL as collateral, and make XLM/sICX eligible for BALN rewards (still underway)

Most proposals focused on adding support for new blockchains and tokens, but there were some additional items, like the move to a soft liquidation model, where, rather than a full liquidation, a borrower’s collateral will only be partially liquidated to reduce their risk unless they have less than $100 of debt.

Loans backed by the legacy BTCB token on ICON now cost 10% interest to incentivise people to bridge it back to BNB Chain.

The DAO also adjusted the allocation for BALN emissions to 60% liquidity, 30% DAO Fund, and 10% Savings Rate, which means borrowers and the Balanced contributors no longer earn BALN.

DAO performance

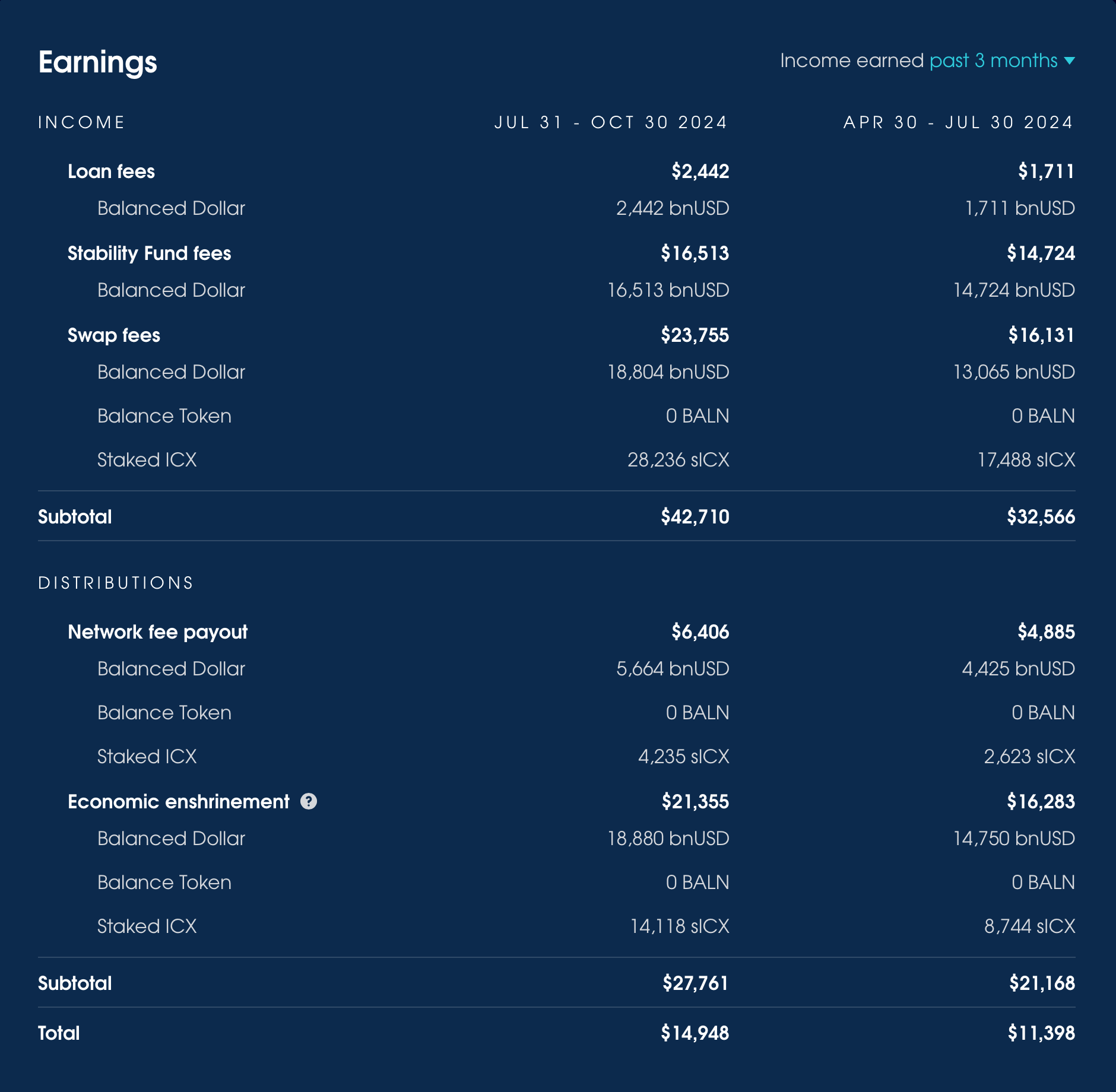

Over the last 3 months, Balanced earned $42,710 from fees:

- 2,442 bnUSD from loans

- $23,755 from swaps

- $16,513 from Stability Fund swaps

$6,406 of that was distributed to bBALN holders, which gives BALN a 30-day trailing APR of 1.23%.

$21,355 was used to buy and burn ICX, fulfilling Balanced’s role in the economic enshrinement.

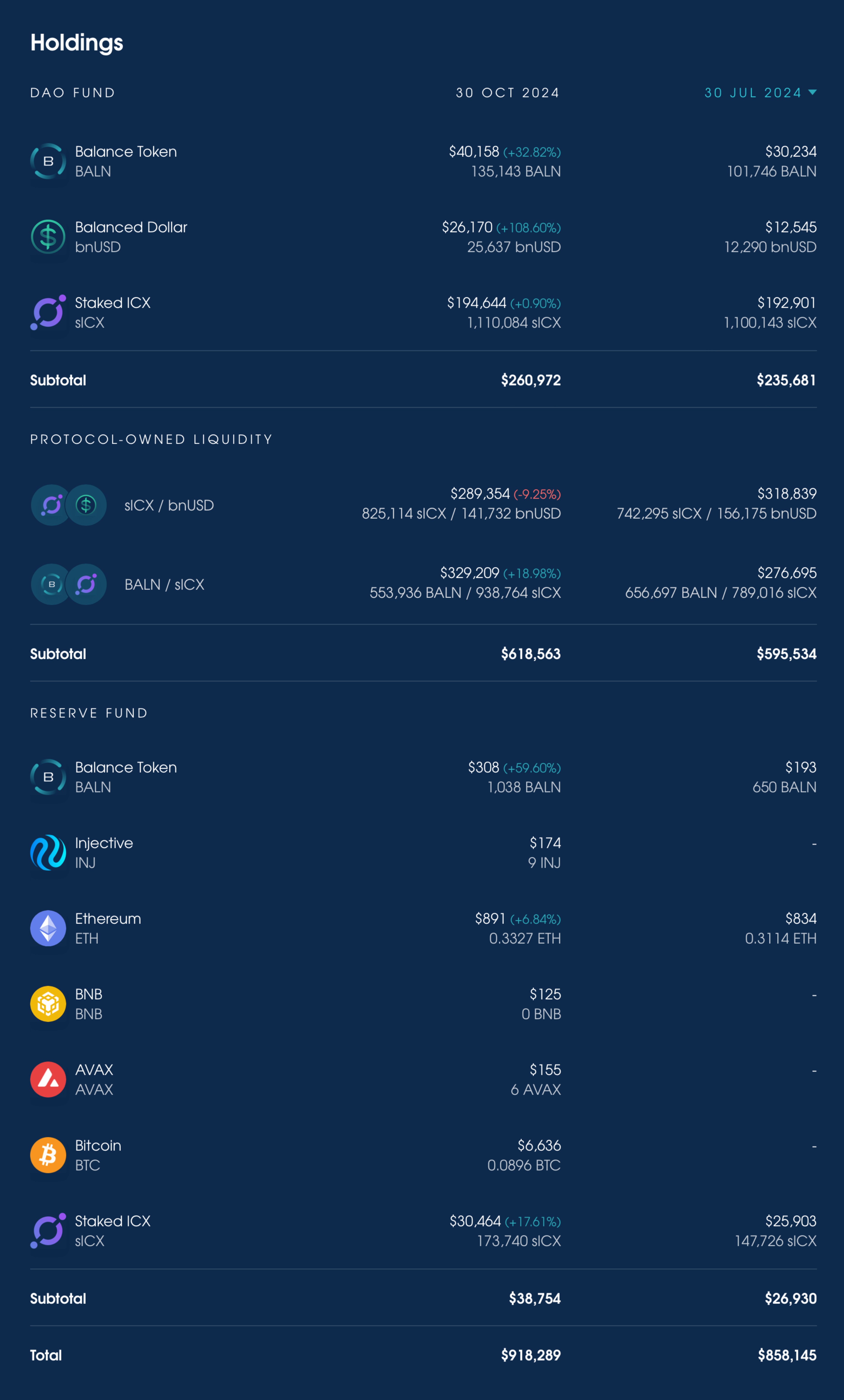

Holdings have increased by $60,144 since the last roadmap update, largely due to the remaining $14,948 of earnings and an increase in asset prices.

15,827,627 BALN have been locked in 885 wallets. There’s a total of 7,175,437 bBALN, giving an average lock-up time of 1.81 years.

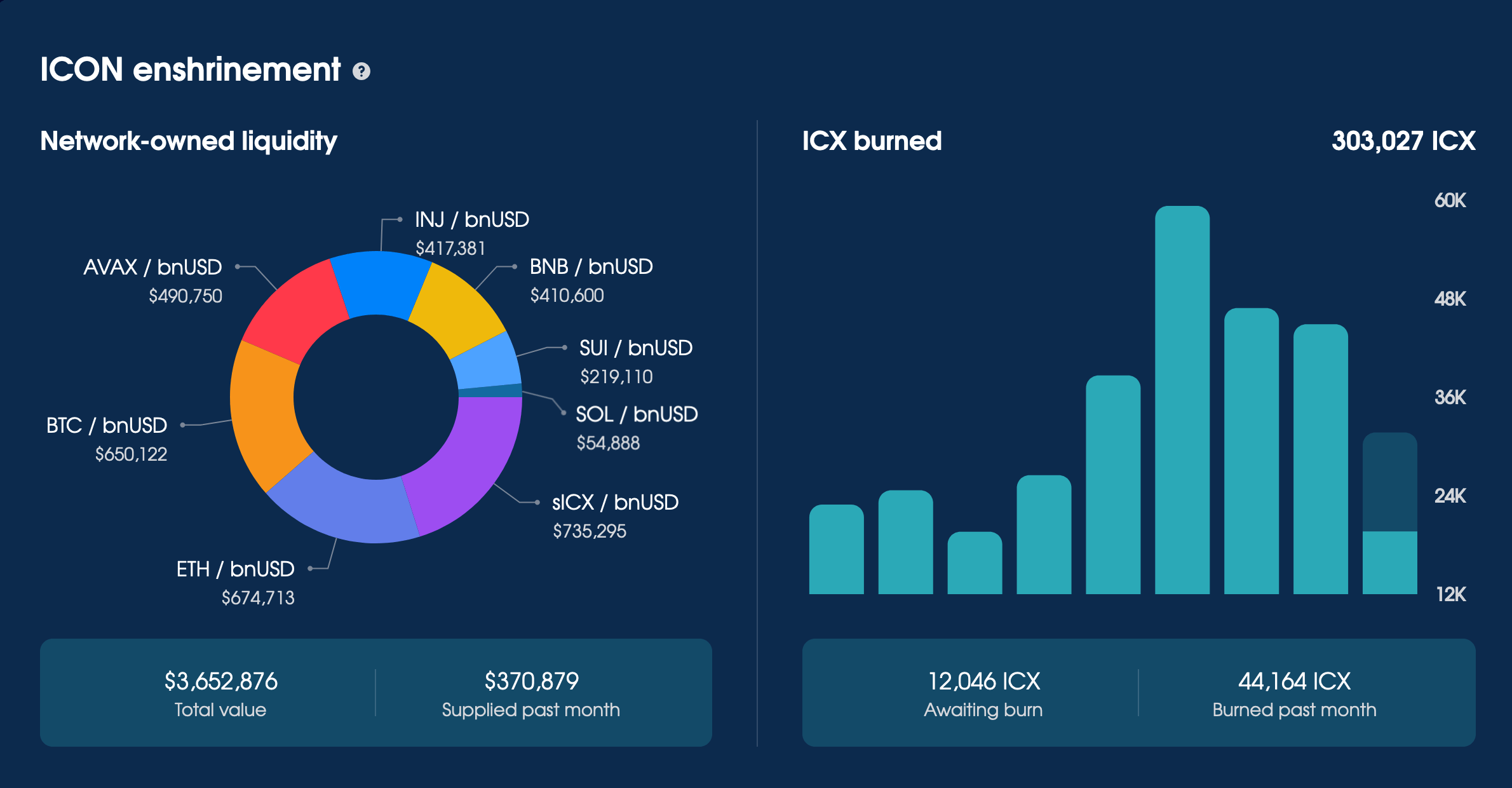

Enshrinement

In the eight months that have passed since the economic enshrinement was enacted:

- Balanced has burned 303,027 ICX

- ICON has supplied ~$3.6M of liquidity for AVAX, BNB, BTC, ETH, INJ, sICX, SUI, and SOL

- ICON has provided ~391,077 sICX of incentives for the Balanced Savings Rate

Keep an eye on the enshrinement stats from burn.icon.community and the ICON enshrinement section on the Stats page.

Balanced wallpapers & NFTs

The cover for this roadmap update, Wave, has been added to the collection of Balanced wallpapers.

The animated version has been added to the Balanced NFT collection, which you can view on the Balanced website:

Wave is the last NFT we’ll release for the Balanced collection on ICON. For a chance to win it, share your favourite update from the roadmap on X/Twitter and tell us why it matters.

The post with the most engagement wins, so make sure to tag @BalancedDeFi to get it re-shared. The winner will be announced in 10 days.

Plans for Q4 2024

There are only a few months left in the year, but the Balanced contributors are not slowing down. During Q4, they plan to:

- Launch Balanced on:

- Stellar

- Solana

- Optimism

- Polygon

- Stacks

- Launch intent-based trading

- Get Balanced listed on DEX aggregators

- Launch BALN and sICX on every connected chain

- Launch cross-chain liquidity pools

- Launch cross-chain rewards

If you have any questions or want to discuss these updates, start a discussion on the Balanced forum or in the Balanced Discord channel.