Roadmap update | Q3 2023

Enhanced website and Stats page, liquidity bribes, and a smart contract exploit.

During the second quarter of 2023, the website and Stats page upgrade was completed, liquidity bribes were implemented, and the contributors continued working towards a cross-chain future. Balanced also experienced its first smart contract exploit, which it was able to recover from within 6 days – with no financial loss borne by its users.

Here’s a summary of what’s been accomplished since the Q2 roadmap update:

Smart contracts

- Analysed and implemented a resolution to address the exploit

- Discussed, planned, and began working on security measures to mitigate damage in a future exploit

- Began implementation of Archway CosmWASM contracts to support cross-chain loans and bnUSD transfers via IBC

Front end / back end

- Added a Liquidity Bribes section to the Vote page

- Upgraded the Stats page

Quality of life and code improvements

- Upgraded balanced.network

- Improved penalty fee handling for early BALN withdrawals (required for BIP36)

- Improved the generic transaction error message

- Added the date to all governance proposals

- Fixed the rewards estimation for sICX/BTCB

- Fixed the voting duration displayed when submitting a new proposal

- Decreased the default slippage to 0.5%

- Improved the asset search UX at mobile

- Updated the ‘All collateral locked’ label to turn red when you borrow the maximum amount

- Improved the decimals for large and small assets in various places

- Updated the wallet to list assets from highest to lowest value

- Updated the ETH logo

- Improved the notification banner animation

- Added a specific time that ICX will have unstaked by

- Updated the wallet to close when switching between pages

- Added a ‘3 month’ option for Balanced earnings on the Performance Details page

- Fixed an issue that prevented bribes from being claimed during their final week

- Truncated headings in the Proposals section

- Added the ability to link to specific trading pairs (app.balanced.network/trade/sICX_bnUSD), liquidity pools (app.balanced.network/trade/supply/CFT_sICX), and the transfer interface (app.balanced.network/trade/bridge)

Balanced exploit

On June 24, a hacker found a way to mint and send LP Tokens to their own wallet, which allowed them to steal assets from the sICX/bnUSD, BTCB/bnUSD, sICX/BTCB, and BALN/sICX liquidity pools.

Some of the assets were recovered from the hacker’s wallet, and the Balanced DAO covered the outstanding loss, albeit at the cost of all protocol-owned liquidity. Thanks to the efforts of the Balanced contributors and community, Balanced resumed operations after 6 days without any financial loss to users.

For more information about the exploit, take a look at the post-mortem:

To limit Balanced’s attack surface in the future, the community have been discussing safety measures for the smart contracts. For more details, make sure to read Security Ideas and Thoughts on Improving Security Response Time.

And a week ago, we announced two pivotal ways that ICON supported Balanced after the exploit:

- Deposited 2.1M ICX into the DAO Fund, where it will be used to restart protocol-owned liquidity. (2.1M ICX can be recovered from the hacker’s wallet, but it requires significant planning and coordination.)

- Borrowed enough bnUSD to buy all 866,966 USDS from the Stability Fund. (After Prime Trust went into receivership, Stably halted USDS redemptions which put the value of bnUSD at risk. ICON will work with Stably to redeem the value over time.)

Many platforms can (and have) failed when faced with a double-blow like the exploit and USDS situation. But thanks to ICON’s support, Balanced came out the other side relatively unscathed — and more resilient than ever.

Website and Stats page upgrade

Thanks to the funding secured through DFP5, PARROT9 recently released major upgrades for the marketing site and Stats page.

If you haven’t seen them yet, make sure to take a look:

To provide some insight into the design process, the team shared this tweet thread alongside the release:

The redesigned @BalancedDAO website is live.

— PARROT9 (@parrot9design) June 17, 2023

Check it out at https://t.co/D0WwcrVZv2, and learn more about our design thinking in this thread. 🧵

1/

And the final progress report is available on the forum:

If you have the opportunity to talk about Balanced online, you can make an even stronger impression using the new marketing cards available in the Balanced branding kit (.zip, 4.1MB):

Governance updates

Since the last roadmap update, governance has continued at a steady pace with 8 proposals submitted and approved.

BIP36: Update Boosted BALN contract to change early unlock penalty structure

bBALN includes the ability to withdraw your BALN early. To prevent abuse, it shipped with a 50% penalty fee. The community felt this was excessive, so the contributors proposed a contract change to adjust the penalty fee.

Now when you withdraw BALN early, your bBALN will be deducted from the amount you receive – a fee that maxes out at 50%.

For example:

- 1,000 BALN locked for 1 year = 250 bBALN. Withdraw early to receive 750 BALN.

- 1,000 BALN locked for 4 years = 1,000 bBALN. Withdraw early to receive 500 BALN.

BIP37: Add BALN bribes for sICX/bnUSD, BTC/sICX, and BALN/sICX

After Craft’s bribes directed almost 50% of the liquidity incentives to the CFT/sICX pool, the Balanced DAO decided to enter the ring with BALN bribes for 3 core liquidity pools.

DFP7: Prepare the cross-chain UI

Following on from the website and stats page upgrade, PARROT9 requested 55,000 bnUSD to cover front-end, design, and content work for the app over a period of 5 months.

40,000 bnUSD will be dedicated to cross-chain work, and 15,000 bnUSD will be used for a range of product improvements. Most of the quality of life improvements in this update were the result of this proposal, with larger updates coming soon.

BIP38: Deprecate the goodwill disbursement contract and return remaining assets to the DAO Fund

After the liquidation event in January 2021, the DAO reduced the liquidation fee and, as an offer of goodwill, allowed anyone who paid a larger liquidation fee to claim a partial refund. 170K sICX was unclaimed more than a year later, so the decision was made to deprecate the contract and send the sICX to the DAO Fund where it could be used more productively.

Reduce the USDS Stability Fund cap to zero

In light of the news about Prime Trust going into receivership and Stably being forced to halt USDS redemptions, the DAO agreed that it’s not worth the risk to hold any USDS as backing for bnUSD.

BIP39: Balanced restart & recovery plan

After the exploit, the contributors needed to enact a number of changes before Balanced could resume operations. This included redirecting assets from the DAO Fund, Reserve Fund, and protocol-owned liquidity to restore users’ positions.

BIP40: Lower the BUSD Stability Fund cap to 100K

BUSD is no longer being minted and its future is unclear, so BIP40 proposed limiting the Stability Fund’s exposure to 100,000 BUSD.

BIP41: Refill BALN bribes for sICX/bnUSD and BALN/sICX

The BALN liquidity bribes introduced in BIP37 proved to be a success, so BIP41 proposed another 3 months of bribes: 4,000 BALN per week for sICX/bnUSD, and 3,000 BALN per week for BALN/sICX.

If you want to participate in the Balanced governance process, make sure to keep an eye on the forum, Discord, and/or Twitter, and look out for the vote notification badge in the app.

DAO performance

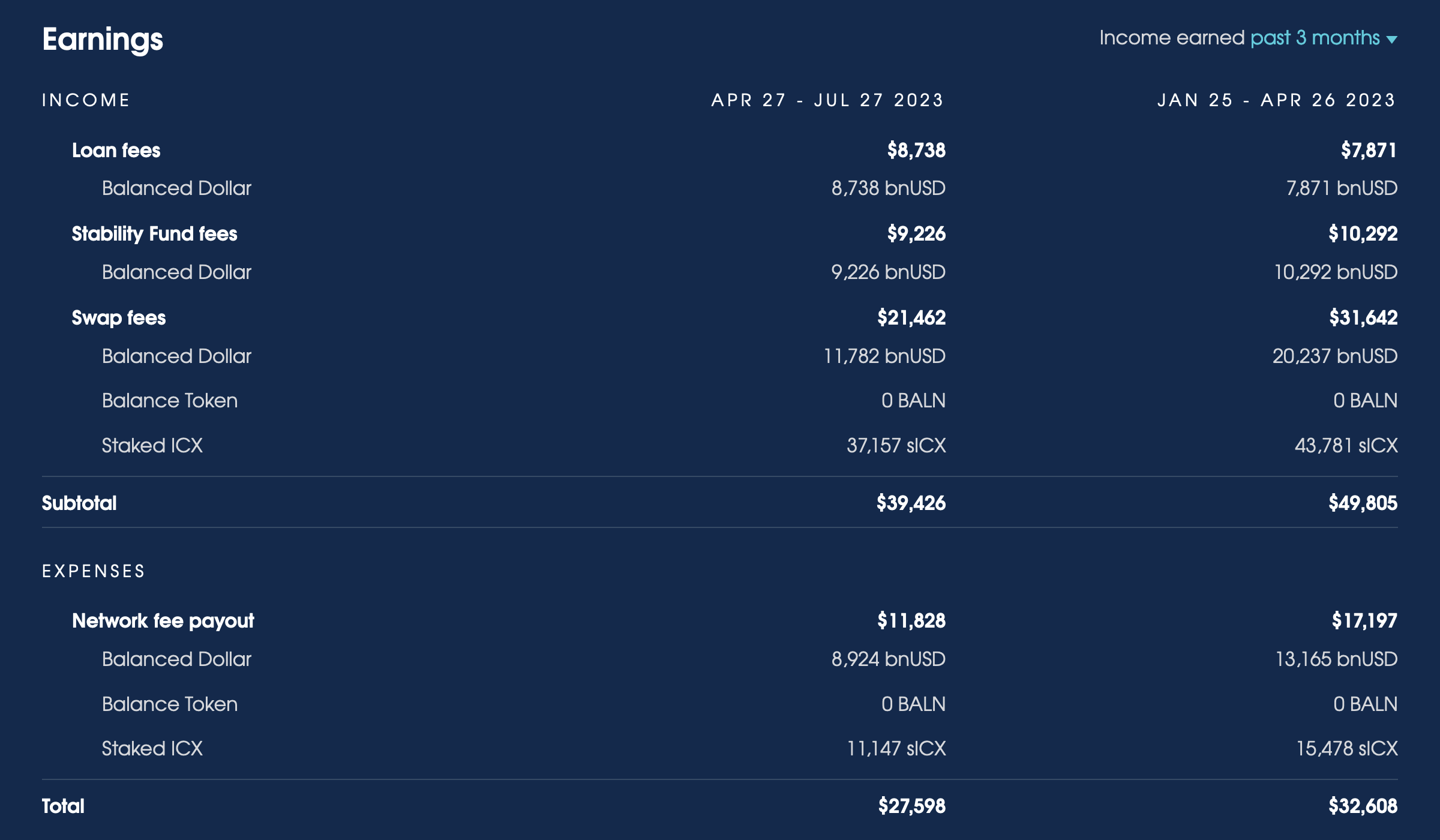

Over the last 3 months, Balanced earned $39,426 from fees:

- 6,738 bnUSD from loans

- 9,226 bnUSD from the Stability Fund

- $21,462 from swaps

$11,828 of that was distributed to bBALN holders, which gives bBALN a 30-day trailing APR of 13.72%.

Since the last roadmap update on April 28, the total amount held by the DAO has decreased by $818,409.

A large chunk of protocol-owned liquidity was stolen during the exploit, and the rest was used in the recovery efforts along with the sICX from the Reserve Fund. But thanks to the ICON team, the DAO Fund saw an increase of $317,754.

13,225,604 BALN have been locked in 1,004 wallets. There’s a total of 6,208,915 bBALN, giving an average lock-up time of 1.87 years.

Balanced wallpapers and NFTs

The cover for this roadmap update, Broadcast, has been added to the collection of Balanced wallpapers.

The animated version has been added to the Balanced NFT collection, which you can view on Craft or through Balanced’s new NFT page:

If you’d like a chance to win the Broadcast NFT, “broadcast” Balanced anywhere online. Share your favourite update from this post, or use one of the new marketing cards. Then tag @BalancedDAO on Twitter or drop it into Discord.

The winner will be announced after 7 days.

Plans for Q3 2023

Here’s what the contributors have planned for Q3:

- Launch xCall integration with Archway and Neutron on testnet (cross-chain loans & bnUSD transfers)

- Implement enhanced security features to mitigate damage from any potential future exploits

- Begin work on the cross-chain UX

- Integrate the Keplr wallet on testnet

- Add a comprehensive wallet to the Home page

- Enhance the signed-out state for the Home page

If you have any questions or want to discuss these updates, start a discussion on the Balanced forum or in the Balanced Discord channel.