Balanced launch campaign

Balanced launched on April 25, 2021. Here’s a recap of the content released on Twitter during the countdown.

Balanced launched on April 25, 2021, to thousands of expectant users. In the hours and days that followed, it hit milestone after milestone.

Prior to the launch date announcement, marketing materials were limited. Our main conversion tool was the Balanced demo, which had been available on the website for people to try for about 8 months.

Here’s a recap of the content released on Twitter leading up to the launch, and the results it led to.

14 days to launch

It’s time.

Balanced: coming to you live, April 25 at 6pm PDT.

$ICX #DeFiForTheRestOfUs

--

Read the announcement:

--

It wouldn’t be a product launch without a fresh website. To learn more about Balanced and why you should use it, check out balanced.network.

--

Have questions? Join our growing community on Telegram and become an early member of the Balanced DAO.

13 days to launch

Only 1% of crypto investors use DeFi.

When we started Balanced, our goal was to create a decentralised finance product the other 99% could actually use.

A thread. 👇

$ICX $BALN #DeFiForTheRestOfUs

--

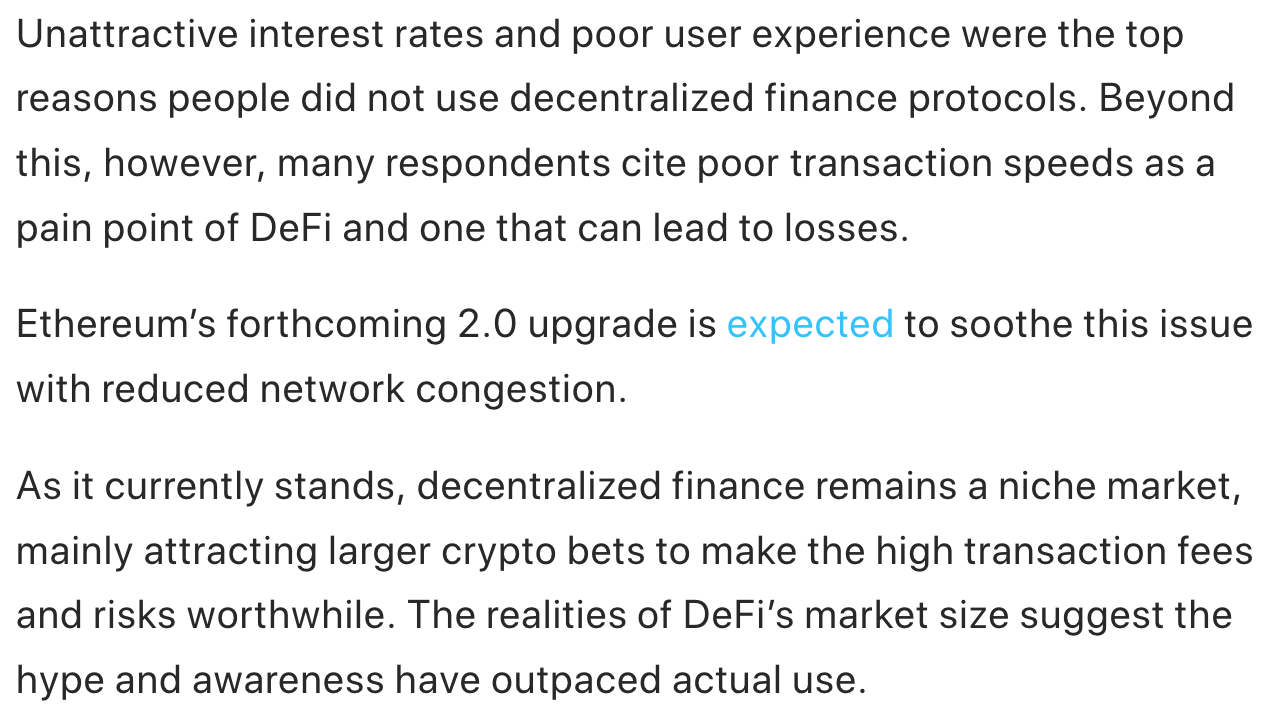

Decentralised finance was meant to be accessible to everyone, why have so few investors adopted it?

High fees, slow transactions, and complex interfaces are the main complaints, along with the risks and unattractive rewards. We’d need to address all of them to realise our goal.

--

High fees and slow transactions are easy to fix with the ICON blockchain.

The average tx fee is $0.005 (0.002 ICX), it boasts 2 second tx times, and has the ability to handle 1,300 tx every 2 seconds.

In other words: it’s the perfect foundation for a DeFi platform.

--

The rewards for most DeFi products are unattractive, or their highs short-lived. Balanced is built on ICON, so it can avoid this trap.

It uses staked ICX as the only form of collateral, which means investors are guaranteed to earn ~11% a year – and won’t lose it all in fees.

--

Some investors will use anything with an incentive, but rewards won’t guarantee adoption: the 99% have higher standards.

We couldn’t just copy what already existed. We had to design for maximum understanding and ease of use – even if that meant doing something completely new.

--

Design-led businesses perform 228% better than the S&P, and Balanced is the first design-led DeFi platform.

It was designed from first principles, with a heavy focus on users that informed our approach to the development, smart contracts, interface, and community.

--

Risk will always exist, but we’ve taken measures to protect from:

ICX volatility: high collateral ratio, and key prices displayed so you can set alerts.

Smart contract bugs: audited by SlowMist, reviewed by ICON devs, and a bug bounty live before launch.

--

Balanced is a DAO with a highly engaged community – even though it hasn’t launched yet. Along with governance decisions, we’ll use their feedback to improve Balanced and inform the future of the platform.

Join us to shape a better future for finance.

12 days to launch

Before Balanced can take on other DeFi products, it has some competition closer to home: the ICON wallet.

Staked ICX earns ~11% a year, but unstaking is high friction: it takes ~7 days and you don’t earn rewards. To encourage action, we had to make Balanced even more appealing.

--

Financial incentives don’t guarantee adoption, but they are a powerful motivator – especially when paired with utility.

Balanced is a multi-purpose finance platform, so it offers 5 different ways to earn rewards. And in doing so, ICX staking rewards start to pale in comparison.

--

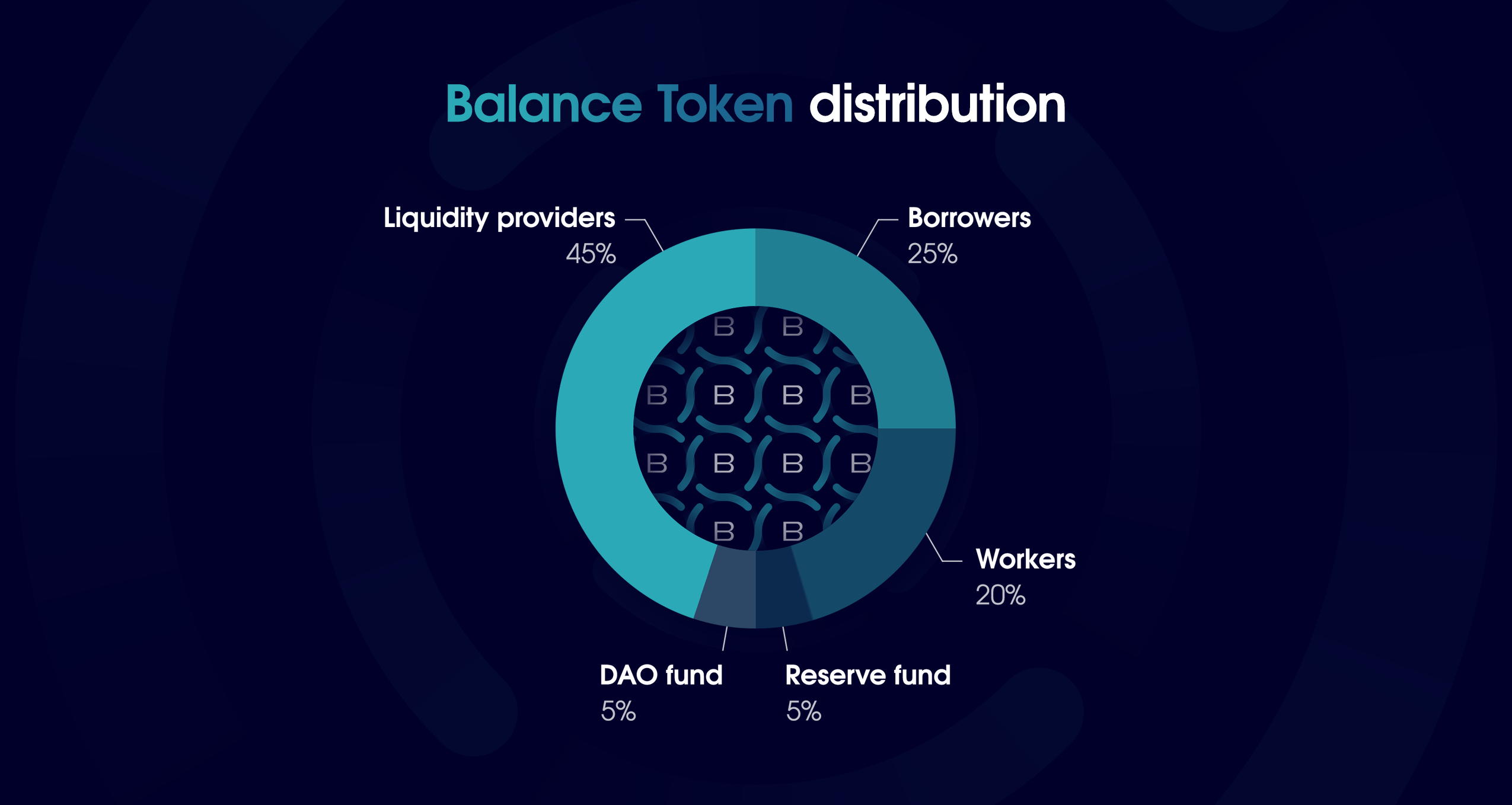

1. Staking rewards

Deposit your ICX as collateral to earn ~11% a year.

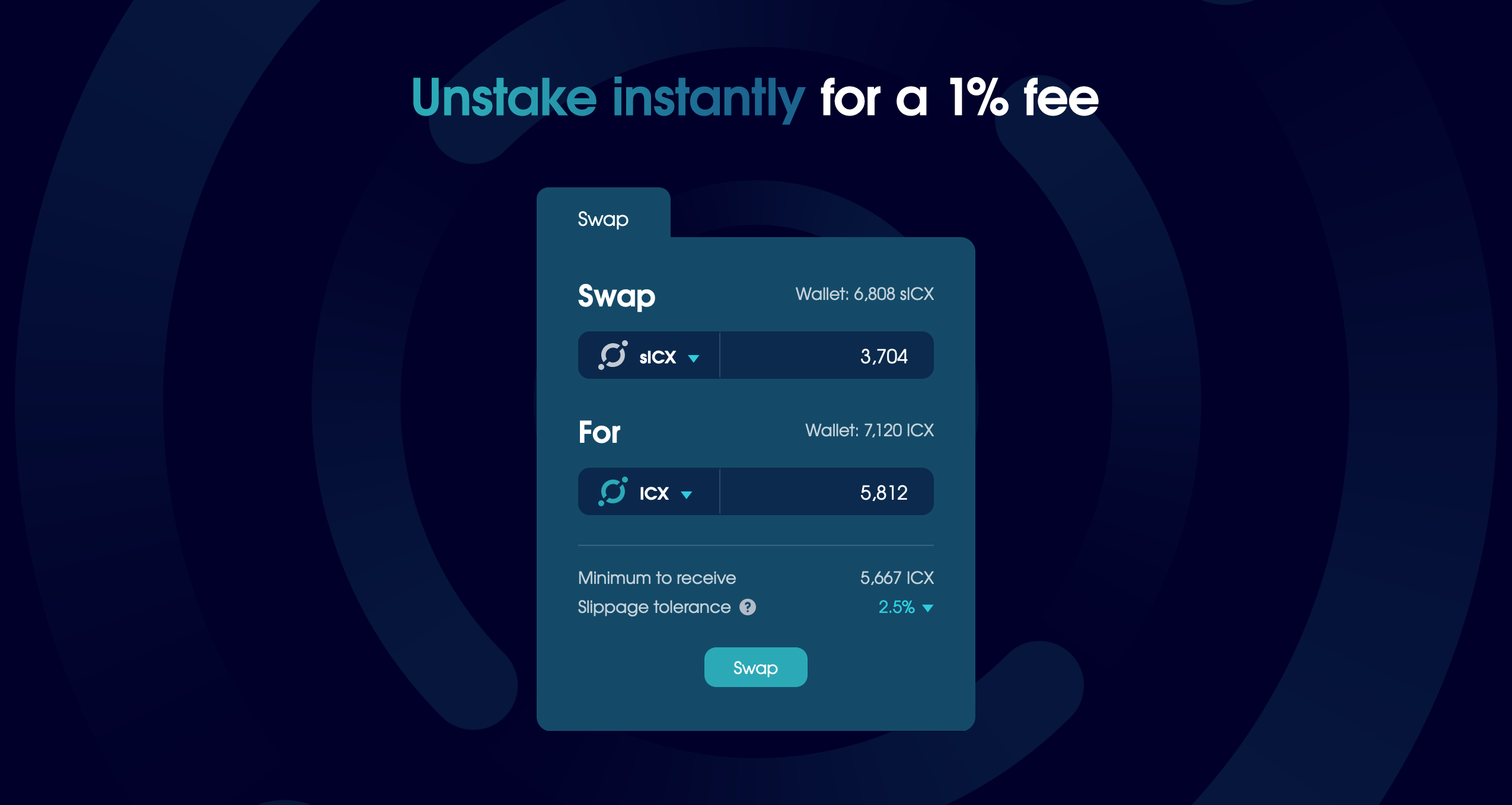

Why stake in Balanced instead of your wallet? There’s no claiming, voting, or re-staking required: it’s 100% passive income. And when you want to withdraw, you can unstake instantly for a 1% fee.

--

2. Loan rewards

Borrow Balanced Dollars against your collateral, and earn Balance Tokens every day you stay below the reward threshold.

Use your bnUSD for payments, trades, or to buy even more ICX.

--

3. Liquidity rewards

Supply ICX, bnUSD, or BALN as liquidity to the Balanced exchange, and earn Balance Tokens daily.

Liquidity is best left to experienced traders, but it provides the ability to swap between assets like never before, so it benefits the entire ICON community.

--

4. Network fees

Stake your Balance Tokens and maintain an active position to start accruing a share of the network fees.

Within 2 months of launch, Balance Token holders can vote to distribute the fees, which will then be paid out weekly.

--

5. Liquidation rewards

If you’re technical, you can set up a bot to liquidate under-collateralised positions for a 10% profit.

If Balanced liquidated all positions itself, it'd be the single point of failure. Incentivizing others is better for the system – and their wallets.

--

How do you encourage ICX holders to unstake, many for the very first time? You build a system that helps them do even more with their investment.

Balanced is a one-stop shop for ICX holders. That’s why it’s the decentralized bank of ICON.

$ICX $BALN #DeFi #DeFiForTheRestOfUs

11 days to launch

According to @naval: to get wealthy, own a piece of a business.

You can own a piece of a bank with Balance Tokens.

Balanced is a #DeFi platform that operates as a #DAO, governed by Balance Token holders. Participate to earn $BALN and help us shape the future of finance.

--

Balanced is a fair launch project. There was no pre-mine: everyone has an equal chance to earn Balance Tokens from launch day.

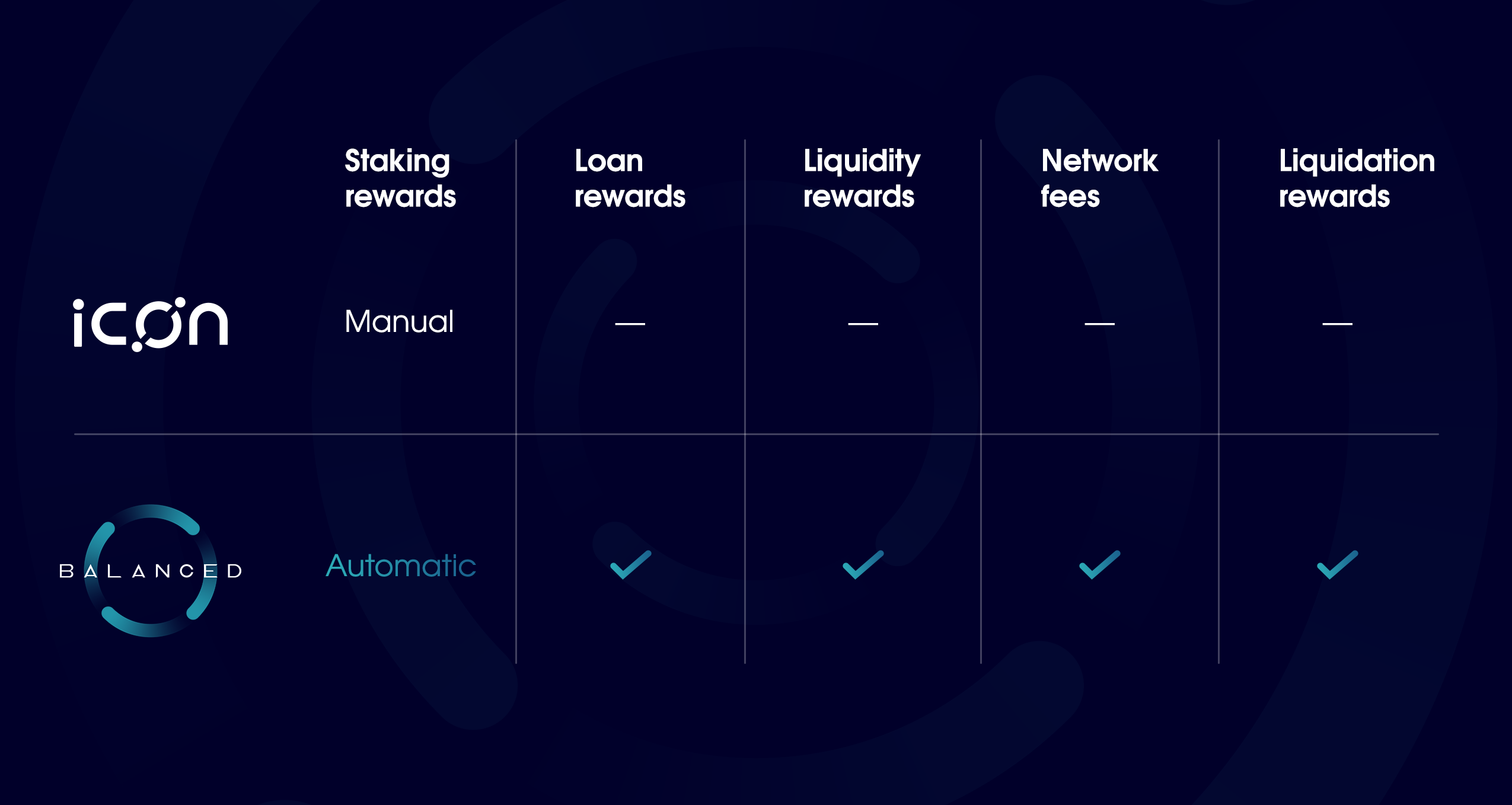

Balanced distributes 100,000 BALN a day for the first 60 days, then it tapers by 0.5%/day until it reaches 1,250 (<2% inflation).

Here’s where it goes:

--

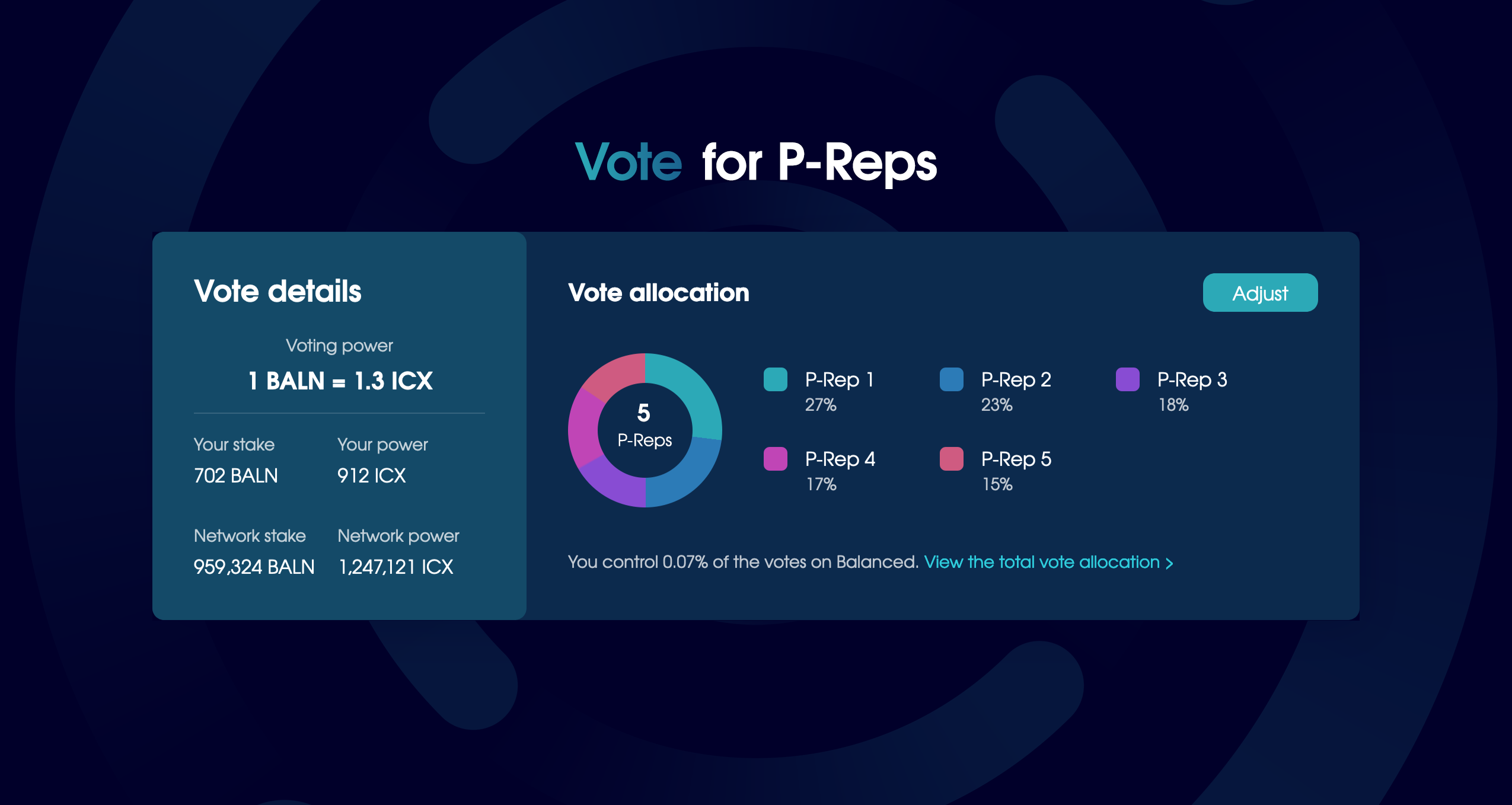

BALN is a governance token: it gives you the power to vote on decisions that shape the future of Balanced.

Soon after launch, you’ll get to delegate ICX to your favorite ICON P-Reps, and vote for the next Balanced asset, fee adjustments, DAO fund initiatives, and more.

--

The first vote for Balance Token holders: distribute network fees.

Network fees are collected from launch, and eligible participants will start earning a share, but BALN holders need to vote to distribute them.

The initial split gives 60% to BALN holders, 40% to the DAO fund.

--

So how do you earn Balance Tokens?

- Borrow at least 50 bnUSD and stay below the reward threshold

- Supply at least $50 to a liquidity pool on the Balanced exchange

The UI will show the amount of BALN you can expect to earn each day, if all variables remain the same.

--

Want to earn Balance Tokens, but not ready to take the plunge into DeFi? Participate in the ICON community airdrip to receive a share of the ICON Foundation’s $BALN every week.

To qualify, all you have to do is stake and vote with your $ICX.

10 days to launch

How to earn an ~11% annual return with Balanced:

- Deposit ICX as collateral.

That’s it. Your deposited amount will increase each day based on the ICON Network reward rate.

Learn how this works.

$ICX $BALN #DeFiForTheRestOfUs

--

When you deposit ICX, it’s first staked so you can earn staking rewards.

This form is known as sICX, and its value is based on the number of ICX in the staking pool, which increases by ~11%/yr.

Each sICX is worth more ICX over time, and you’ll always see the ICX value in the UI.

--

When you withdraw collateral, you’ll receive sICX. It continues to increase in ICX value as long as you hold it, but when you’re ready to use ICX, you can:

- Unstake it from your wallet (takes up to ~7 days)

- Swap it for ICX on the Balanced exchange for a 1% fee

--

Got questions about sICX? Ask us in Telegram, and stay tuned for our upcoming article about sICX and how you can use it.

9 days to launch

Balanced gives $ICX a new role: collateral for synthetic assets, like Balanced Dollars.

bnUSD is always worth 1 USD, so it’s suitable for payments, grants, and as the default currency for apps on the ICON Network.

The more it’s used, the more ICX is removed from circulation...

--

How to borrow Balanced Dollars:

- Deposit ICX as collateral.

- Take out a loan.

There’s a 10 bnUSD minimum, and you can borrow up to 25% of your collateral value.

You’ll pay a 1% fee (deducted in bnUSD), but there’s 0% interest, so it’s perfect for long-term loans.

--

To earn Balance Tokens, keep your risk below the reward threshold. You can borrow up to 20% of your collateral value before you no longer qualify.

To make sure you’re always eligible for rewards, set an alert for the ICX price shown underneath, and reduce your risk if necessary.

--

Borrowers receive 25% of the daily Balance Token distribution, so your expected return varies based on the size of your loan – and everyone else’s.

APY = USD value of annual BALN rewards / total bnUSD borrowed

The more $bnUSD you borrow, the more $BALN you’ll earn.

--

How does Balanced guarantee the price of its assets? No matter their price elsewhere, Balanced will always buy them for their true value.

If you purchase bnUSD for $0.90, you can “retire” it on Balanced for $1 of ICX collateral, and pay only a 0.5% fee.

--

If you want Balanced Dollars but don’t want any risk, you can always buy bnUSD from the Balanced exchange.

How will you use Balanced Dollars? Share your plans with us here and in Telegram, so we can help everyone get the most out of bnUSD from launch day.

8 days to launch

If you plan to borrow Balanced Dollars on launch day, unstake your $ICX now. The current unstaking time is ~7.4 days, and Balanced goes live in 8.

Isn’t unstaking a hassle? If you’ve ever wanted to bypass the unstaking period, learn how Balanced will provide a better experience.

--

First, stake your ICX through Balanced.

Deposit your ICX as collateral, and keep it there to accrue staking rewards.

When you’re ready to use it, withdraw some or all of your collateral. You’ll receive sICX (staked ICX).

How to earn an ~11% annual return with Balanced:

— Balanced (@BalancedDAO) April 16, 2021

1. Deposit ICX as collateral.

That’s it. Your deposited amount will increase each day based on the ICON Network reward rate.

Learn how this works. 👇$ICX $BALN #DeFiForTheRestOfUs https://t.co/37tZ7rtXX2 pic.twitter.com/32vZEgfSeH

--

To convert your sICX to ICX, you can unstake it from the wallet.

You’ll be added to a queue, and will receive ICX as soon as it's available.

This is based on the volume of unstaking requests vs collateral deposited, so it could take from 5min up to the usual unstaking time.

--

To unstake instantly, go to the Balanced exchange and swap your sICX for ICX.

You’ll receive 1% less ICX than if you waited: a 0.3% fee, and a 0.7% price difference.

And if you want sICX again, you can always convert ICX to sICX for free.

7 days to launch

If you borrow Balanced Dollars, you can earn Balance Tokens. While it’s a nice way to earn some income, $bnUSD wasn’t created just to sit in your wallet.

Here are some ways you could use it. 👇

$ICX #DeFi #DeFiForTheRestOfUs

--

1. Leverage your $ICX.

Use Balanced Dollars to buy more ICX on the exchange.

Deposit your new ICX as collateral to earn more staking rewards, and reduce your risk of liquidation.

--

2. Buy more $BALN.

Use your Balanced Dollars to buy more Balance Tokens, then stake them from your wallet.

As long as you still qualify for loan rewards (borrow at least 50 bnUSD and stay below the reward threshold), you’ll earn a larger share of the network fees.

--

3. Supply liquidity.

Supply $bnUSD to a liquidity pool, along with an equal value of $sICX or $BALN.

By supplying Balanced Dollars, you’ll help get it into circulation, and earn even more BALN for your efforts.

Just make sure you understand the risk of impermanent loss.

--

4. Trade it to use somewhere else.

Borrow Balanced Dollars and sell it for $ICX on Balanced, then send your ICX to an exchange like @binance.

Convert it to another asset to make a trade, or to refinance your debt on another platform.

--

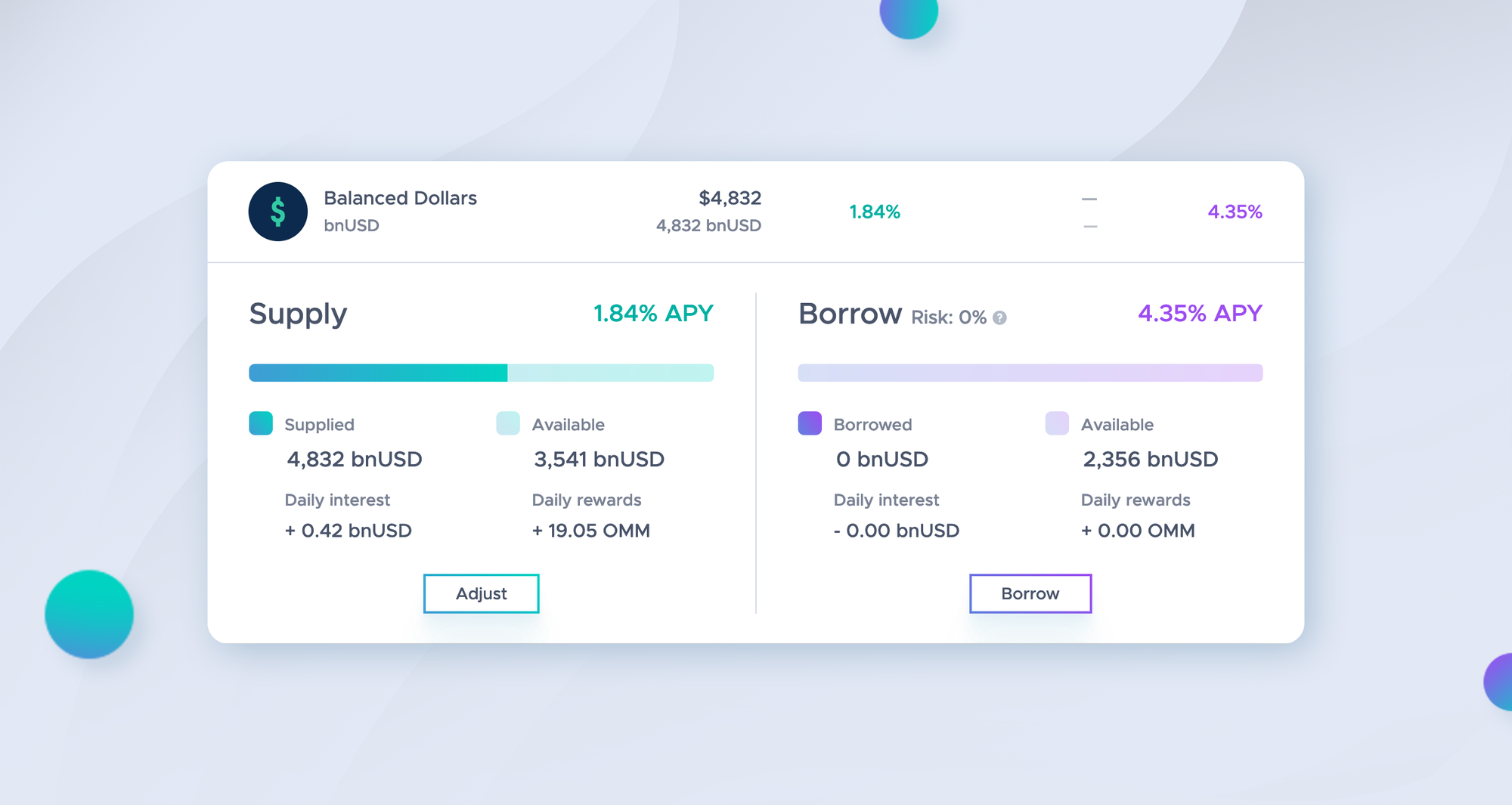

5. Supply it on Omm (coming soon).

After the circulating supply of Balanced Dollars reaches a satisfactory level, bnUSD could be listed as a market on @ommfinance.

Supply your bnUSD to earn interest and Omm Tokens daily, in addition to your rewards from Balanced.

6 days to launch

Balanced is a decentralised finance product run by smart contracts. It’s risky, just like everything else in #DeFi / #crypto.

We can’t deny the risk, and it’s irresponsible to ignore it. All we can do is be transparent, and minimize the attack surface as much as possible...

--

Balanced smart contracts were audited and approved by @SlowMist_Team, who’ve been trusted to audit top exchanges, like @binance, @HuobiGlobal, and @OKX.

The contracts have since been reviewed by multiple third parties, including the ICON core dev team.

--

An audit reduces the risk of smart contract bugs, but there’s always a risk, so we’ve also launched a bug bounty program on @immunefi.

It’s targeted at vulnerabilities that put investors’ funds at risk or compromise the smart contracts.

More details here:

--

What about other security risks?

To prevent attacks that redirect people from balanced.network to a phishing site, we'll use DNSSEC to verify the integrity of the website.

Learn how this type of exploit affected MyEtherWallet:

--

The Balanced team has also taken a number of precautions to secure their accounts and devices, starting with strong, randomly generated passwords and two-factor authentication for every account.

We’ll share more details about our security requirements soon.

--

Even with strict security practices, the risk won’t disappear completely.

But there is a way to limit the damage:

If a bug or vulnerability caused investors to lose money, $BALN holders could vote to use the DAO fund and emergency reserve fund to cover or reduce the amount lost.

5 days to launch

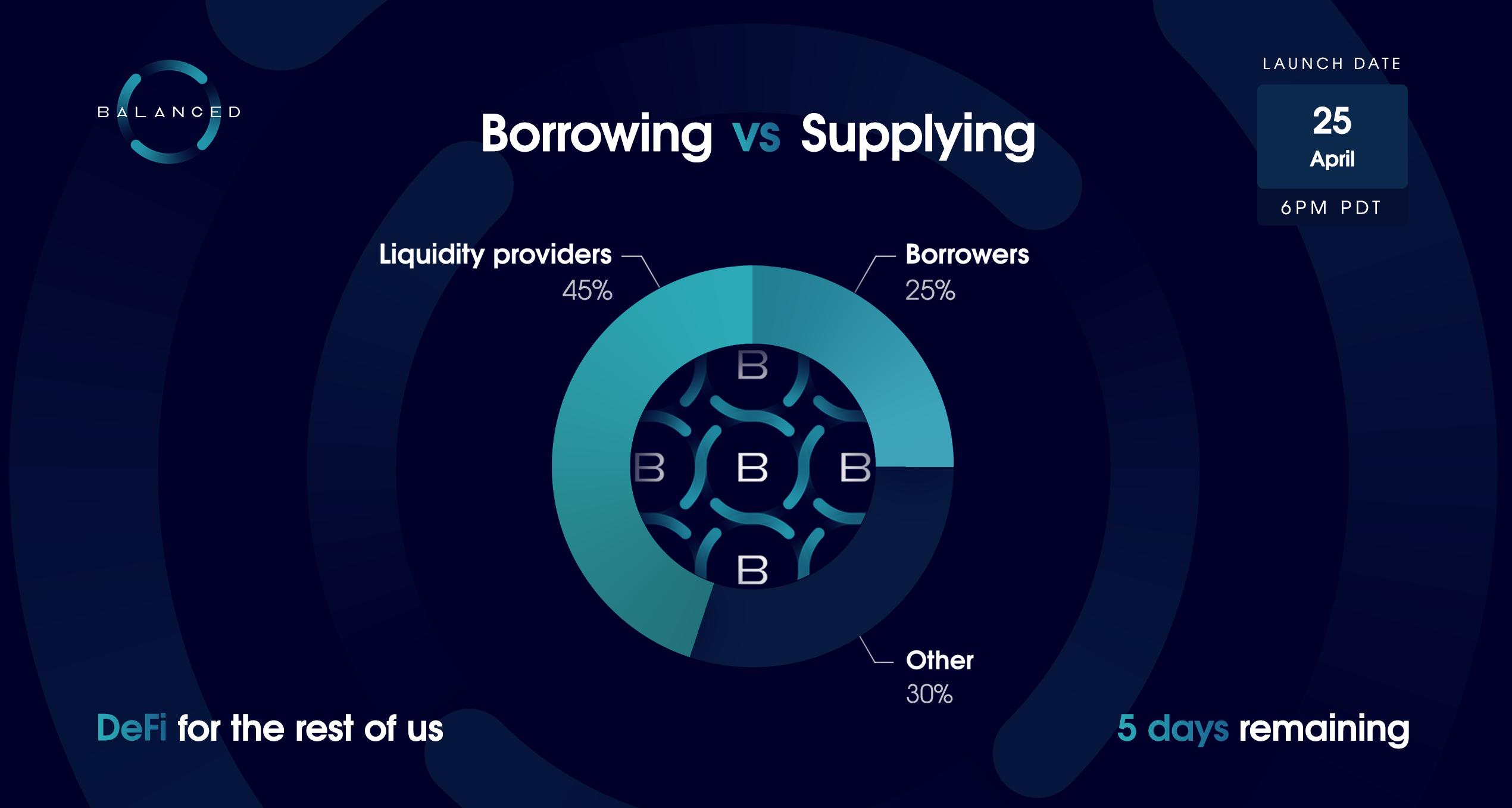

Balanced’s main purpose is to create synthetic assets for the ICON ecosystem. Borrowers earn 25% of the daily Balance Tokens, while liquidity providers earn 45%.

Why does Balanced reward liquidity providers so highly? And what does it mean to provide liquidity?

--

You can use Balanced to borrow new assets, but unless they’re widely circulated and easy to swap between, their use – and value – is limited.

That’s why Balanced includes an exchange, and incentivizes liquidity providers to make sure its assets are always available to trade.

--

Balanced will start with 3 liquidity pools: sICX/bnUSD, BALN/bnUSD, and ICX/sICX.

In addition to Balance Tokens, the pools receive half of the trading fee from each swap.

Beyond that, each liquidity pool has its own quirks...

--

The sICX/bnUSD pool receives 17.5% of the BALN, and allows people to buy bnUSD without needing to take out a loan.

It uses sICX instead of ICX, so you continue to earn staking rewards. If you need to get some, it’s free to swap your ICX for sICX on the exchange.

--

The BALN/bnUSD pool receives 17.5% of the BALN, and will be available from day 2, after the first BALN is distributed.

All BALN supplied earns a share of the network fees.

This pool has the highest risk of impermanent loss, especially while BALN is in price discovery mode.

--

The ICX/sICX pool receives 10% of the BALN, and allows people to unstake instantly.

This pool works like a queue that follows the First In First Out method.

You supply ICX, which doesn’t earn staking rewards. When your order is filled, you’ll receive sICX and stop earning BALN.

--

All pools except ICX/sICX come with the risk of impermanent loss. To learn more, check out What is impermanent loss?

If you’d like to supply liquidity to Balanced, join the discussion on Telegram:

4 days to launch

The team has worked tirelessly for the last year to get Balanced into your hands. However, our work doesn’t end on launch day: it’s only just begun.

There’s a laundry list of enhancements we’d like to make, but here are some of the core features we’re most excited about.

--

Price charts

At launch, the exchange won’t include price charts, but they’ll be switched on within the first few weeks to reflect what you see in the prototype.

The charts use TradingView, so we plan to add technical indicators once there’s enough price data to make them useful.

--

Network fees

The first vote for the Balanced DAO will take place within the next 2 months.

Balance Token holders can vote to distribute the fees accrued by Balanced up till that point, then every week after.

The split will be 60% to eligible BALN holders, 40% to the DAO fund.

--

Governance

For Balanced to operate as a DAO, it needs voting functionality.

The Vote page will give staked Balance Token holders the ability to vote for their favorite ICON P-Reps, add new assets, spend money in the DAO fund, and more.

--

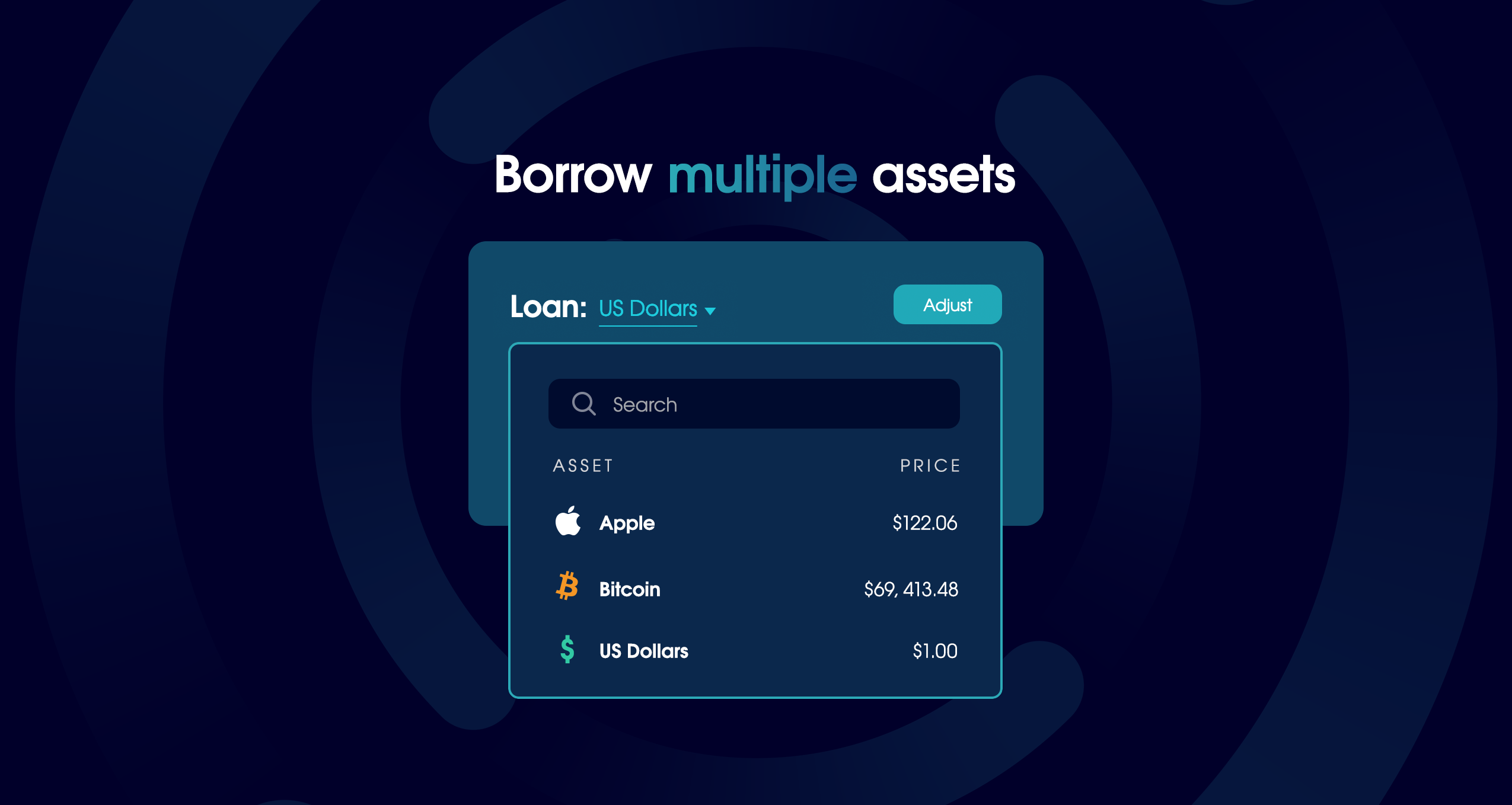

Multi-asset loans

Balanced was created to make a stable coin, bnUSD.

With multi-asset functionality, BALN holders can vote to make new assets – whether they’re pegged to an ecosystem (BTC, ETH), product (AAPL, TSLA), commodity (XAU, OIL), or another currency (KRW, EUR, NZD).

--

Bridge integration

To onboard people new to ICON, we’ll add Bridge as a sign-in option.

It will require KYC, but they’ll be able to sign in to Balanced with an email address, deposit USD, then swap the USDb they receive for ICX.

Convenient whether you want to borrow or trade.

--

Product design never ends, so to sustain Balanced’s growth, the early contributors are funded by Balance Worker Tokens (BALW).

These entitle the holders to 20% of the daily BALN distribution, and BALN holders can vote to transfer the BALW to other workers as they see fit.

3 days to launch

Balanced is a multi-purpose finance platform. There are many ways to use it, each with a varying level of risk.

If you’re not sure how to take advantage of everything Balanced has to offer, here are some use cases and the risks to be aware of for each.

#DeFiForTheRestOfUs

--

ICON community airdrip.

To earn Balance Tokens without taking on any risk, participate in the ICON community airdrip.

Every week from May 2, anyone with staked/delegated $ICX can sign in to Balanced and claim a weekly “drip” of $BALN.

Risk: none

--

Deposit collateral.

Deposit your $ICX as collateral and earn staking rewards automatically. You can withdraw it as staked ICX (sICX) at any time.

You can unstake sICX from your wallet, or pay a 1% fee to swap it for ICX.

Risk: smart contracts

How to earn an ~11% annual return with Balanced:

— Balanced (@BalancedDAO) April 16, 2021

1. Deposit ICX as collateral.

That’s it. Your deposited amount will increase each day based on the ICON Network reward rate.

Learn how this works. 👇$ICX $BALN #DeFiForTheRestOfUs https://t.co/37tZ7rtXX2 pic.twitter.com/32vZEgfSeH

--

Borrow $bnUSD.

If you deposit collateral, you can borrow up to 25% of the value in bnUSD.

To earn $BALN, keep your risk below the reward threshold, and set an alert for the ICX price shown underneath.

Risks: smart contracts, liquidation, rebalancing

If you borrow Balanced Dollars, you can earn Balance Tokens. While it’s a nice way to earn some income, $bnUSD wasn’t created just to sit in your wallet.

— Balanced (@BalancedDAO) April 19, 2021

Here are some ways you could use it.👇$ICX #DeFi #DeFiForTheRestOfUs https://t.co/KZG7i1Cgu0 pic.twitter.com/OrNruUVEcR

--

Supply liquidity.

Supply assets to one of the Balanced liquidity pools and earn $BALN daily.

You can supply ICX to the ICX/sICX pool, or an equal value of both assets to the sICX/bnUSD or BALN/bnUSD pools.

Risks: smart contracts, impermanent loss

Balanced’s main purpose is to create synthetic assets for the ICON ecosystem. Borrowers earn 25% of the daily Balance Tokens, while liquidity providers earn 45%.

— Balanced (@BalancedDAO) April 21, 2021

Why does Balanced reward liquidity providers so highly? And what does it mean to provide liquidity? https://t.co/ZBWFqPHjo4 pic.twitter.com/TOjbthcYgy

--

Liquidate under-collateralised positions.

If you’re a technical trader, you can set up a bot to liquidate under-collateralised positions for a 10% profit.

We’ll share more details about how to set this up soon.

Risk: none

--

How do you plan to use Balanced, and what’s your appetite for risk? Let us know here or in Telegram.

2 days to launch

Balanced’s primary audience is the ICON community, so step 1 in the adoption strategy is to get $ICX holders to use it. Step 2 is to reach the rest of the #crypto space.

Today, we’re thrilled to announce a strategic partnership that will help Balanced reach even further.

--

@cmsholdings is a pro in the DeFi space. They’ve supported many notable projects, including:

- Vega

- Equilibrium

- DODO

- Alchemix

--

@FBGCapital is a digital asset management firm and blockchain incubator. Some of the projects they’ve been involved in are:

- Equilibrium

- Coinlist

- MakerDAO

- Ampleforth

- REN

- Terra

--

Balanced uses @BandProtocol as its oracle solution, so @PNattapatsiri & @sydneykevinlu were an obvious choice.

In addition to oracle design, they bring their experience with security, partnerships, exchanges, and networks. Both have already been exceptionally helpful.

--

There are also a handful of others who, for now, wish to remain anonymous.

They include 2 lead engineers of a top DeFi protocol, and 3 others with a meaningful influence in the broader blockchain and VC communities.

--

What do these partners add to Balanced’s strategy?

In addition to their wide range of experience, they’ll act as advisors and liquidity providers, and drive growth through industry relationships, access to other geographies, and more.

Read more here:

1 day to launch

We’re down to the final 24 hours.

A huge thank you to everyone involved in getting Balanced over the finish line: @lydia_labs @iconosphereprep @parrot9design @mousebelt @icondao @sudoblockio @helloiconworld

--

Special thanks also to @fezbox, @adflondon, @NorskKiwi1, @Spl3en_ICON, @ICONPinas, @holaicon, and other community members who’ve helped us test and promote Balanced.

--

To tide you over until the launch, we’ve published 4 articles for some light reading.

If you’ve ever been confused about sICX and how it works:

--

If you want to know all the different ways you can earn Balance Tokens:

--

If you want to understand the rebalancing/retirement process:

--

If you want to know the intricacies about supplying liquidity:

Launch day

The decentralised bank of ICON is now open for business.

Join us in the future: balanced.network

$ICX #DeFi #DeFiForTheRestOfUs

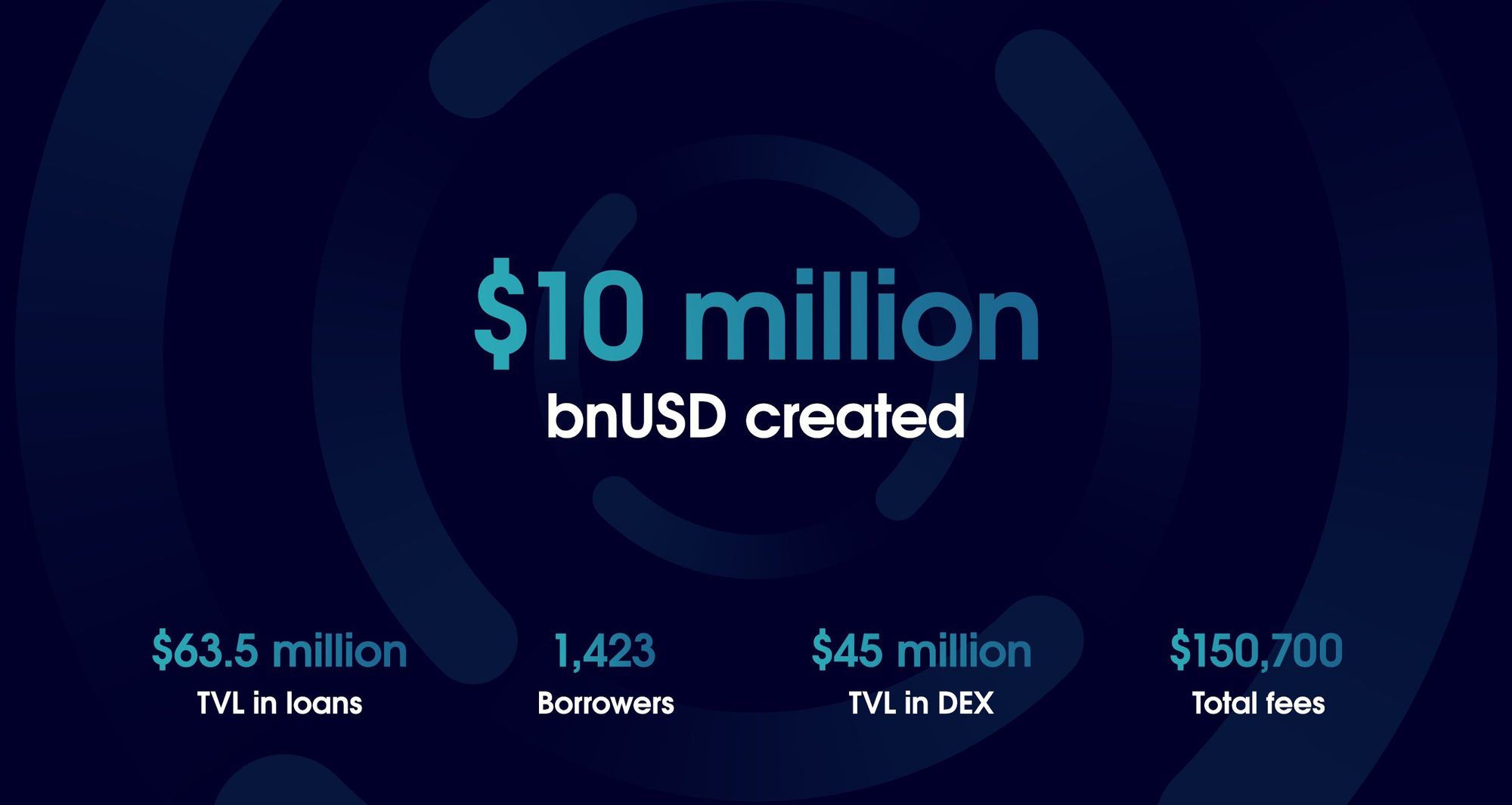

2 days post-launch

In just over 50 hours, 10 million Balanced Dollars have already been created. The response has been unreal.

Other key statistics:

- TVL (collateral): $63.556 million

- TVL (DEX): $45 million

- Borrowers: 1,423

- Liquidity providers: 358 (sICX/ICX), 966 (sICX/bnUSD), 599 (BALN/bnUSD)

- Total fees: $ 150.7K

11 days post-launch

Balanced Dollars: 22,567,566

TVL (collateral): $141.6M

TVL (DEX): $80.4M

Total TVL: $222M

Borrowers: 2,564

Liquidity providers:

- 624 (sICX/ICX)

- 1,721 (sICX/bnUSD)

- 1,808 (BALN/bnUSD)

bnUSD holders: 3,868

BALN holders: 7,668

Fees: $495K

- 47K sICX

- 364K bnUSD

- 930 BALN

APY: 81% - 776%

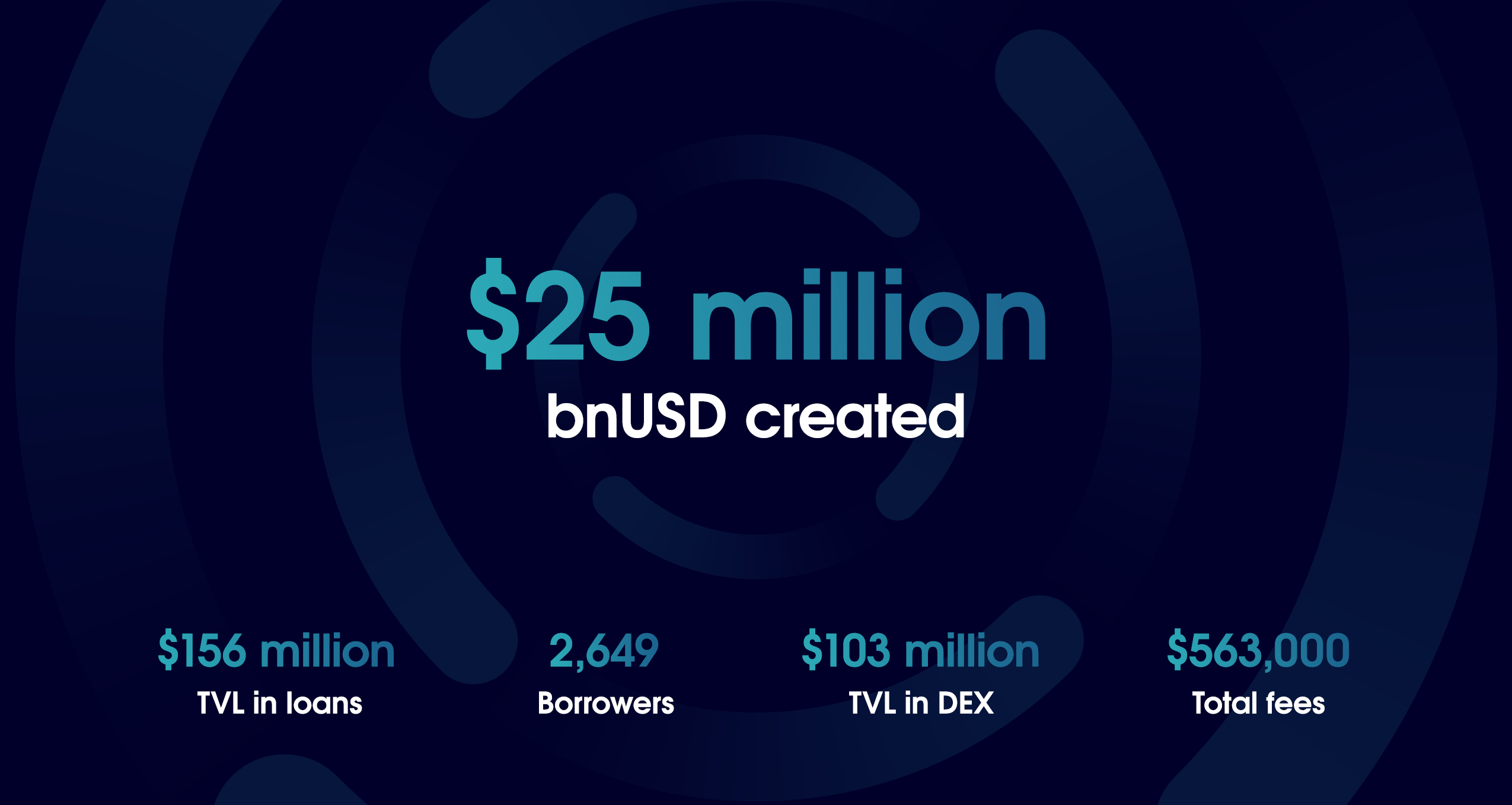

12 days post-launch

Balanced Dollars: 25,469,313

TVL (collateral): $156M

TVL (DEX): $103M

Total TVL: $259M

Borrowers: 2,649

Liquidity providers:

- 688 (sICX/ICX)

- 1,725 (sICX/bnUSD)

- 1,876 (BALN/bnUSD)

bnUSD holders: 4,016

BALN holders: 8,017

Fees: $563K

- 51,434 sICX

- 408,829 bnUSD

- 1,002 BALN

APY: 77% - 741%

16 days post-launch

The Balanced collateral pool now holds 10% of the $ICX circulating supply! 🎉 What an incredible milestone to reach after just 16 days.

From where we’re standing, the future for Balanced – and ICON – looks pretty bright. ☀️