Roadmap update | Q2 2023

The end of rebalancing, FYEO security audit, governance updates, and plans for the second quarter of 2023.

During the first quarter of 2023, the Balanced community focused heavily on governance, with 12 proposals discussed and approved. Rebalancing was replaced by a redemption mechanism, the Stats page and app received numerous updates, and the smart contracts were audited by FYEO.

Here’s a summary of what’s been accomplished since the Q1 roadmap update:

Smart contracts

- Completed a security audit with FYEO

- Developed a whitelist for emergency shut-offs

- Replaced rebalancing with a redemption mechanism

- Designed, implemented, tested, and deployed a Balanced OTC contract to acquire assets for protocol-owned liquidity (i.e. BTC, ETH)

- Added contract versioning to easily track contract upgrade status

- Removed manual work for fee handling and conversion to BALN

Front end / back end

- Retired the Activity History section, which was costly to maintain to a high standard

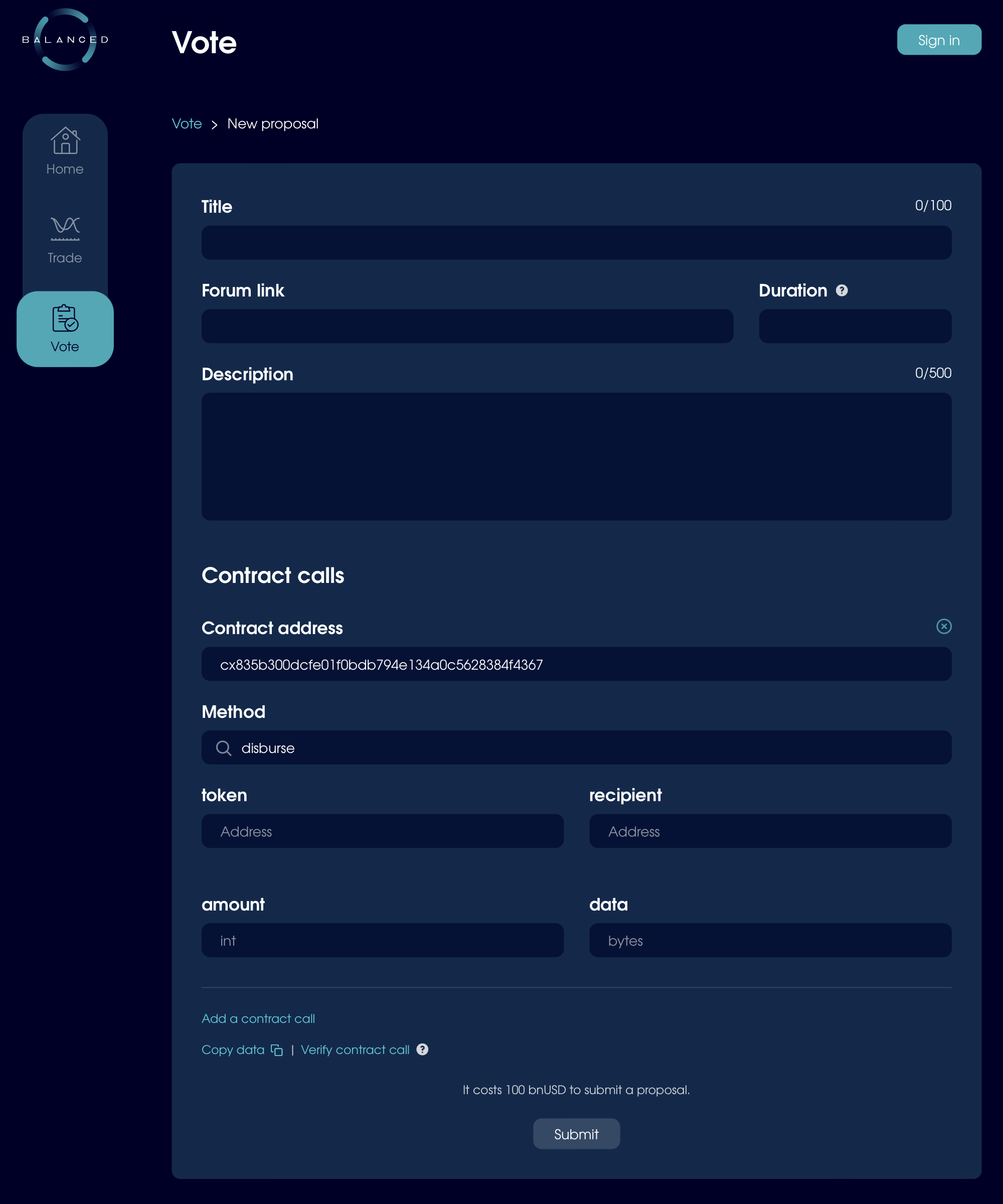

- Upgraded the New Proposal page to support arbitrary contract calls

- Updated the back-end APIs for the app and Stats page

- Added a multi-collateral chart to the Stats page

- Added protocol-owned liquidity info to the Performance Details page

Quality of life and code improvements

- Added the date to each proposal once voting ends

- Added the forum link to each proposal

- Added the price for each token

- Updated the Position Details section to reflect the move from rebalancing to redemptions

- Added a “View bribes” link to incentivised pools that offer bribes

- Improved the explanation for sICX unstaking estimates

- Improved the ICX queue UX

- Fixed a bug that let you swap for the same asset

- Removed the beta warnings from the Transfer modal

- Prevented a MetaMask pop-up from appearing every time a page was refreshed

- Updated the APY calculation for liquidity pools to reflect the total LP tokens staked

- Fixed an issue that prevented the sICX/BTC pool incentives from appearing on smaller screens

- Fixed a bug that hid the ICX queue from the Exchange section on the Stats page when there was no liquidity

- Updated fee information to maintain accuracy after several changes from recent proposals

- Improved the generic transaction error message and linked to the docs for more guidance

- Fixed some issues with bridged tokens

- Fixed various other issues related to liquidity pools and proposals

The end of rebalancing

Previously, Balanced relied on rebalancing to keep bnUSD at $1. But since the introduction of the Stability Fund, rebalancing was only necessary as a last resort.

So, in February, rebalancing was replaced by a redemption mechanism. The move provides a better borrower experience, and was necessary for bnUSD to be cross-chain compatible.

What are redemptions?

Similar to rebalancing, traders can “redeem” bnUSD for $0.90 of borrower collateral, which repays 0.995 bnUSD of borrower debt. Each redemption is spread across a group of borrowers to limit the impact.

Redemptions are only available via the Balanced Loans contract, and are only worthwhile if the price of bnUSD falls below $0.90 and the Stability Fund is empty.

FYEO smart contract audit

From 27 February – 3 April, FYEO conducted a security assessment of Balanced’s Java smart contracts.

5 findings were reported, all of which have been resolved by the Balanced smart contract developers.

Here’s an extract of FYEO’s general observations:

If you want to dive into the details, you can view the audit report below, or access it any time from the Balanced docs.

Progress on the website and Stats page upgrade

Work on the Balanced website and Stats page upgrade continues, and is expected to be complete within this quarter.

In case you missed it, check out this progress update for a list of everything completed up to March, and this tweet thread for a preview of the animated graphics, like this one:

Since then, the PARROT9 team has:

- Updated the Stats page and app to use the latest back-end infrastructure

- Upgraded the Collateral chart to support multiple collateral types and show the total value backing bnUSD

- Designed new governance sections for the Stats page

- Continued to work on the Balanced website upgrade

Development for the new governance sections on the Stats page is underway, and the bnUSD chart will be updated soon to highlight minting activity for each collateral type.

Governance updates

Since the Q1 roadmap update, 12 proposals have been submitted and approved:

Purchase BTC and ETH through Karma

The Balanced DAO used Karma Finance to auction off ~$50k of BALN in exchange for BTCB and ETH from BNB Smart Chain.

Increase the DAO’s share of network fees

The network fee ratio was adjusted in order to direct more of Balanced’s income to protocol-owned liquidity. Before the proposal, Balanced distributed 60% of the network fees to bBALN holders. Now, bBALN holders receive 30% fees, while the DAO Fund retains 70%.

The more fees the DAO earns, the more liquidity it can supply, which leads to more fees. The goal was to increase the speed of this flywheel.

Add protocol-owned liquidity to the BALN/sICX pool

This proposal deepened liquidity for the core BALN pool, which also has value in terms of supporting triangular arbitrage between sICX/bnUSD, BALN/sICX, and BALN/bnUSD.

Pair BTCB and ETH with bnUSD for protocol-owned liquidity

A follow-up from the proposal to purchase BTC and ETH via Karma. The BTC and ETH was supplied to the ETH/bnUSD and BTCB/bnUSD pools with an equivalent amount of bnUSD to increase Balanced’s protocol-owned liquidity.

BIP27: Increasing the LTV ratio for ETH and BTC

BIP27 saw the reintroduction of the BIP nomenclature. By increasing the borrow limit to match ICX, this proposal aimed to provide a more useful product for borrowers, and increase the fees earned from BTC and ETH collateral.

BIP28: Add sICX/BTCB as a votable pool

This proposal allowed bBALN holders to incentivise the sICX/BTCB liquidity pool. Because the price of sICX and BTC are more correlated to each other than to the US Dollar, sICX/BTCB is appealing to liquidity providers who want to participate in a more passive pool.

BIP29: Invest 75k bnUSD into BTC for protocol-owned liquidity

BIP29 was the first proposal to use the new Balanced OTC contract, which was developed by a Balanced community contributor. The DAO deposited 75k bnUSD into the contract, and opened an OTC order to purchase BTC at a 1.5% discount (based on the Band Oracle price). Arbitrage traders quickly deposited BTC from BNB Smart Chain to fill the order.

BIP30: Adjust the fee split for the ICX queue

For every fee charged to swap sICX for ICX, the ICX queue retained 70% and the DAO Fund received 30%. All other liquidity pools split the fee 50:50, so this proposal updated the ICX queue to match. The goal was to standardise the fee structure while also increasing revenue to the DAO and bBALN holders.

BIP31: Add CFT/sICX as a votable pool

To increase liquidity for Craft’s CFT token, this proposal allowed bBALN holders to incentivise the CFT/sICX liquidity pool.

The CFT/sICX pool is the first to offer bribes, a feature often used on Curve to incentivise veCRV holders to direct inflation to a desired pool. The bribes renew every 7 days, and you can claim them from the Craft website. So far, bribing has proven extremely effective: At the time of publishing, the CFT/sICX pool has been allocated 43.87% of the BALN incentives.

BIP32: Add bnUSD and BTCB as protocol-owned liquidity

A follow-up from BIP29, which acquired ~$75k of BTCB using the Balanced OTC contract. The BTCB and ~75k bnUSD was supplied to the BTCB/bnUSD liquidity pool to increase Balanced’s protocol-owned liquidity.

BIP33: Invest 100k bnUSD into BTC for protocol-owned liquidity

The DAO deposited another 100k bnUSD into the contract, and opened an OTC order to purchase BTC at a 1.5% discount (based on the Band Oracle price). It also removed all remaining USDS and IUSDC, and converted it to bnUSD through the Stability Fund.

BIP34: Unstake Balanced’s LP tokens

To prevent Balanced from taking inflation away from liquidity providers, BIP34 unstaked the LP tokens Balanced holds for its protocol-owned liquidity. The DAO Fund contract was also updated to allow for staking and unstaking LP tokens through governance.

BIP35: Pair BTCB and sICX with bnUSD for protocol-owned liquidity

Voting is currently underway for a 13th proposal, BIP35. If approved, all the BTCB and sICX held in the DAO Fund, plus an equal value of bnUSD, will be invested into protocol-owned liquidity.

The DAO shows no sign of slowing down, nor has it reached the limits of what’s possible through the smart contracts. To complement their efforts, the app has been updated to support arbitrary contract calls for new governance proposals:

To try it out, head over to app.balanced.network/vote/new-proposal. You can find a list of Balanced smart contract addresses in the docs, or use any other ICON-based smart contract. Due to its flexibility, some smart contract knowledge is required, but the contributors and community will be happy to guide you.

If you want to participate in the Balanced governance process, make sure to keep an eye on the forum, Discord, and/or Twitter, and look out for the vote notification badge in the app.

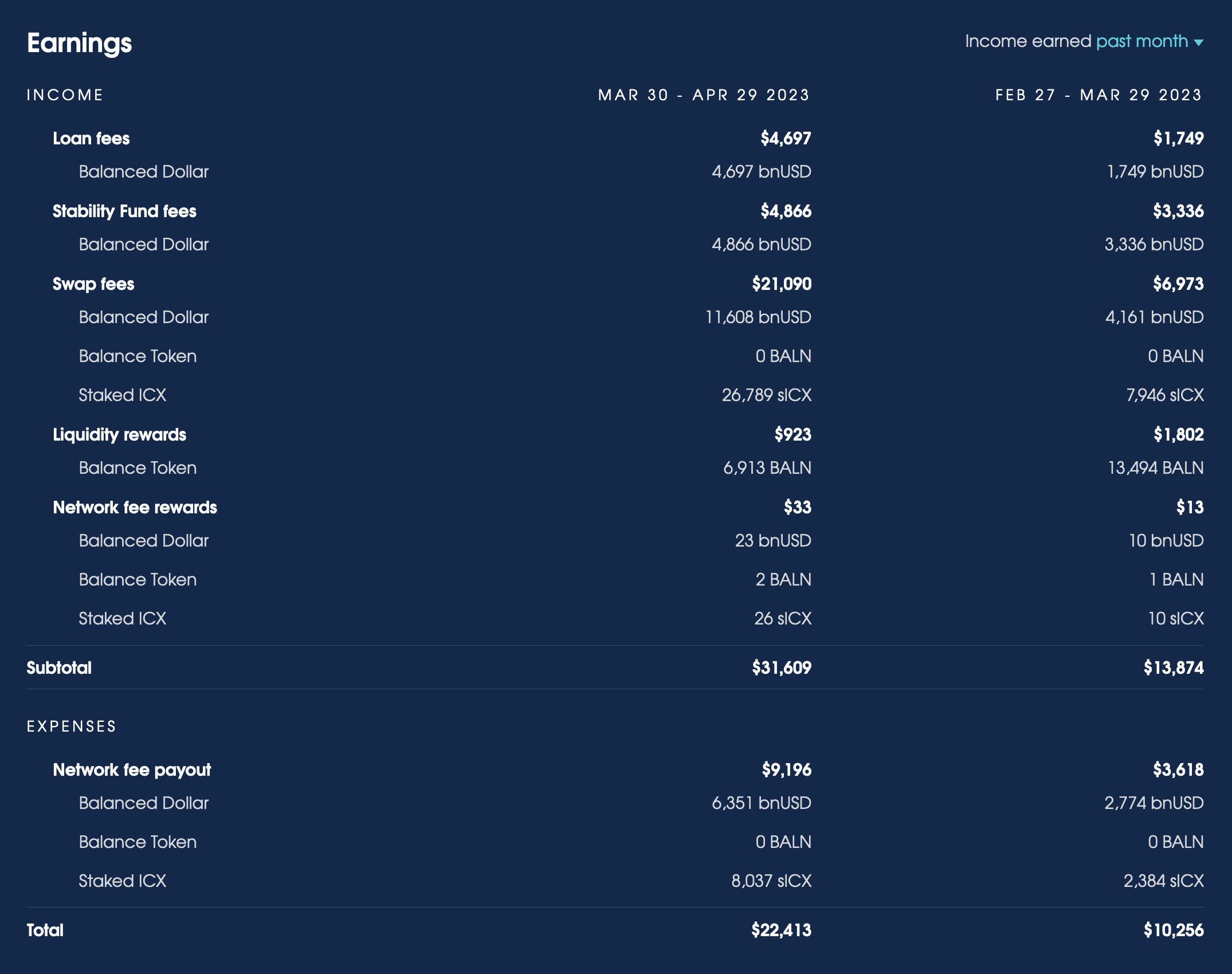

DAO performance

Over the last 2 months*, Balanced earned $42,711 from fees:

- 6,446 bnUSD from loans

- 8,202 bnUSD from the Stability Fund

- $28,063 from swaps

$12,814 of that was distributed to bBALN holders, which gives bBALN a 30-day trailing APY of 13.83%.

Balanced also earned 20,407 BALN ($2,725) through protocol-owned liquidity, and $46 of network fees for holding 34k bBALN. As Balanced’s LP tokens were unstaked with the approval of BIP34, this data will no longer be tracked.

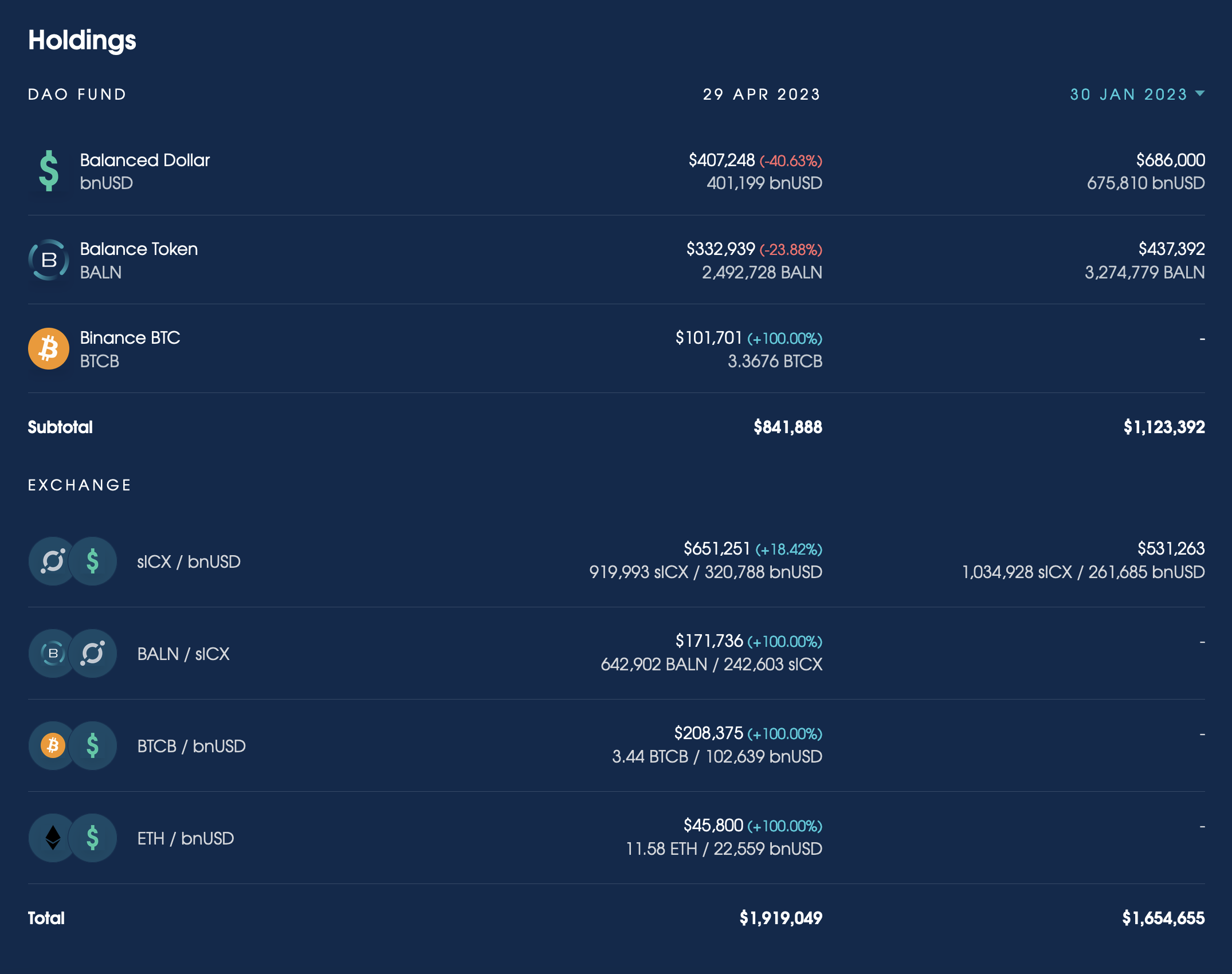

Since the last roadmap update on January 30, Balanced has increased its protocol-owned liquidity position by $545,899 – up 102.75%.

The total amount held in the DAO Fund and on the exchange increased by $264,394 (+ 15.98%) over the same time frame.

12,834,790 BALN have been locked in 1008 wallets. There are 5,975,401 total bBALN, giving an average lock-up time of 1.86 years.

*3-monthly comparisons will commence in the Q3 update, once the new Balanced backend has collected enough data.

Balanced wallpapers and NFTs

The cover for this roadmap update, Loop, has been added to the collection of Balanced wallpapers.

The animated version has been added to the Balanced NFT collection on Craft.

If you’d like a chance to win the Loop NFT, retweet the roadmap announcement on Twitter and let us know your favourite highlight from this update.

The winner will be announced 7 days after publishing.

Plans for Q2 2023

In Q2, the Balanced smart contract developers will collaborate with ICON’s xCall integrations team to build out cross-chain features. We’ll continue to ship improvements to the Balanced app, Stats page, and website, and we expect to maintain the pace of governance proposals for protocol-owned liquidity and various parameter adjustments.

Here’s what we have planned for Q2:

- Release the formal audit report from FYEO

- Continue governance proposals to actively manage the DAO Fund / protocol-owned liquidity

- Discuss and propose a whitelist for emergency shut-offs

- Complete the upgrade to the Stats page and marketing site

- Begin implementing xCall features to support cross-chain collateral deposits, borrowing of bnUSD, and transferring of bnUSD

If you have any questions or want to discuss these updates, start a discussion on the Balanced forum or in the Balanced Discord channel.