Roadmap update | Q3 2024

Five blockchain connections, smart contract audits, cross-chain enhancements, and 19 proposals.

During the second quarter of 2024, the contributors launched Balanced on five blockchains in quick succession. They also prepared for cross-chain loans, completed a smart contract audit, and squashed bugs that came up during this period of rapid development.

Here’s what the contributors accomplished since the Q2 roadmap update:

Smart contracts

- Deployed smart contracts on:

- Arbitrum

- Base

- Optimism

- Prepared smart contracts to deploy on Polygon

- Completed a Solidity (EVM) smart contract audit with Hashlock

- Worked with MoveBit to audit the Move (Sui) smart contracts

- Unified wBTC from Arbitrum and BTCB from BNB Chain under a single BTC token

- Made progress on the Clarity integration for Balanced and GMP contracts on Stacks

- Reached the integration testing phase for Balanced and GMP contracts on Solana

- Added functionality to the router contract to support Stability Fund swaps

Front-end / back-end

- Launched Balanced on:

- Avalanche

- Arbitrum

- BNB Chain

- Base

- Havah

- Added the ability to swap through the Stability Fund

- Added support for the unified BTC token

- Finalised the cross-chain loan UI

- Began work on the Injective connection

Quality of life and code improvements

- Improved the handling of multi-chain tokens

- Improved the sign-in experience

- Fixed various decimal issues

- Fixed a layout issue with liquidity incentives

- Refactored the swap and bridge code

- Fixed an issue that occurred when connected to an unsupported EVM chain

- Added support for USDT on ICON

- Retired BTCB transferred to ICON via ICON Bridge

- Improved handling for trades with a high price impact

- Added the fee APR to your liquidity pool details

Marketing initiatives

- Published Balanced connects to Avalanche

- Published Balanced connects to Arbitrum & BNB Chain

- Published Balanced connects to Base

- Published Balanced connects to Havah

- Published The state of cross-chain on Balanced

- Published Beyond blockchain borders (HackerNoon)

- Prepared content for the cross-chain loans release

- Ramped up the social media presence with more regular posts

- Purchased Twitter Premium for maximum visibility

Cross-chain progress

Since the last roadmap update, Balanced has connected to five blockchains: Avalanche, Arbitrum, BNB Chain, Base, and Havah.

Cross-chain loans are up next, followed by connections to Injective, Optimism, and Polygon.

There’s a lot to catch up on, so check out this post for a recap of Balanced’s journey and a preview of where it’s going next:

Governance updates

Governance slowed down just slightly over the last 3 months, with 19 proposals for bBALN holders to vote on:

- BIP 72: Add AVAX USDC to the Stability Fund and increase the hyTB limit

- BIP 73: Migrate ETH from ICON Bridge to the Balanced Asset Manager

- BIP 74: Update the router to support Stability Fund swaps and add new security features

- BIP 75: Add Arbitrum and Base to Balanced

- DFP 9: Use 500 bnUSD as prize money for a poker tournament

- BIP 76: Add AVAX, BNB, and INJ as collateral types for bnUSD

- BIP 77: Lower the Stability Fund fee to 0.1%

- BIP 78: Update the Asset Manager to support BTC

- DFP 10: Fund PARROT9's work on Balanced until the end of 2024

- BIP 79: Add support for wBTC from Arbitrum, and USD from Arbitrum and Base

- BIP 80: Remove legacy tokens, fix bugs, and configure withdraw limits for new tokens

- BIP 81: Increase the Stability Fund fee to 0.3%

- BIP 82: Add the ability to swap USDC for ICX via the router and Stability Fund

- BIP 83: Connect Balanced to Optimism, and add support for USDT on Arbitrum, Avalanche, BNB Chain, and Optimism

- BIP 84: Approve USDT for use in the Stability Fund

- BIP 85: Add support for BTC as a collateral type

- BIP 86: Allow all new liquidity pools to receive BALN incentives

- BIP 87: Increase the limits for BTCB, Base USDC, and Arbitrum ETH

- BIP 88: Connect to Polygon

DAO performance

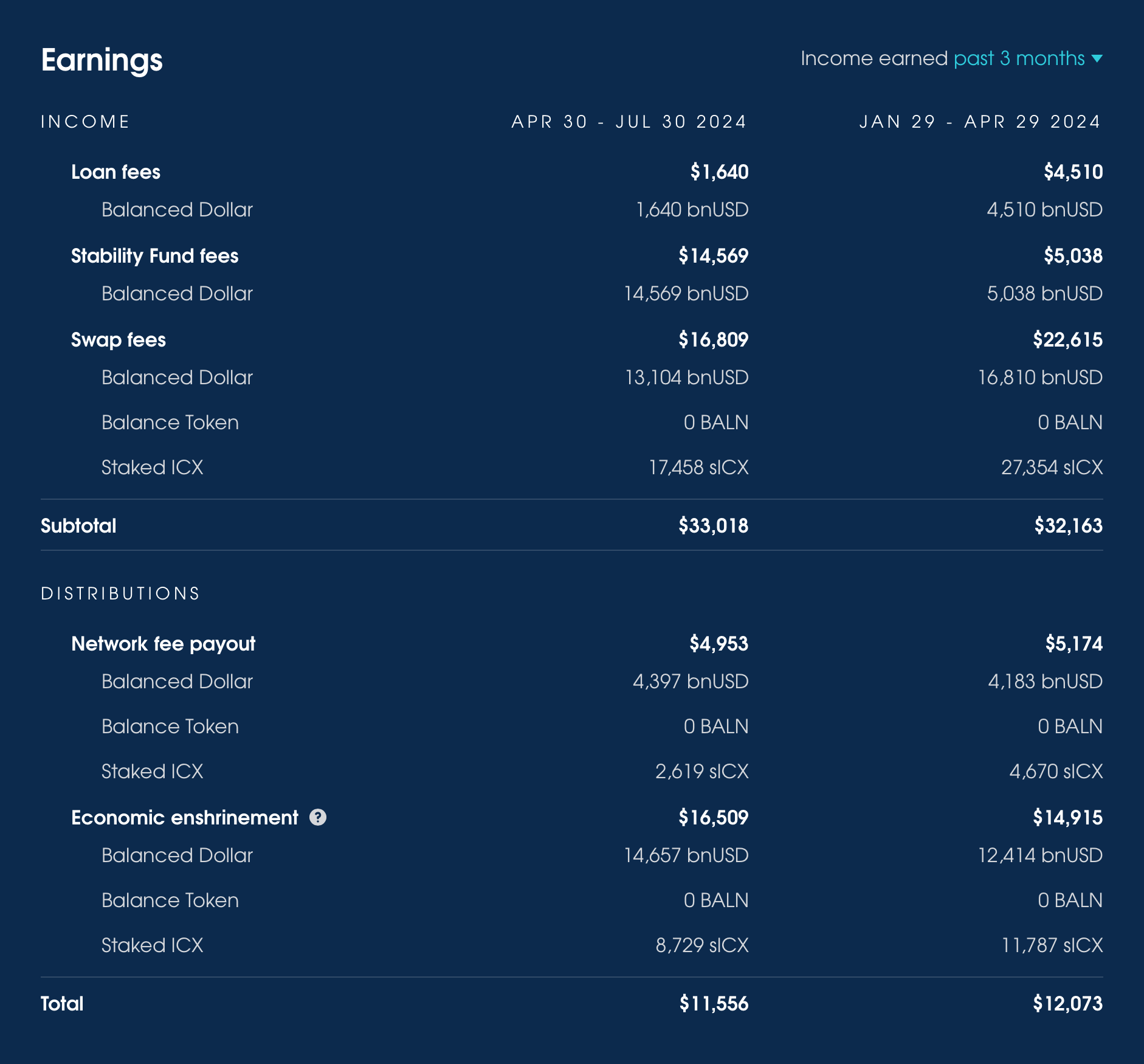

Over the last 3 months, Balanced earned $33,018 from fees:

- 1,640 bnUSD from loans

- $14,569 from the Stability Fund

- $16,809 from swaps

$4,953 of that was distributed to bBALN holders, which gives BALN a 30-day trailing APR of 1.21%.

$16,509 was used to buy and burn ICX, fulfilling Balanced’s role in the economic enshrinement.

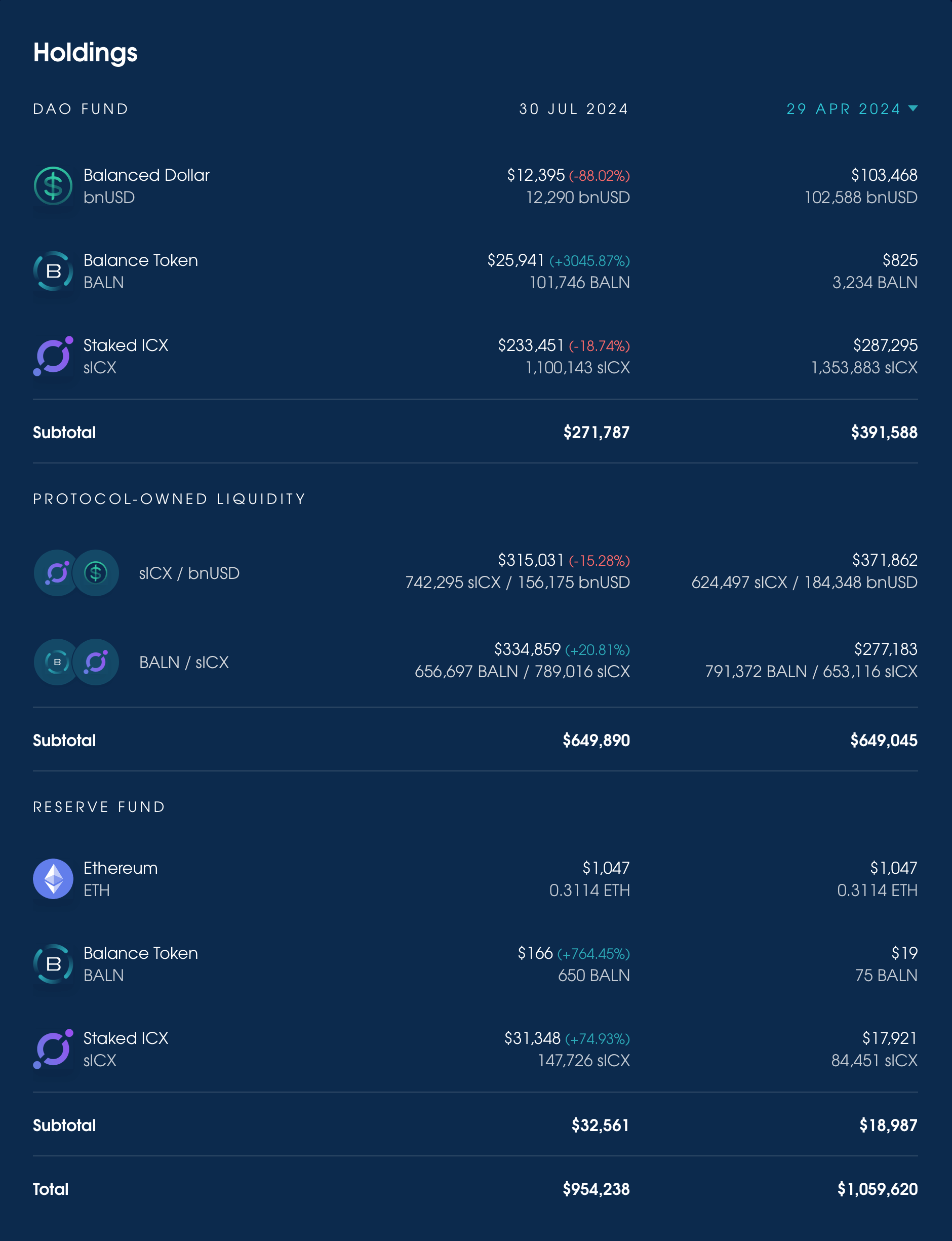

Holdings have dropped by $105,382 since the last roadmap update, mostly due to DFP 10, which gave PARROT9 $170k to work on Balanced until the end of the year.

15,850,924 BALN have been locked in 892 wallets. There’s a total of 7,926,118 bBALN, giving an average lock-up time of exactly 2 years.

Economic enshrinement

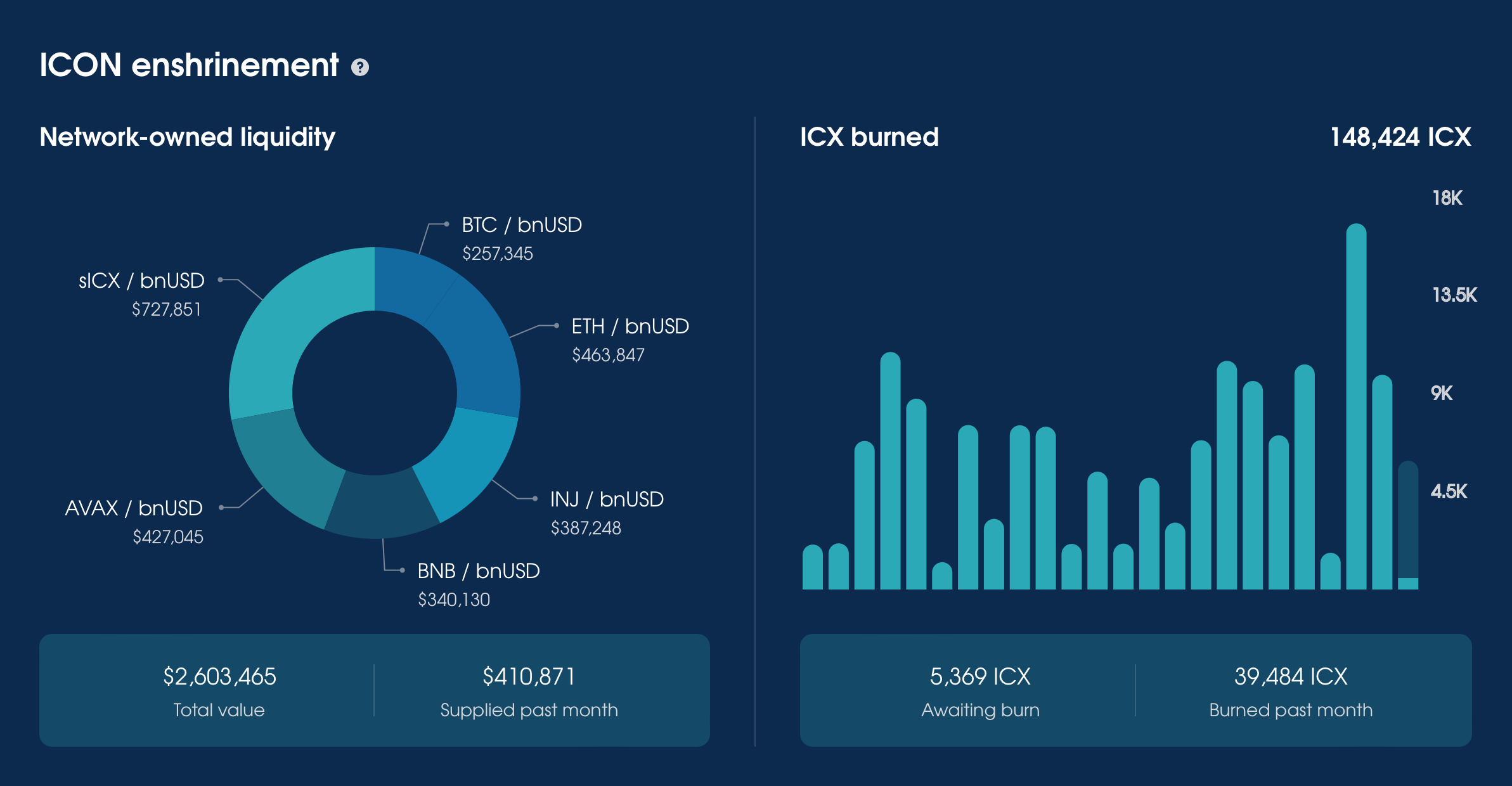

In the five months that have passed since the economic enshrinement was enacted:

- Balanced has burned 148,424 ICX

- ICON has supplied ~$2.6M of liquidity for sICX, AVAX, BNB, BTC, ETH, and INJ

- ICON has provided ~228k sICX to incentivise the Balanced Savings Rate

Keep an eye on the enshrinement stats from burn.icon.community and the ICON enshrinement section on the Stats page.

Savings Rate

The Savings Rate has grown steadily over the past few months. It now offers an average return of 15% per year, thanks to incentives generated through borrower interest and ICON blockchain emissions. This translates to over $9,000 in rewards each month, with 75,280 sICX and 24,190 bnUSD paid out to date.

The amount of bnUSD deposited continues to range between 750k - 970k.

You can move bnUSD in and out of the Savings Rate without any waiting times, so make sure to take a look next time you’re on the Home page.

Balanced wallpapers & NFTs

The cover for this roadmap update, Burst, has been added to the collection of Balanced wallpapers.

The animated version has been added to the Balanced NFT collection, which you can view on the Balanced website:

If you’d like a chance to win the Burst NFT, share a meme about Balanced or your favourite update from the roadmap on Twitter. The post with the most engagement wins, so make sure to tag @BalancedDeFi to get it re-shared.

The winner will be announced in 10 days.

Plans for Q3 2024

During Q3, the contributors plan to:

- Launch cross-chain loans

- Launch Balanced on Injective, Optimism, and Polygon

- Deploy smart contracts on Sui, Solana, Stacks, and Stellar

- Complete a Solana smart contract audit with Hashlock

- Design the interface for concentrated liquidity

- Improve stability and address technical debt

- Roll out a new soft liquidation feature for loans

- Add support for more collateral types, like wstETH and weETH

If you have any questions or want to discuss these updates, start a discussion on the Balanced forum or in the Balanced Discord channel.