Roadmap update | Q4 2025

Intent-based trades across 11 chains, governance retirement, and the path to Balanced v2.

During Q3, the Balanced team improved the trading experience across 11 blockchains, designed and shared an interactive money market demo, and prepared for the final stages of Balanced’s transition from a frontend for its own protocol to a frontend for third-party protocols.

Shipped: Intent-based trades on every chain

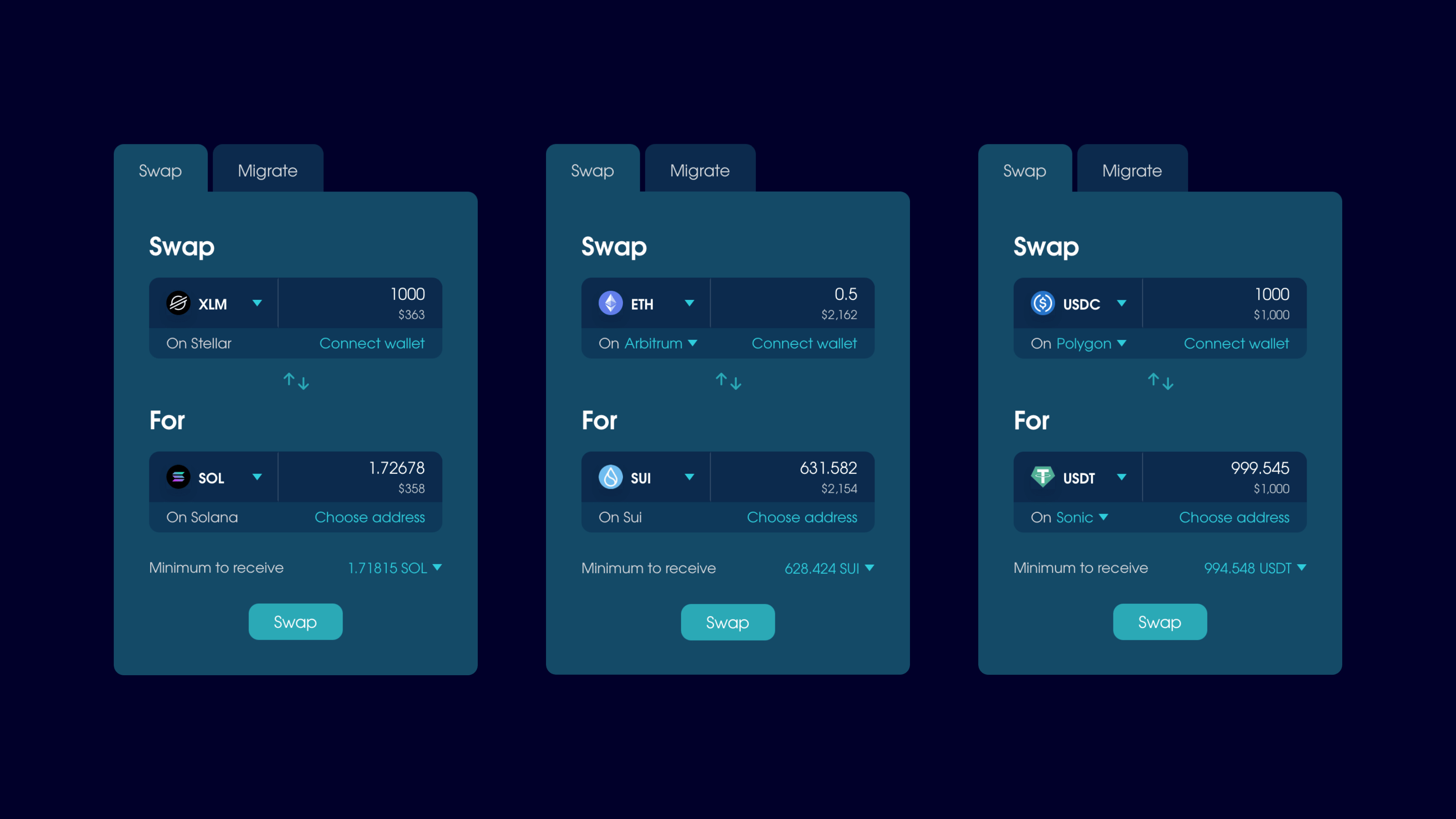

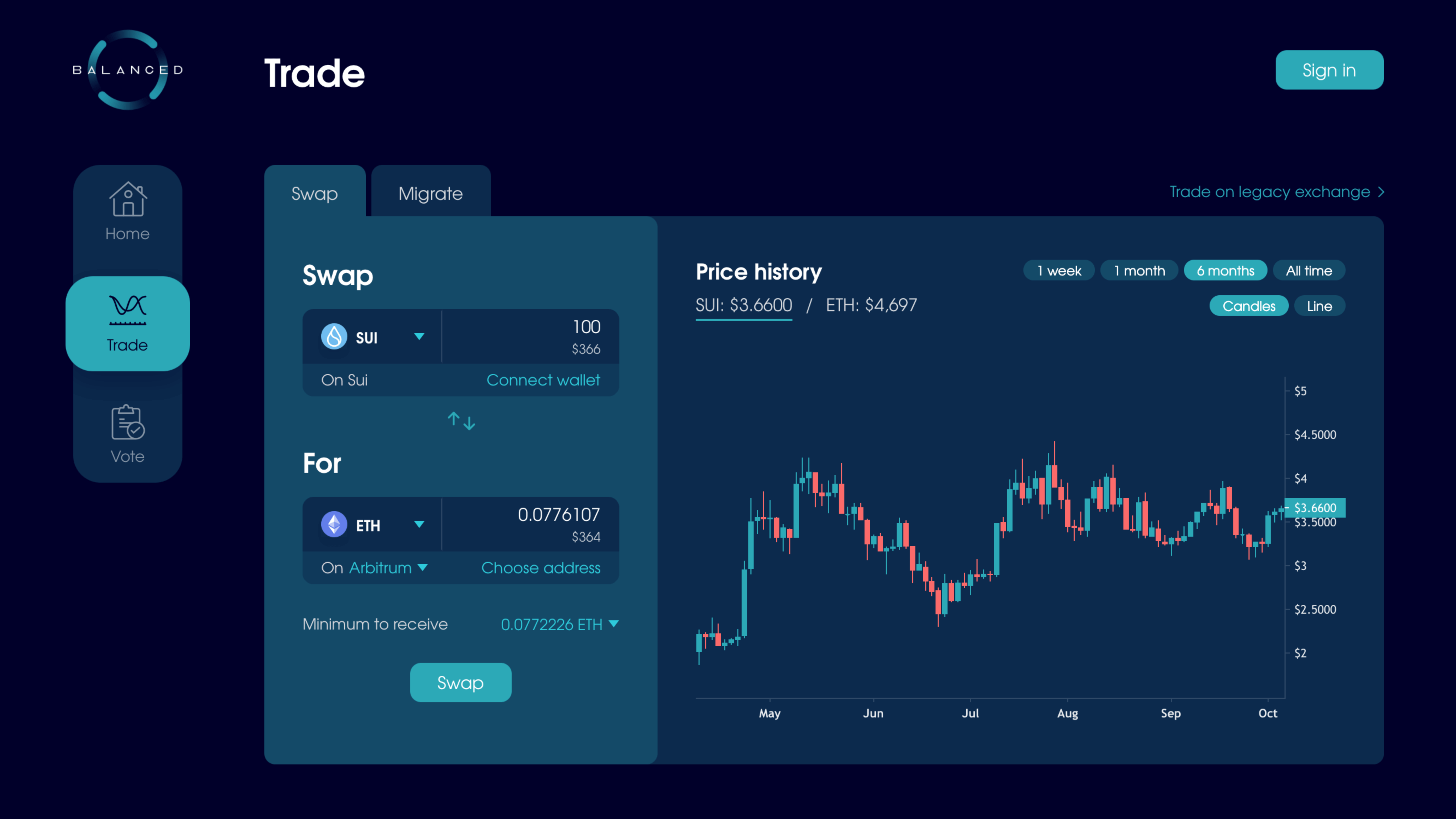

In September, the Trade page was upgraded to support SODAX Intents, which makes it easy to trade crypto across 11 chains in ~30 seconds at a competitive rate.

SODAX is already working on improvements to its tech that will make trading even faster, and a wider range of assets will become available over time.

The upgrade was a huge step forward for Balanced, which no longer needs to attract deep liquidity to its own pools to offer an appealing exchange rate. Instead, SODAX Intents acts like an aggregator that connects to a range of exchanges to source the best price for every trade.

The exchange upgrade marks the start of Balanced’s move to a new tech stack, so there were some unavoidable limitations:

- There are now two versions of bnUSD (trading uses the new version, other Balanced features use bnUSD(old)).

- Liquidity pools were moved to the legacy exchange alongside assets unavailable through SODAX Intents, including BALN and sICX.

- Trading on Archway, Havah, and Injective is only available through the legacy exchange (Injective will be reintroduced in v2).

For more details, check out the announcement post:

To complete the upgrade, we released price charts a few weeks later. No longer reliant on liquidity pools for the price data, all price history now comes from Coingecko and you can see the USD price chart for every asset you want to trade:

In progress: Retire Balanced governance

At the end of October, Balanced will complete its transition from protocol to frontend only.

Yesterday, voting began on the final proposal to shut down governance and halt BALN inflation. Once approved, bBALN holders will no longer receive network fees or boosted rewards, and the early unlock penalty will be removed so they can migrate their BALN to SODA.

Six months after the vote, the DAO Fund will be converted to SODA and distributed pro-rata to everyone who locks up SODA when they migrate BALN.

Be aware that if you use the Balanced liquidity pools, BALN rewards will stop when the proposal passes next week, though they’ll continue to capture 50% of the fees until people stop trading through the legacy exchange.

If you hold bBALN, make sure to cast your vote within the next 5 days.

We’ll release a blog post when the changes have been enacted and the BALN > SODA migration is live, so you have all the information you need to take action.

Up next: Balanced v2

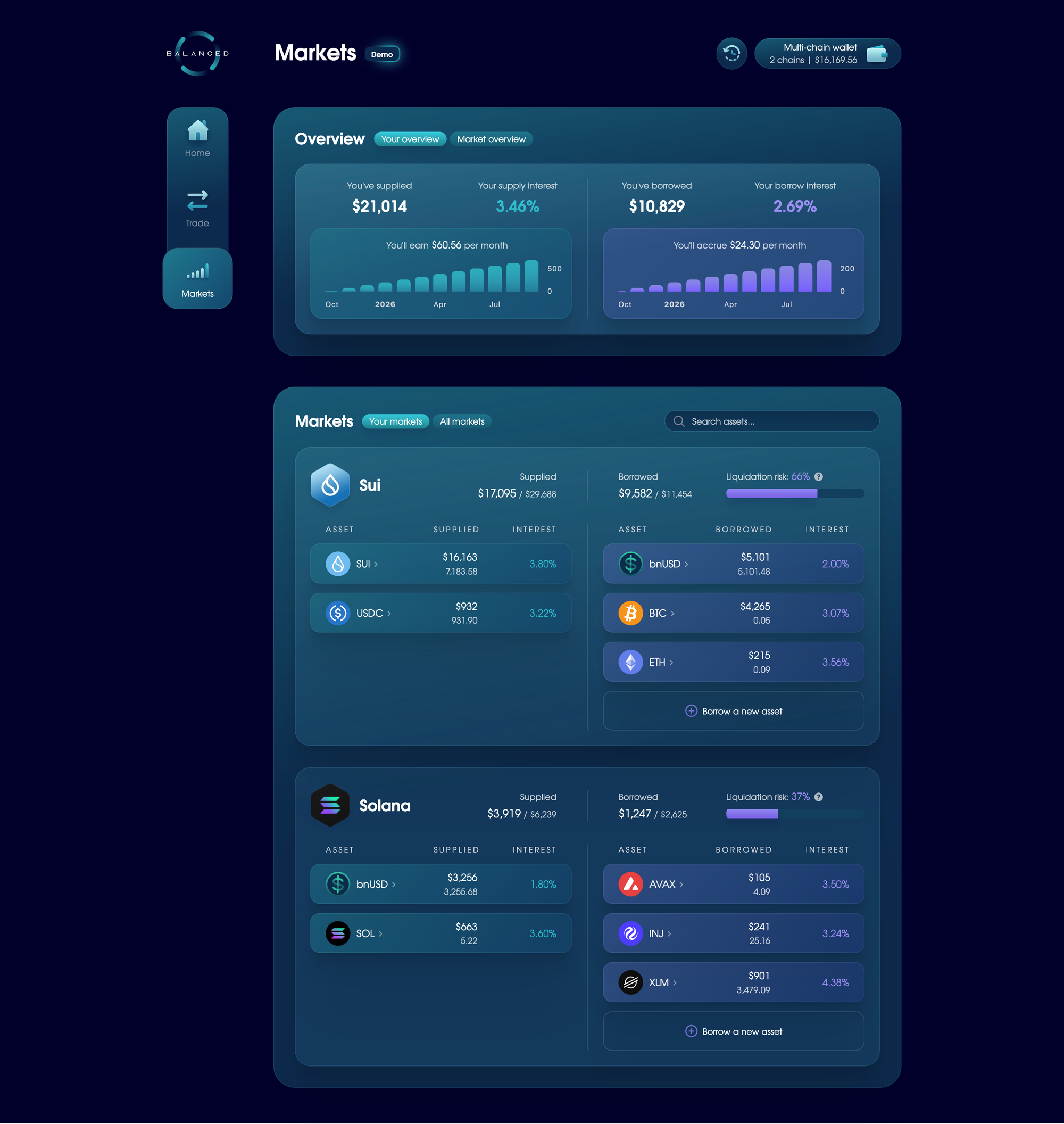

During Q3, we set out to create the most flexible cross-chain money market. The design is now 80% complete and available to preview through our interactive money market demo.

After the BALN migration update, building it will be our core focus.

The money markets will launch in Balanced version 2, which will be a separate application. Built from scratch to remove every trace of the old tech stack (including the Balanced protocol), v2 will feel smoother, faster, and more polished than ever.

Balanced v2 will start with money markets and trading (both powered by SODAX), then expand with widgets — a feature that unlocks support for additional protocols.

Our widget strategy is essential for us to remain competitive. Rather than build everything ourselves, we’ll use widgets to interact with any protocol we choose. With the right execution, an extensive widget library will make Balanced so useful that when it comes to cross-chain DeFi, you’ll never want or need to use anything else.

We made decent progress with widgets during Q3 and we’re feeling confident in the direction, so you may see them in the demo soon.

When will Balanced v2 launch? At this stage it’s anyone’s guess, but no later than Q1 2026 — even if that means we have to release one feature at a time.

At the time of launch, we’ll move v1 to a different domain so you can withdraw liquidity and repay loans without any immediate time pressure.

To stay up to date, follow Balanced on X/Twitter, join the Balanced Discord channel, or subscribe to receive new blog posts via email: