bnUSD: now available to borrow cross-chain

Borrow bnUSD against your favourite collateral type on any supported blockchain.

As of today, bnUSD loans no longer require an ICON wallet. You can now deposit collateral from any supported blockchain, and receive bnUSD on the chain of your choice.

Learn more about the Balanced Dollar stablecoin, and how you can open a cross-chain loan.

What is bnUSD, and what can you do with it?

If you’re new to Balanced and bnUSD, here’s what you need to know:

bnUSD is a decentralised stablecoin that tracks the price of 1 US dollar. It’s over-collateralised, so the total supply cannot exceed the value of the cryptocurrencies that back it.

bnUSD began on the ICON blockchain, but you can also use it wrapper-free on Arbitrum, Archway, Avalanche, Base, BNB Chain, Havah, and every additional blockchain Balanced connects to.

You can borrow bnUSD, transfer it cross-chain, and swap it for crypto on any connected chain.

If you transfer bnUSD to ICON, you can also supply liquidity and take advantage of the Balanced Savings Rate. Liquidity pools earn 50% of the trading fees and some pools offer additional incentives, while the Savings Rate allows you to earn interest on bnUSD (currently ~ 15%) until you need to use it.

Learn more about the bnUSD stablecoin.

How to open a cross-chain loan

At launch, Balanced supports these collateral types:

- AVAX (Avalanche and ICON)

- BNB (BNB Chain and ICON)

- BTC (Arbitrum, BNB Chain, and ICON)

- ETH (Arbitrum, Base, BNB Chain, and ICON)

- INJ (ICON – Injective coming soon)

- sICX (ICON)

Loans are isolated, which means you’ll have a separate risk profile for each asset and chain. For example, if you deposit ETH as collateral on both Arbitrum and Base, you have two positions. You can borrow bnUSD against your Arbitrum ETH position without putting your Base ETH at risk.

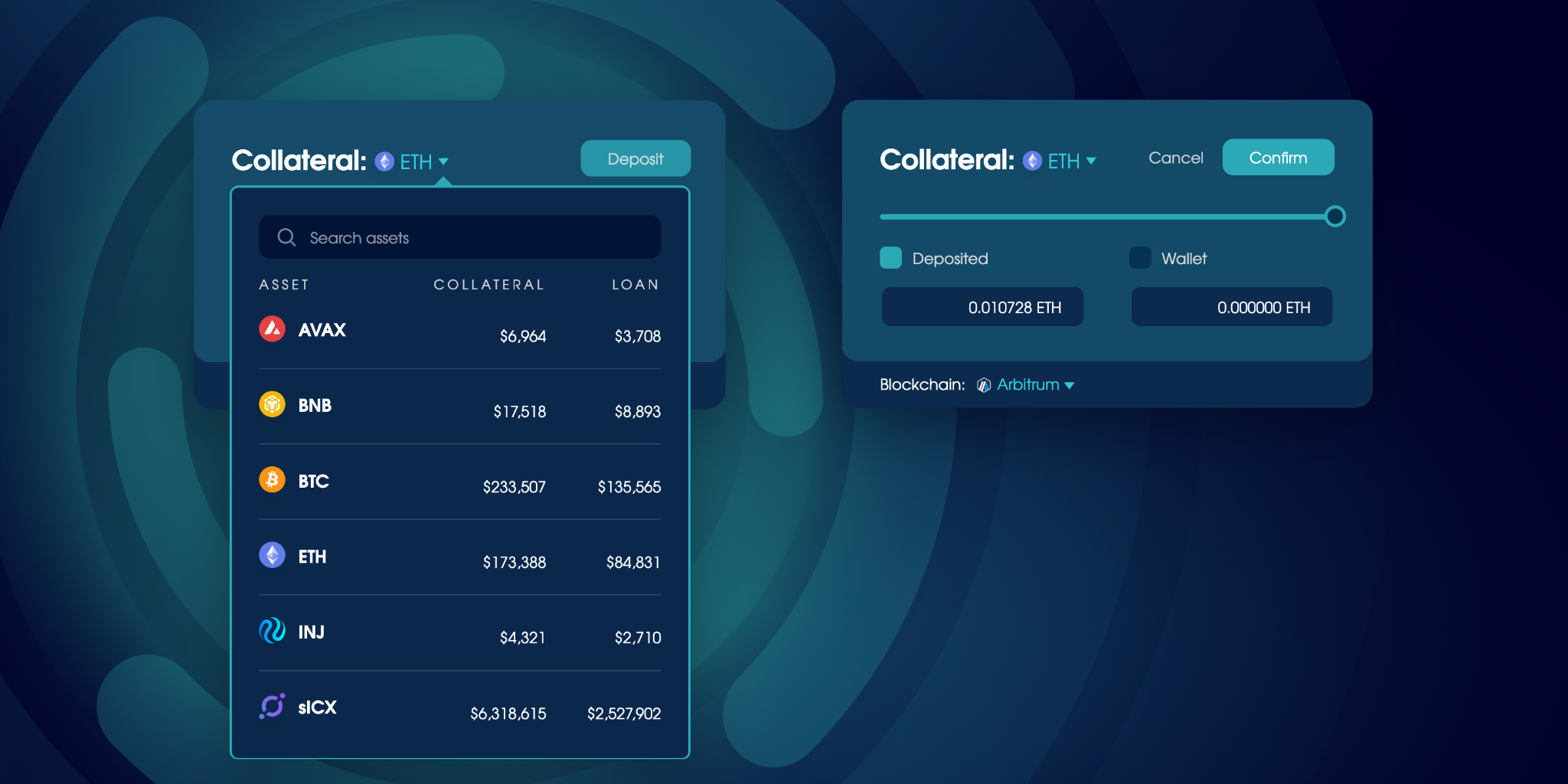

1. Deposit collateral

To deposit collateral, visit app.balanced.network and sign in with your wallet(s).

From the Collateral section:

- Choose a collateral type, then choose which blockchain to deposit from.

- Click Deposit and enter the amount.

- Click Confirm and complete the transaction.

It’s free to deposit collateral, but there’s a cross-chain fee that varies per blockchain.

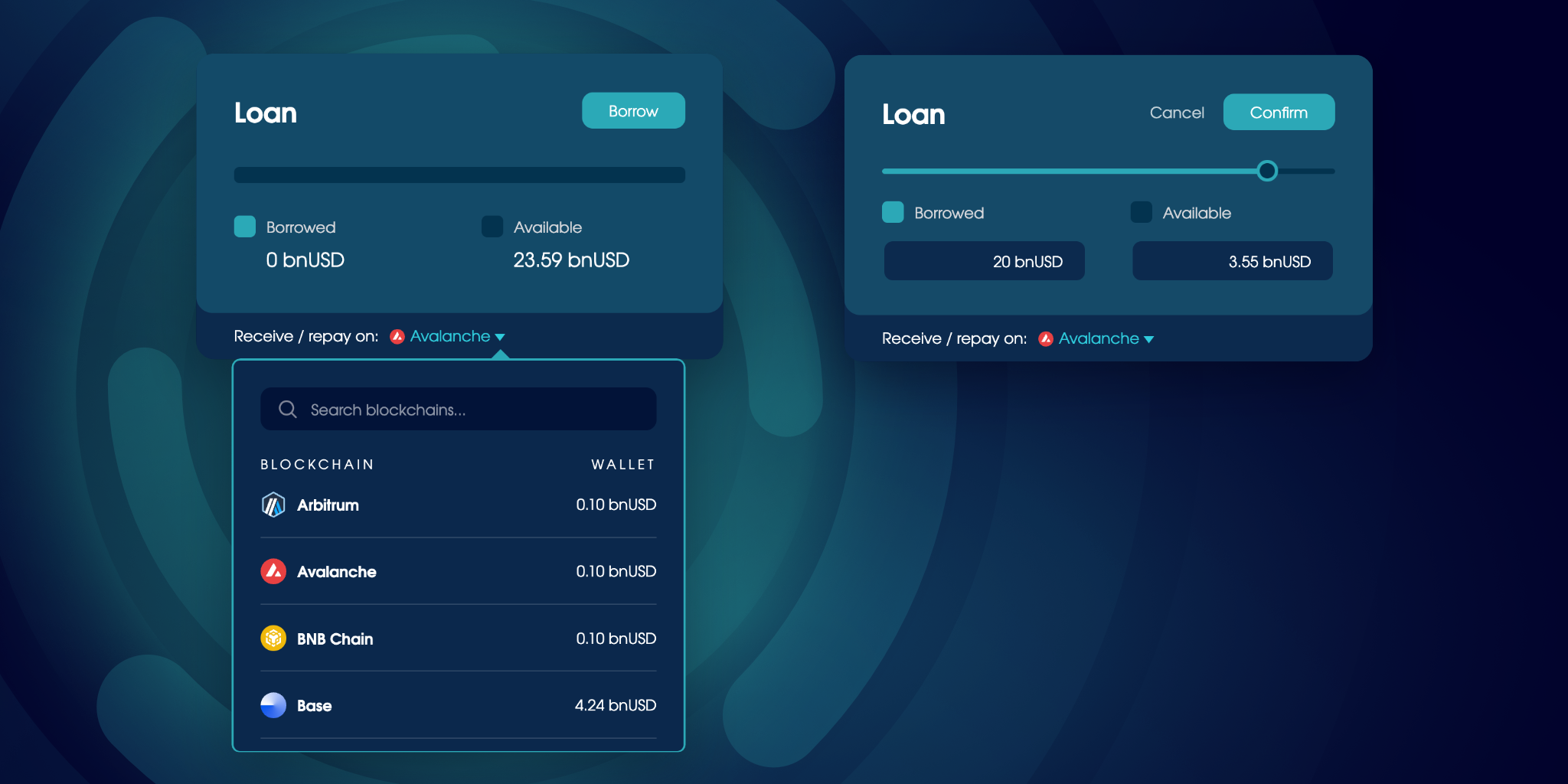

2. Borrow bnUSD

If you have multiple collateral types, set it to the one you want to borrow against. Then, from the Loan section:

- Choose which blockchain to receive bnUSD on.

- Click Borrow, then enter the amount.

- Use the Position Details section to assess your risk.

- Click Confirm and complete the transaction.

In addition to the cross-chain fee, there’s a 0.2% borrow fee and your debt will increase by 2% per year. Your debt is linked to your collateral, so you can receive and repay bnUSD on any connected chain.

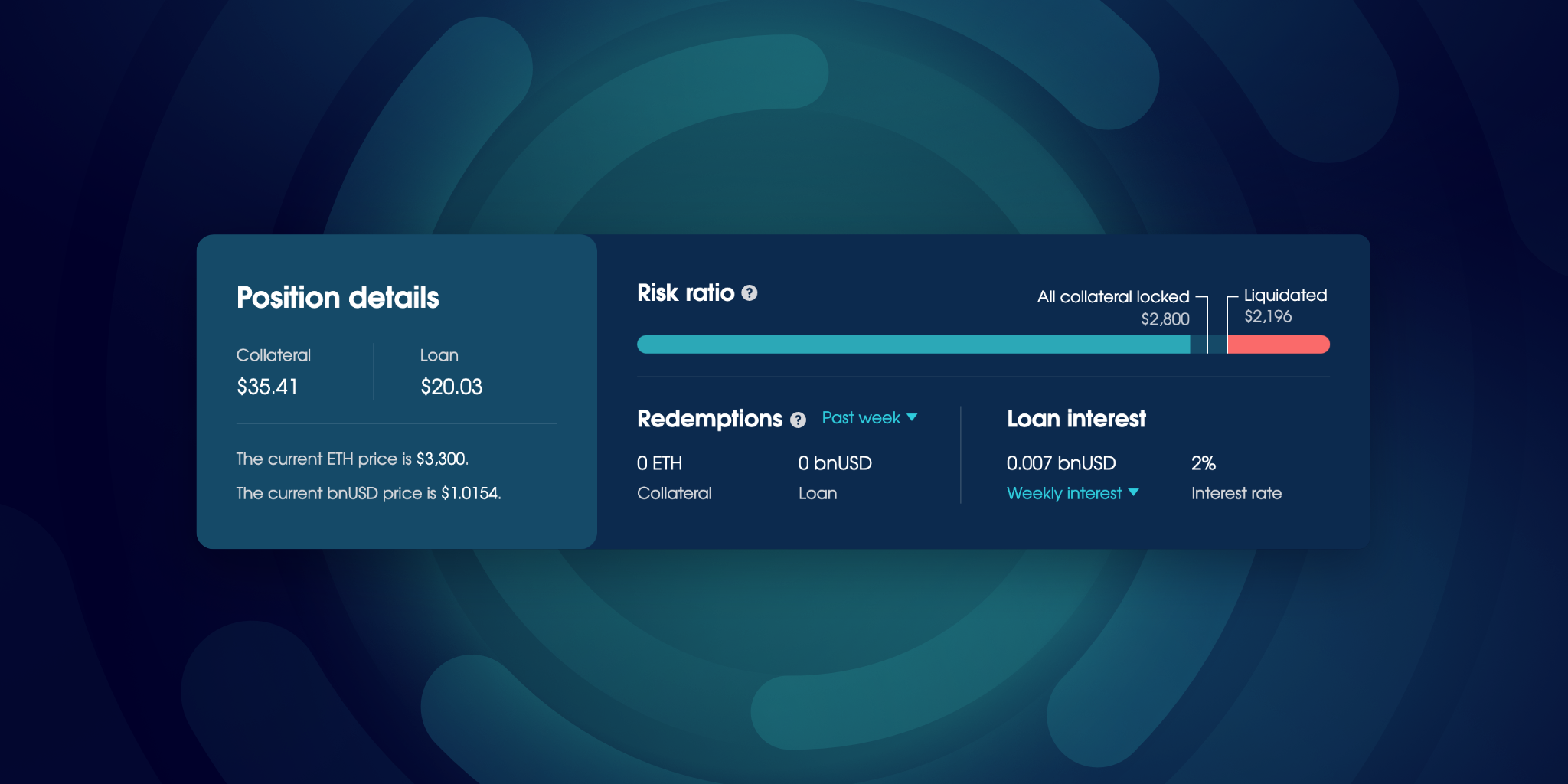

3. Monitor your risk

After you take out a loan, check the Position Details section regularly. It shows the price each collateral type has to reach before it gets liquidated to repay your debt, which helps you assess your risk against the market conditions.

Note that these prices are based on your current debt, and don’t account for interest accrued over time.

Learn what else Balanced does to keep the bnUSD price stable in this blog post:

Borrow bnUSD on your favourite blockchain

Experiment with cross-chain loans from the Balanced demo – no wallet required.

When you’re ready to leverage your crypto for real, visit the Balanced app.

To learn more about Balanced, visit the website, read the docs, and join the Balanced community on Discord.