Roadmap update | Q2 2024

25 proposals, a design update for bnUSD, and four blockchains connected via smart contracts.

During the first quarter of 2024, the contributors made preparations for Balanced to embark on its cross-chain adventure in earnest. They refactored the front-end code to make it easier to scale, connected the smart contracts to a handful of different blockchains, and increased the amount of liquidity on the exchange and in the Stability Fund.

Here’s what the contributors accomplished since the Q1 roadmap update:

Smart contracts

- Deployed smart contracts on:

- Avalanche

- BNB Chain

- Havah

- Injective

- Prepared smart contracts to deploy on Ethereum, Base, Arbitrum, and Optimism

Front end / back end

- Launched the Balanced Savings Rate

- Updated the Stats page to include the:

- Savings Rate

- ICON enshrinement

- Withdrawal limits

- bnUSD caps

- HiYield Treasury Bills

- Full breakdown of the DAO’s holdings

- Worked on the design for cross-chain loans

- Added support for USDC, INJ, AVAX, and BNB

- Began work on the Avalanche connection

Quality of life and code improvements

- Refactored the cross-chain code to simplify the development process for each connection

- Fixed various issues encountered when using a Ledger

- Refactored some development packages to reduce build times

- Pushed a fix to prevent the swap input fields from being used as a decoy for clickjacking

- Moved the ICON Bridge UI from the Trade page to app.balanced.network/legacy-bridge

- Removed legacy tokens from the app

- Fixed an issue that prevented people from signing in with Hana wallet

- Fixed an issue that hid BTCB in the collateral selector

- Fixed some issues with the Stability Fund

- Added a ‘switch chains’ button to the Bridge tab

Marketing initiatives

- Published bnUSD stability: Now incentivised with the Balanced Savings Rate

- Published Economic enshrinement with the ICON blockchain

- Added Savings Rate info to the website

- Optimised the website design for smaller screen sizes

- Evolved the bnUSD logo design

- Added a Balanced emoji pack to Discord

- Began preparations for a larger cross-chain marketing push

Cross-chain progress

With the support of ICON behind them, the smart contract team forged ahead with their cross-chain work. Over the past three months, they’ve deployed contracts to work with Avalanche, BNB Chain, Havah, and Injective.

These connections are not yet available in the app, where a code refactor has taken top priority. The experience should be just as smooth when connected to 10 blockchains as it is with 2, so it was necessary to address the technical debt before we ship support for a growing number of wallets and chains.

The code refactor is almost complete, so you can expect more frequent connections after we ship support for Avalanche later in Q2.

The Avalanche launch will support cross-chain swaps and transfers, and the ability to use AVAX as collateral from an ICON wallet. The full cross-chain loan experience will come later.

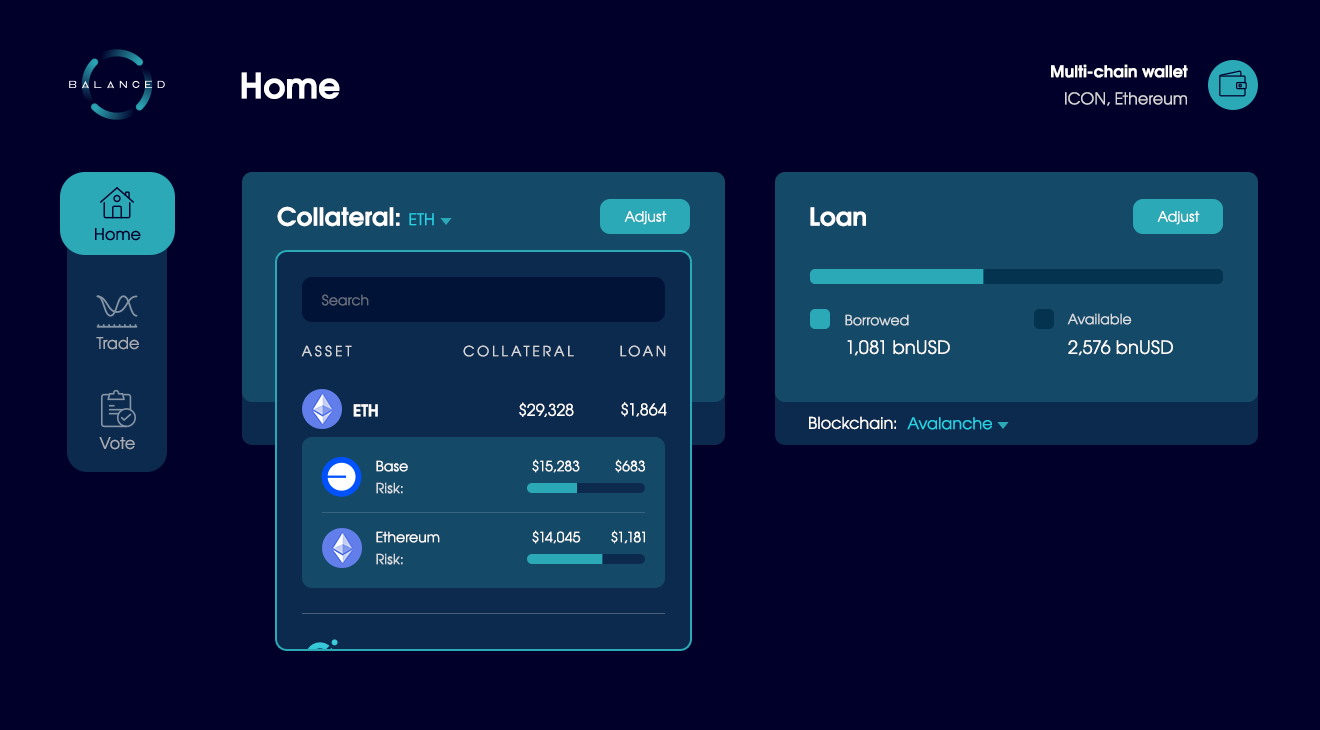

Here’s an early preview of the design:

ICON Bridge migration

Before Balanced can connect to Ethereum and other EVM chains, we need to migrate ETH from ICON Bridge to the Balanced asset manager contract. Doing so will allow Balanced to manage all future ETH deposits, and consolidate ETH from multiple chains under a single token.

To accommodate for this change, ICON Bridge has paused all new deposits, and the legacy transfer UI has been removed from the Trade page.

All bridged assets except for ETH can still be transferred back to their native chain from https://app.balanced.network/legacy-bridge.

You will not be able to transfer ETH to another chain until the app supports it.

Voting is now underway for BIP 73 to complete the migration. Upon approval, ICON will begin to acquire network-owned liquidity in preparation for Balanced’s launch into the ether.

See the forum post for more info:

Balanced turns 3; bnUSD evolves

On April 26 (UTC), Balanced celebrated its 3rd birthday.

Time passes quickly in the crypto hustle culture. There’s always a new feature to ship. Another optimisation to make. Novel ideas to explore. Balanced has gone from an MVP that supports a single chain, to a fully-fledged finance product that’s about to take the wider DeFi ecosystem by storm.

No birthday is complete without a present, but what can you gift a 3-year old product?

Something we’ve put off for a long time: a new design for bnUSD.

Balanced has a strong, identifiable brand. bnUSD did not. We’ve known it from the beginning, but priorities were always elsewhere. As we prepared to position bnUSD as a leading cross-chain stablecoin, we realised we couldn’t put it off any longer. Balanced has matured as a platform, and bnUSD would need to reflect that.

Learn more about PARROT9’s rationale for the new design:

Governance updates

Governance has been on fire since the last roadmap update, with 23 proposals approved and enacted, and 2 still in progress.

- BIP 50: Add support for Noble USDC from Archway

- BIP 51: Implement the economic enshrinement agreement

- DFP8: 4 months of design & dev work

- BIP 52: Add Archway USDC (archUSDC) to the Stability Fund

- BIP 53: Configure Avalanche and add hyTB

- BIP 54: Upgrade the Loans contract and add support for the Savings Rate

- BIP 55: Upgrade Balanced oracle to support external price oracles

- BIP 56: Upgrade the Stability Fund to support HiYield tokens (hyTB)

- BIP 57: Add 2% interest to loans

- BIP 58: Fix a bug in the Loans contract

- BIP 59: Add HiYield Treasury Bills (hyTB) to the Stability Fund

- BIP 60: Increase Stability Fund limit for archUSDC and hyTB to $500k

- BIP 61: Parameter changes & maintenance

- BIP 62: Add BSC and BNB to Balanced

- BIP 63: Add the ability to track yield-bearing assets

- BIP 64: Increase Stability Fund limit for hyTB to $1M

- BIP 65: Connect to Havah

- BIP 66: Configure bnUSD for Avalanche and BNB Smart Chain

- BIP 67: Unify tokens available on multiple chains

- BIP 68: Update various safety limits

- BIP 69: Connect to Injective

- BIP 70: Reallocate the DAO’s holdings

- BIP 71: Create a generic USDC token for Balanced

- BIP 72: Add AVAX USDC and increase Stability Fund limit for hyTB

- BIP 73: Migrate ETH from ICON Bridge to the Balanced asset manager

Most proposals configured the Balanced contracts to support new blockchains and improve interactions with cross-chain assets. The ICON enshrinement agreement was finalised, the front-end team received 4 months of funding, and various parameters were adjusted to improve security.

There’s also a new proposal discussion underway on the forum. Do you think the DAO should fund poker tournaments to increase community engagement? Make sure to weigh in on this post:

DAO performance

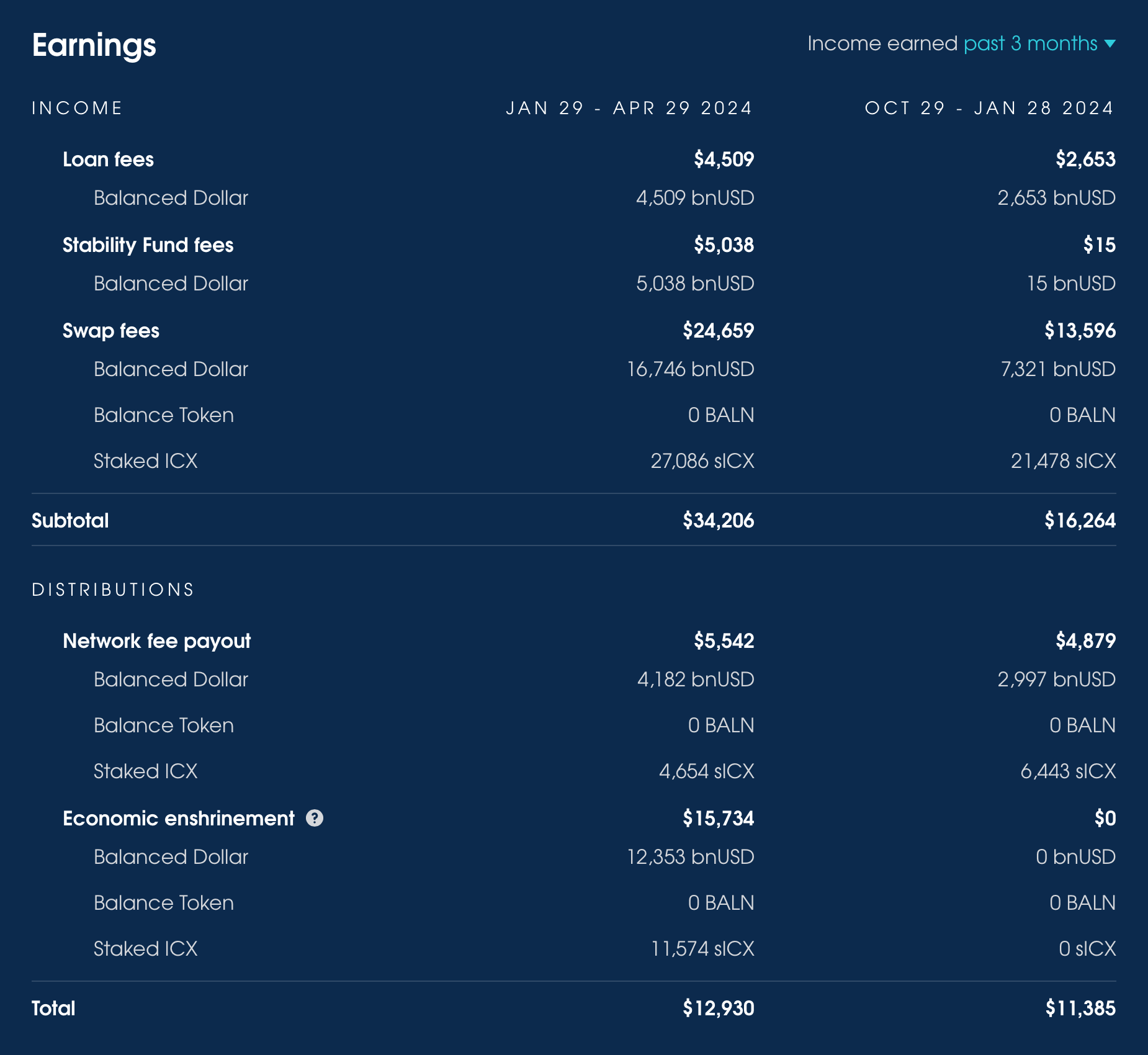

Over the last 3 months, Balanced earned $34,222 from fees:

- 4,509 bnUSD from loans

- $5,038 from the Stability Fund

- $24,659 from swaps

$15,734 was used to buy and burn ICX, fulfilling Balanced’s role in the economic enshrinement

$5,542 of that was distributed to bBALN holders, which gives BALN a 30-day trailing APR of 1.06%.

At current prices, the DAO’s holdings appear to have dropped by $503,519 since the last update. This is mostly due to market conditions and the economic enshrinement, as ICON purchased BALN from the DAO Fund in exchange for sICX. If you contrast the values from the Q1 2024 update, you’ll see that the difference is closer to $14k.

15,845,263 BALN have been locked in 890 wallets. There’s a total of 8,833,256 bBALN, giving an average lock-up time of 2.22 years.

Economic enshrinement

The final enshrinement proposals were enacted in February. Since then:

- Balanced has burned 57,597 ICX

- ICON has supplied ~$1.13M of liquidity for sICX, AVAX, BNB, and INJ

- ICON has provided ~90k ICX of incentives for the Balanced Savings Rate

To keep an eye on the enshrinement stats, check out burn.icon.community and the new ICON enshrinement section on the Stats page.

Savings Rate and real-world assets

The Balanced Savings Rate (BSR) has been live for just over 2 months. Thanks to its ~12% reward rate, it has maintained a steady ~$850k of deposits. Around $7,500 of rewards have been distributed to participants each month in the form of sICX and bnUSD.

Since its release, the price of bnUSD has been more stable than ever. The Stability Fund has received almost $1M in liquidity via USDC and HiYield Treasury Bills (which provide a ~5% return), making it easier for traders to stabilise the price.

You can move bnUSD in and out of the Savings Rate without any waiting times, so make sure to take a look next time you’re on the Home page.

As a reminder, borrowers now pay 2% interest per year. Their debt will increase block by block, and the proceeds distributed to BSR participants. If you’ve borrowed bnUSD from Balanced, make sure to check in on your positions regularly.

Balanced wallpapers & NFTs

The cover for this roadmap update, Stream, has been added to the collection of Balanced wallpapers.

The animated version has been added to the Balanced NFT collection, which you can view on the Balanced website:

If you’d like a chance to win the Stream NFT, share your favourite update from the roadmap on Twitter and tag @BalancedDeFi.

The winner will be announced in 10 days.

Plans for Q2 2024

During Q2, the contributors plan to:

- Deploy smart contracts on:

- Ethereum, Base, Arbitrum, and Optimism

- Sui

- Stellar

- Stacks

- Launch cross-chain swaps & transfers on:

- Avalanche

- Injective

- Havah

- BNB Chain

- Ethereum, Base, Arbitrum, and Optimism

- Launch cross-chain loans on Avalanche and BNB Chain (testnet)

- Begin work on concentrated liquidity

- Reorganise the Stats page

If you have any questions or want to discuss these updates, start a discussion on the Balanced forum or in the Balanced Discord channel.