Roadmap update | September 2021

New liquidity pools, additional vote functionality, rebalancing improvements, and a preview of upcoming features.

Since our August update, the Balanced contributors have been busy with numerous improvements to the product and smart contracts.

- Added the ability for community members to submit votes

- Listed 4 new liquidity pools: IUSDC/bnUSD, OMM/sICX, OMM/IUSDC, and OMM/USDS

- Launched 4 on-chain votes (BIP2, BIP3, BIP4, and BIP5)

- Pushed the full bnUSD pegging mechanism to mainnet, and made the rebalancing experience smoother for all borrowers (to learn more, see this Twitter thread)

- Designed and launched the Balanced blog

- Launched the Balanced Discord

- Got Balanced, bnUSD, BALN, and sICX listed on CoinMarketCap

- Got bnUSD, BALN, and ICX added to the P2PB2B exchange

- Designed mockups for the DAO financial statements

- Designed mockups for locking BALN to create bBALN

Quality of life improvements:

- Added an expansion indicator to the wallet

- Added a notification for when ICX has finished unstaking and is ready to claim

- Reduced the time banner messages are visible for

- Added BALN from liquidity pools to the voting weight

- Added a percentage option to the Swap tab

- Fixes for bugs, the activity feed, and ledger

- Improved the risk ratio section at mobile

- Fixed some bugs in the smart contracts

We're also:

- Testing continuous block rewards

- Doing research and architecture planning for bBALN

- Working on multi-language support

- Adding a notification to show when a proposal you haven't voted on is active

We covered a lot of ground this month, so let's dive into a few of the changes.

New liquidity pools

To support the launch of Omm, we released 4 new liquidity pools on August 31. One was IUSDC/bnUSD, which is now incentivized with 0.5% of the daily BALN.

The other 3 pools – OMM/sICX, OMM/IUSDC, and OMM/USDS – are incentivized by Omm Tokens, but the way you earn rewards for these pools is different. Learn how to earn OMM for supplying liquidity.

The release of these pools caused a huge spike in volume. According to Dapp.com, Balanced recorded several all-time highs on August 31 after the pools were listed, with 3,039 users and 62,072 transactions.

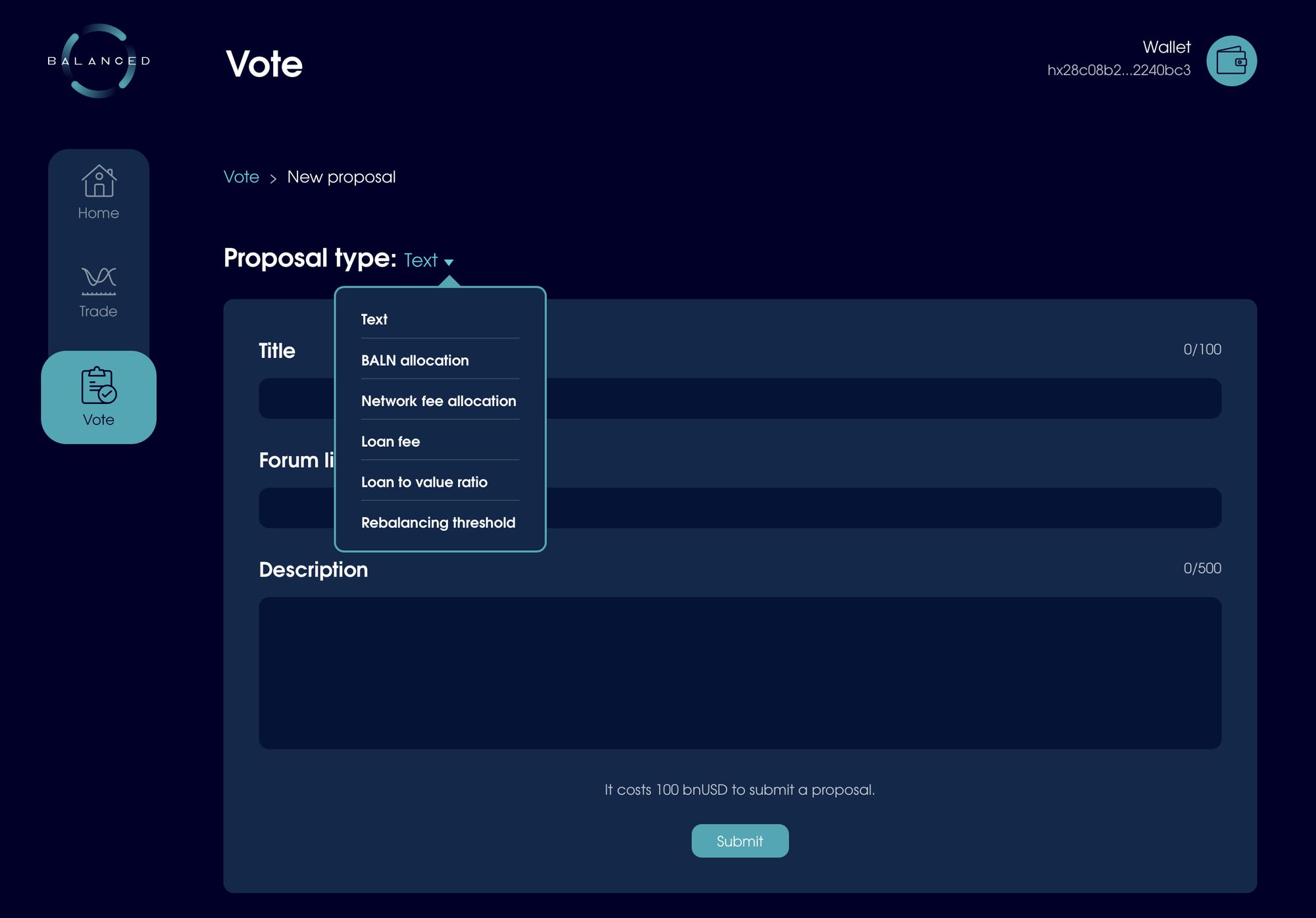

Voting

The Balanced DAO continues to set the standard for governance participation. Of the 4 on-chain votes, the lowest level of engagement was BIP4, with 934 voters and 56.58% of eligible BALN was used to vote.

Today we released the ability for community members to submit proposals. Until now, that responsibility has been left to the core contributors.

This release supports 6 proposal types:

- BALN allocation: Adjust the distribution ratio of Balance Tokens.

- Loan fee: Adjust the fee borrowers pay when they mint Balanced Dollars.

- Network fee ratio: Adjust the ratio of fees paid to eligible BALN holders versus the DAO fund.

- Loan to value ratio: Adjust the amount people can borrow against their collateral.

- Rebalancing threshold: Adjust how tightly we should keep Balanced Dollars to its $1 peg.

- Text: Suggest features and higher-level strategic decisions.

Before you submit a proposal, share it on the forum for the community to discuss, following the procedure outlined in the docs: https://docs.balanced.network/user-guide/participate-governance

To submit a proposal, you'll need to have staked at least 0.1% of the total BALN supply, and pay a 100 bnUSD fee.

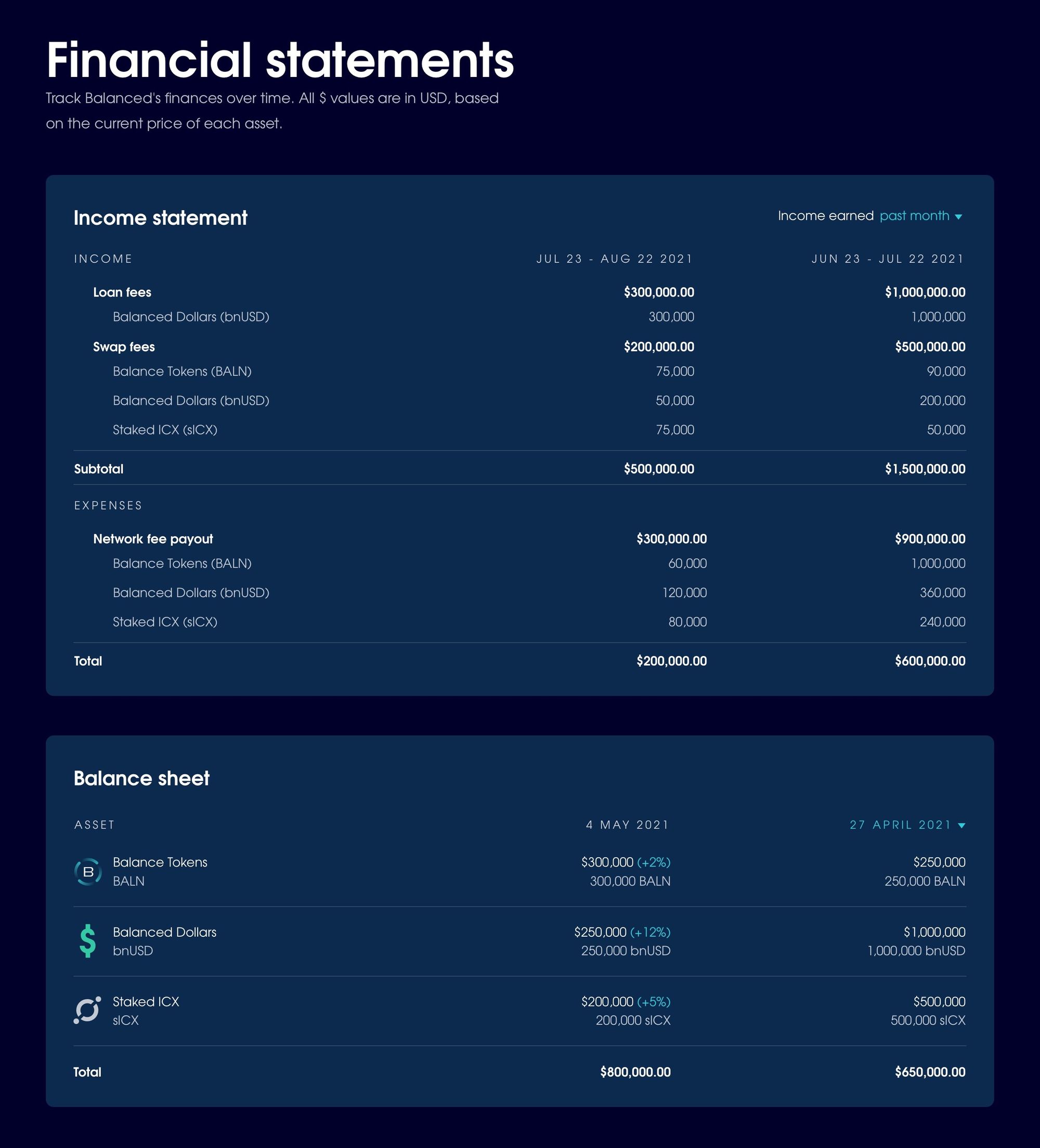

DAO financial statements

As we’ve seen from the 4 votes held over the past month, the Balanced community is already highly engaged in governance. To help them make even more informed decisions, we decided to open the books and create an adjustable income statement and balance sheet:

The Balanced financial statements are already in development and will be released during September.

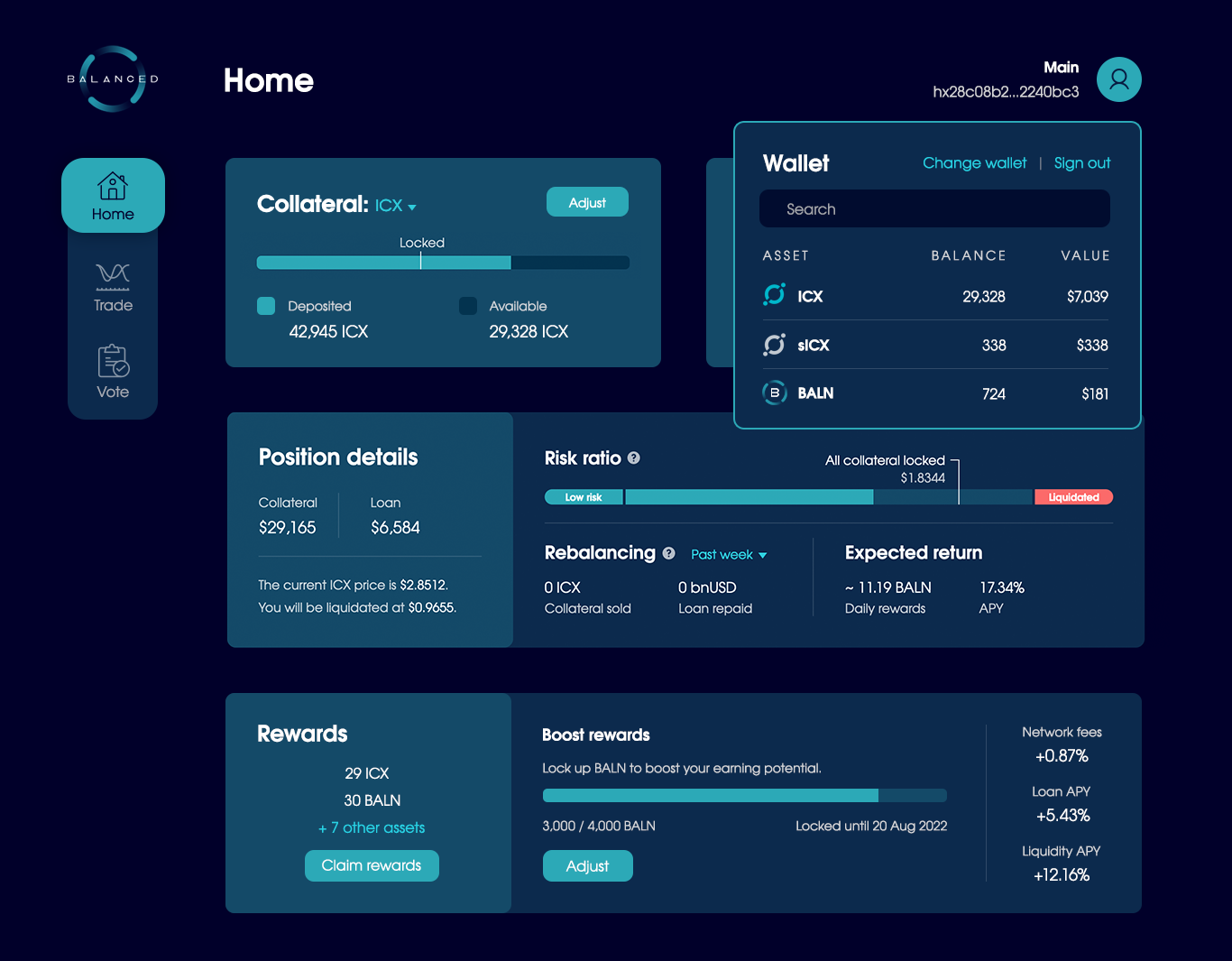

Boosted BALN

The community voted for BIP4, which requires you to lock up BALN to boost your earning potential. Now we're now working to implement it in a way that introduces as little complexity as possible.

We're still refining the details, but we expect the Home page to look a little something like this after the boosted BALN update:

We'll share a more in-depth post about the design before the changes are pushed to mainnet.

Targets for September

In the month of September, we’ll focus on token economics enhancements to BALN, add support for new collateral types, and a few other features. Specific targets include:

- DAO financial statements live on the Stats page

- Continuous BALN mining rewards on mainnet

- Initial bBALN implementation on testnet

- Transaction routing on mainnet

- New collateral types on testnet

- Rewards category for staked BALN on testnet

- Enhancements to smart contract architecture

- Progress on Java contract development

- Additional community proposal types, including spending from the DAO fund

- More quality of life improvements

If you have any questions or want to discuss these changes, join our growing Discord channel.