Roadmap update | Q2 2025

Cross-chain support for the Savings Rate, liquidity pools, and rewards, and a strategy that alters the direction of Balanced.

During Q1 2025, the Balanced contributors continued to extend Balanced’s cross-chain functionality, increased blockchain support for intent-based trades, and worked on large-scale upgrades to Balanced’s technology stack to support ICON’s move from blockchain to DeFi app platform.

Here’s what the contributors accomplished since the last roadmap update:

Smart contracts

- Upgraded the contracts to support cross-chain Savings Rate, liquidity pools, and rewards

- Shipped updates for intents & the ICON solver, including support for ICON, Polygon, Stellar, and an

exact_outfeature to specify the amount to receive (rather than just the amount to swap) - Upgraded all blockchain connections to the new cluster relay setup

- Prepared for ICON’s transition to SODAX

- Deployed new relay infrastructure

- Deployed new asset manager contracts

- Deployed money market contracts on Sonic

- Built SDKs to support front-end integrations

Front-end / back-end

- Launched cross-chain liquidity pools

- Launched the cross-chain Savings Rate

- Launched cross-chain rewards

- Launched Balanced on Polygon

- Added support for intent-based trades on ICON and Polygon

- Added USDC on Solana and Stellar

- Added support for a new ICX/sICX liquidity pool

- Began work on improved transaction handling

Quality of life & code improvements

- Added a blockchain filter to asset selectors on the Trade page

- Improved handling for withdrawal limits on the Trade page

- Added the option to clear searches across the app

- Removed old code from the ICX-only queue

- Added trustline handling for Stellar wallets (required to hold assets on Stellar)

- Improved intent fee handling

- Pushed a range of bug fixes and stability improvements

Marketing initiatives

- Published Liquidity pools, Savings Rate, and rewards go cross-chain

- Published Balanced connects to Polygon

- Added a privacy policy

- Made the Balanced demo fully interactive across chains

- Worked on blockchain-specific marketing pages

- Worked on Balanced’s content & distribution strategy

- Assisted with ICON’s co-marketing efforts

Cross-chain expansion

Balanced extended its cross-chain functionality in March with the release of the Savings Rate, liquidity pools, and rewards on 11 blockchains. You can now deposit bnUSD into the Savings Rate and/or supply liquidity on your favourite chain(s), and earn rewards for it.

Support for Polygon arrived a few days later to bring the total number of blockchains to 13. Unlike previous connections, Polygon launched with no liquidity available for its native token, POL, but thanks to the power of intent-based trades, we didn’t need it.

Intents are now available for Arbitrum, ICON, Polygon, and Sui, so you can make 5-second swaps between a wider range of assets. Support for Stellar will ship within the coming days, then it’s time to integrate a new version of intents that supports all connected chains.

Co-marketing campaigns

A few weeks ago, the ICON team finished a co-marketing campaign with Studio Mirai, who have one of the largest communities in the Sui ecosystem.

Over 1,300 wallets participated in the 6-week Mirai Season campaign, which saw the SUI and mSUI collateral held on Balanced increase from $50k to a peak of ~$320k, despite the turbulent market conditions. Now over a month post-campaign, the SUI + mSUI collateral sits at $118k.

Preparations for new initiatives are underway, including a bnUSD/USDC pool on Steamm within the Sui ecosystem, and an exclusive user acquisition pilot program on Stellar.

The SODAX strategy: a new direction for Balanced and ICON

Earlier this week, ICON announced their plan to transition from a blockchain into a cross-chain DeFi platform based on Sonic. ICON’s cross-chain technology will merge with the Balanced protocol to become SODAX, and the SODAX infrastructure will be available for others to use.

Balanced will continue to operate as a front-end for SODAX, but it will no longer be its own protocol. Governance will be removed, and PARROT9 will assume full ownership over the app and brand direction. Their goal: make Balance self-sustainable through transaction fees.

The transition is expected to take several months, and systems will be put in place to help people:

- Convert bnUSD to a newer version of the token

- Convert BALN to SODA (the SODAX governance token)

- Migrate loan and liquidity positions

After the transition is complete, PARROT9 will be free to enact their own vision for Balanced, which will include support for additional protocols to unify the cross-chain DeFi experience.

We’ll release additional details about the transition over the coming weeks to keep the community informed. Until then, read these posts to get up to speed:

- ICON’s SODAX announcement

- Benny Options’ proposed next steps for Balanced

- PARROT9’s vision for Balanced

It’s a significant change to digest, so if you have any questions, comments, or concerns, add them to the forum posts or start a discussion in the Balanced Discord channel.

And make sure to tune in to ICON’s AMA session this Thursday at 9pm UTC.

Governance updates

Most of the contact work in Q1 involved the new Sonic infrastructure, so governance slowed to just 6 proposals:

- BIP 107: Support the cross-chain Savings Rate, add Solana USDC, upgrade Solana & Optimism to the cluster relay setup, borrow bnUSD for intent-based trades, and change the voting quorum from 30% to 25%

- BIP 108: Add BALN to Polygon and upgrade Arbitrum & Injective to the cluster relay setup

- BIP 109: Optimise reward queries, upgrade Archway & Polygon to the cluster relay setup, and borrow liquidity for intent-based trades on Solana, Stellar and ICON

- BIP 110: Support Stellar UDSC and upgrade Base & Stellar to the cluster relay setup

- BIP 111: Upgrade Avalanche & Sui to the cluster relay setup

- DFP 14: Use $10k of BALN to incentivise a bnUSD/USDC pool on Steamm

DAO performance

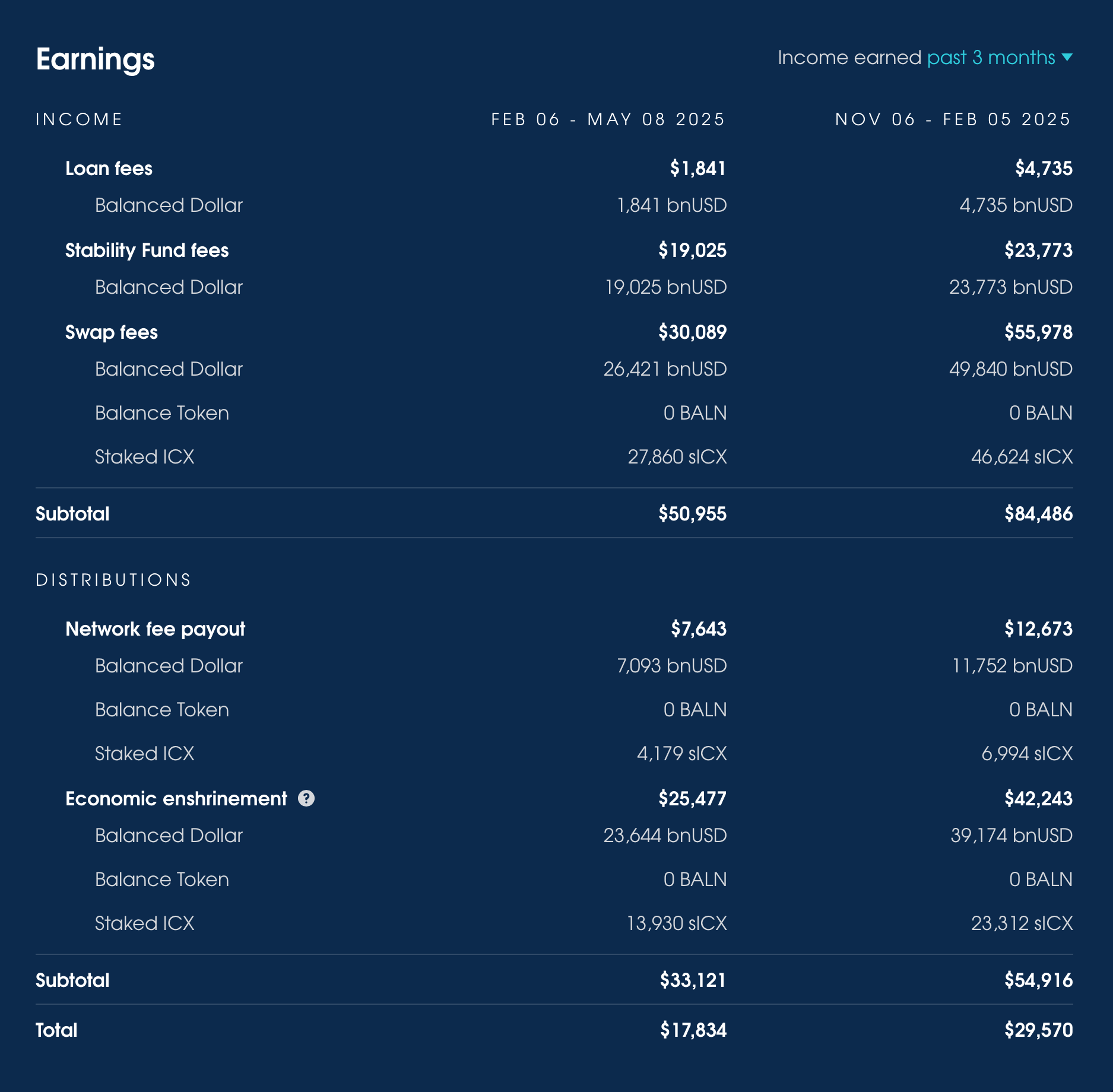

Over the last 3 months, Balanced earned $50,955 from fees:

- 1,841 bnUSD from loans

- $30,089 from swaps

- $19,025 from Stability Fund swaps

$7,643 of that was distributed to bBALN holders, which gives BALN a 30-day trailing APR of 4.56%.

$25,477 was used to buy and burn ICX, fulfilling Balanced’s role in the economic enshrinement. Balanced’s net profit for the quarter was $17,834.

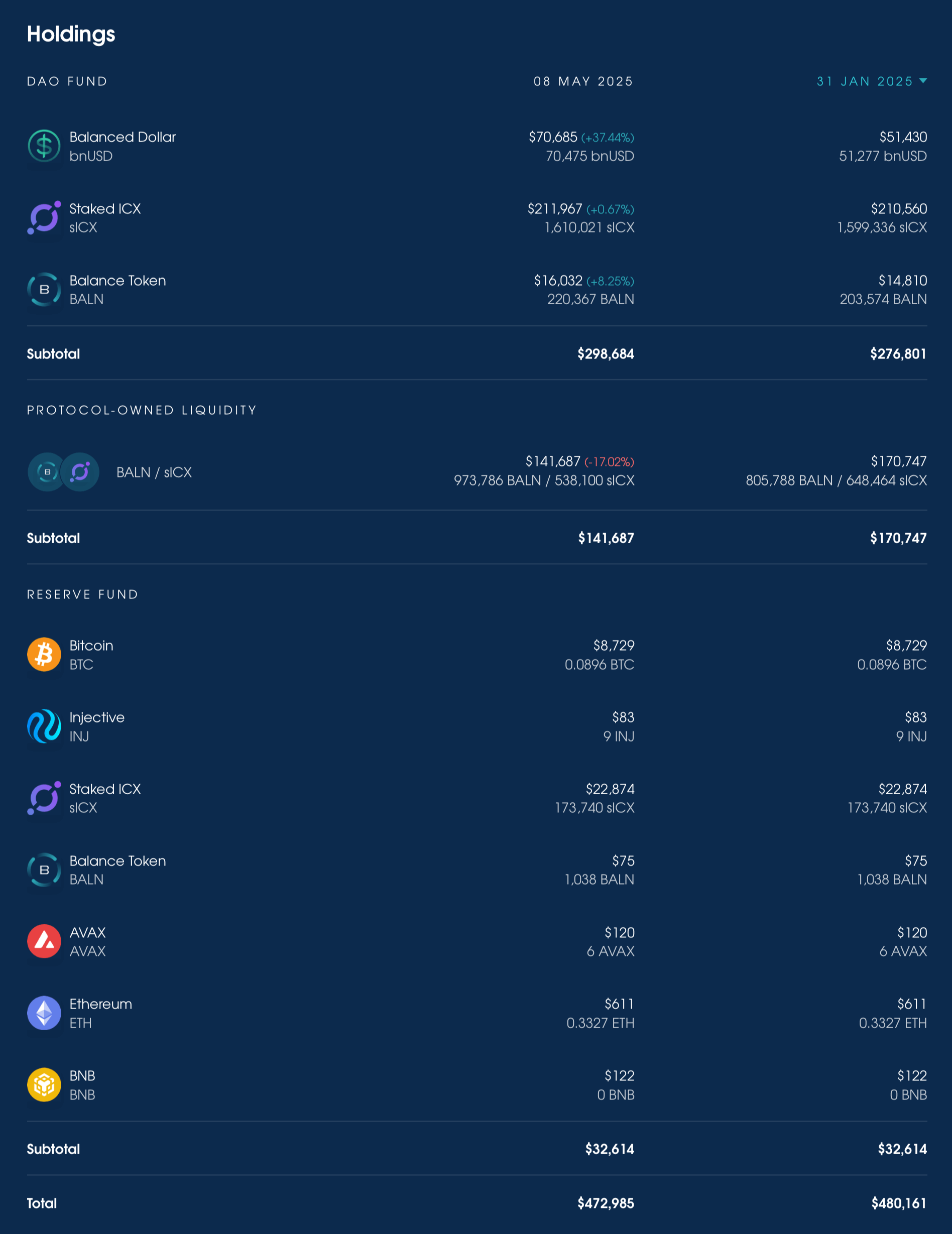

The DAO Fund increased by $21,883 while protocol-owned liquidity fell $29,060, which reduced the total holdings by $7,176.

12,960,384 BALN have been locked in 825 wallets. There’s a total of 6,052,839 bBALN, giving an average lock-up time of 1.86 years.

Enshrinement

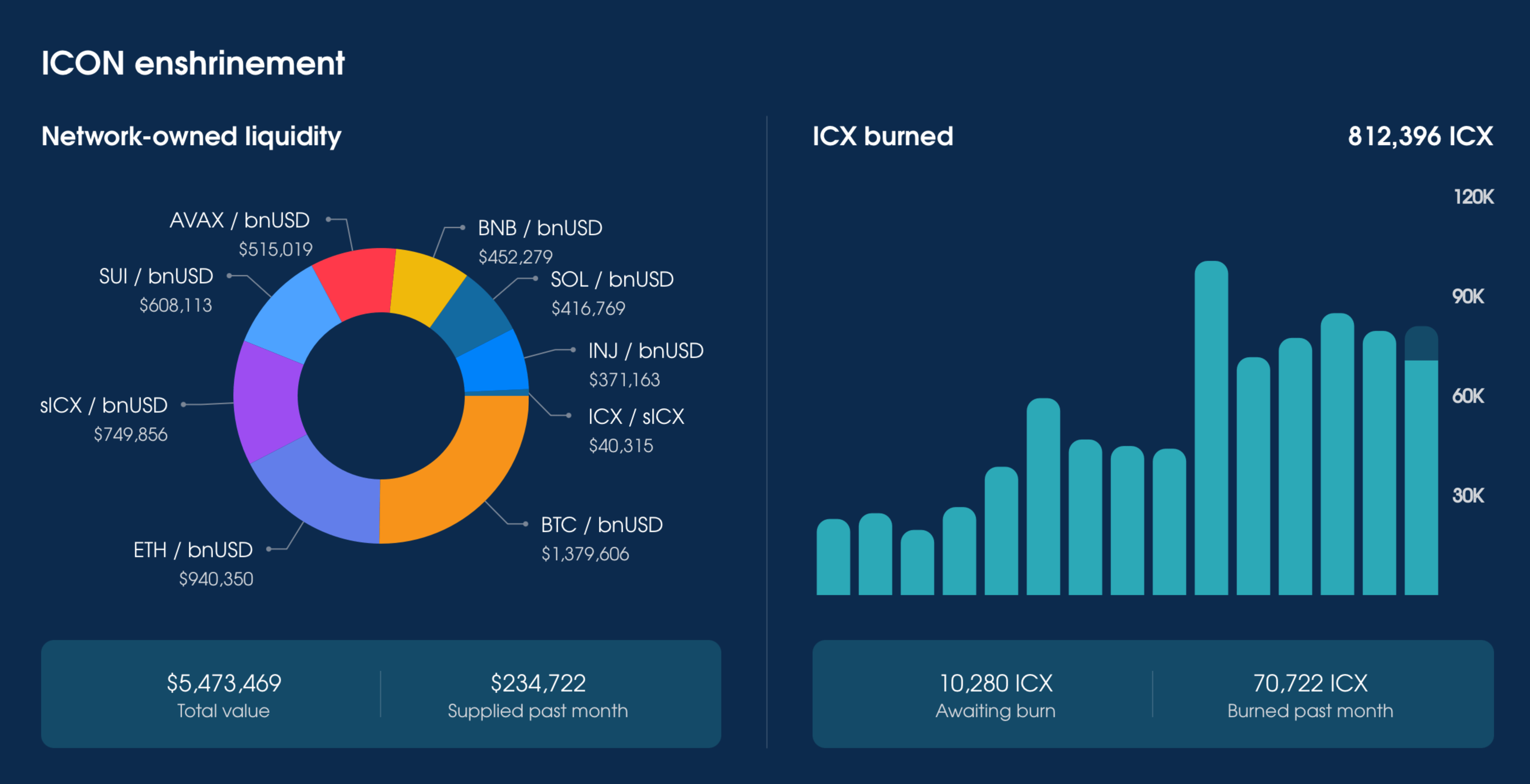

In the 14 months that have passed since the economic enshrinement was enacted:

- Balanced has burned 812k ICX

- ICON has supplied ~$5.45M of liquidity for AVAX, BNB, BTC, ETH, ICX, INJ, sICX, SUI, & SOL

- ICON has provided ~636,160 sICX of incentives for the Savings Rate

Plans for Q2 2025

During Q2, the contributors plan to:

- Add intent-based trades to every connected chain

- Continue contract upgrades for SODAX & Sonic

- Work on front-end updates for SODAX + Sonic

- Publish blockchain-specific marketing pages

If you have any questions or want to discuss these updates, join the Balanced Discord channel.