How bnUSD maintains its peg

A deeper dive into rebalancing and the Stability Fund.

Balanced Dollars is an over-collateralised stablecoin that aims to maintain a peg against the US Dollar. It can be created using leverage (deposit cryptocurrency as collateral and borrow bnUSD against it) or via arbitrage (deposit other stable assets into the Balanced Stability Fund).

The most important aspect of any stablecoin is the underlying mechanism that keeps it stable. It's essential to understand this mechanism to properly assess the risks associated with holding it.

Balanced Dollars use a combination of two mechanisms: the Balanced Stability Fund and rebalancing.

Balanced Stability Fund

The Stability Fund is a simple yet powerful mechanism that leverages other stablecoins to maintain the stability of bnUSD. Balanced has a list of approved stable assets (currently Orbit Bridge USDC and USDS) that can be deposited into the fund to mint bnUSD 1:1 (minus a fee), and vice versa.

The Stability Fund mechanism allows traders to take advantage of arbitrage if there is a mispricing of bnUSD against other stablecoins. For example, if bnUSD were trading at 1.05 USDS, a trader could deposit 1 USDS into the Stability Fund, receive 1 bnUSD, swap that 1 bnUSD for 1.05 USDS, and repeat the process until the price is in parity.

The Stability Fund is the primary support mechanism for the bnUSD peg.

Rebalancing

If the Stability Fund provides insufficient profit for arbitrage traders, the rebalancing mechanism can be used as a last resort to maintain the purchasing power of bnUSD against more volatile assets. Rebalancing automatically mints/burns bnUSD to stay within a certain range of the $1 peg.

To analyse how this works in practice, the best place to look is the Balanced liquidity pool for sICX/bnUSD. For simplicity, I’ll assume that the aforementioned range and all fees are 0%.

If a trader has bnUSD and is looking to purchase ICX, the trader only has one option: sell bnUSD for ICX using the Balanced liquidity pool. However, Balanced has an automated mechanism, rebalancing, to correct the price of the liquidity pool in the case that arbitrage using the Stability Fund is failing or insufficient.

Let’s look at a scenario:

- Balanced: 1 ICX = 4 bnUSD

- Market price on exchanges: 1 ICX = 4 USD

Now, imagine the market price of ICX drops to 2 USD. The new situation is:

- Balanced: 1 ICX = 4 bnUSD

- Market price on exchanges: 1 ICX = 2 USD

There is now a clear price difference between the market price of ICX and the price offered by Balanced.

Rebalancing will sell some ICX collateral from borrowers in exchange for bnUSD from the Balanced DEX, basically creating a redemption mechanism for bnUSD. The bnUSD is then used to repay the debt of the borrowers at a favorable price (favorable vs the market price of ICX) and burned.

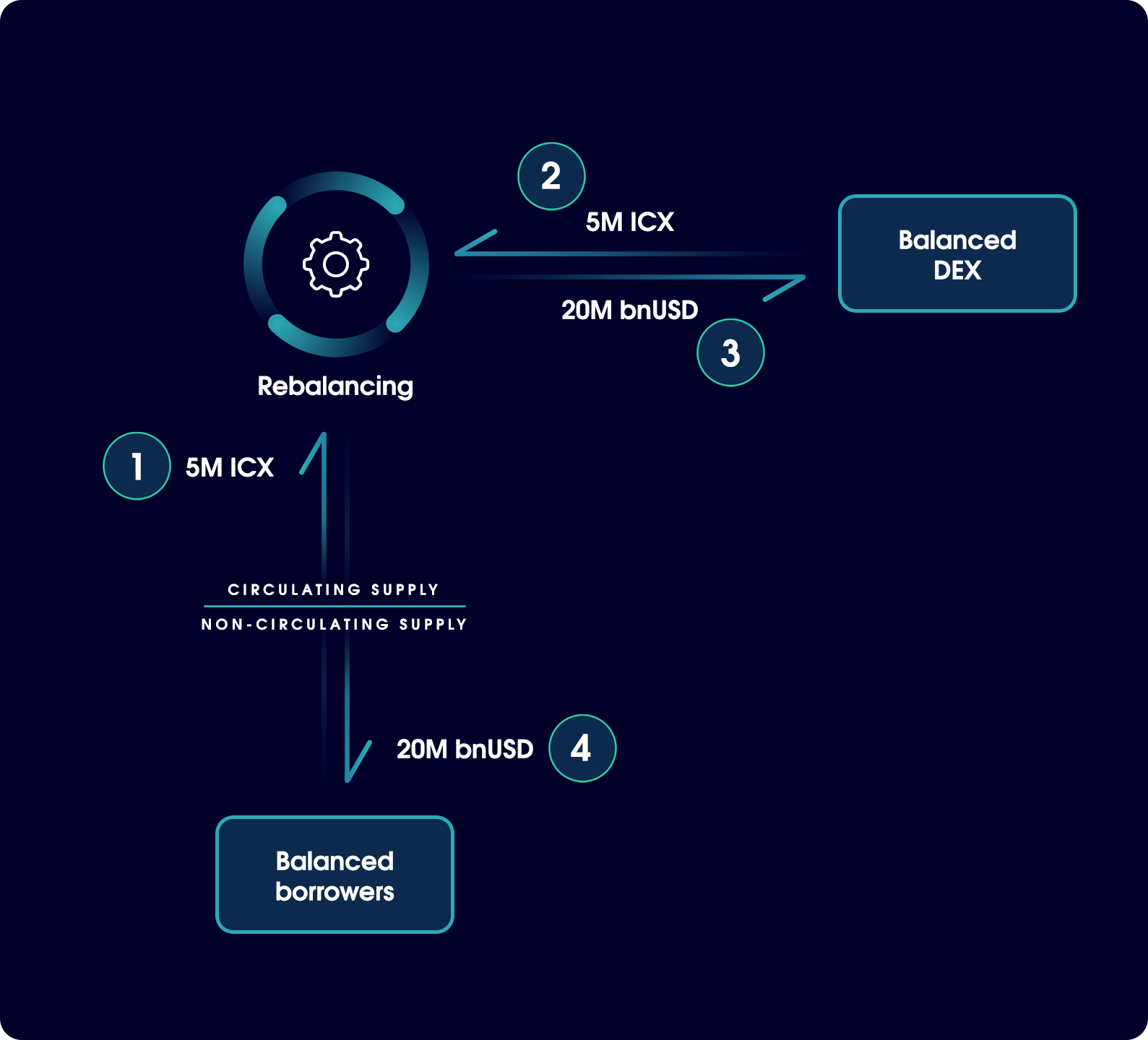

Here’s the flow of funds for rebalancing (numbers are just examples):

- 5M ICX is removed from the collateral pool, taken pro-rata based on total bnUSD debt.

- 5M ICX is sold on the Balanced DEX for 20M bnUSD.

- 20M bnUSD is used to pay off borrower debt (pro-rata based on total bnUSD debt) and burned.

- This continues until the Balanced DEX price equals the market price of ICX.

The end result of this trade is that all Balanced borrowers have some of their ICX collateral sold at a favourable price (versus market value) to help maintain the peg of bnUSD. This increases the circulating supply of ICX and decreases the circulating supply of bnUSD.

Conclusion

From a high-level, bnUSD isn’t as complicated as it may seem. It has two mechanisms to keep it stable: the Stability Fund to create arbitrage, and rebalancing as a last resort.

After reading this post, my goal is for users and supporters of Balanced to better understand the inner workings of the product and perhaps give them more confidence when using the product and explaining it to others.