Roadmap update | Q1 2023

Cross-chain transfers, governance updates, and plans for the first quarter of 2023.

2022 was a productive year for Balanced. It saw the release of a number of core upgrades, including multiple collateral types, Boosted BALN, the Stability Fund, Java smart contracts, and ICON Bridge.

The original vision from the white paper is now complete, so the focus for 2023 shifts to maintenance, governance, and sourcing funds for cross-chain efforts.

Ongoing funding for the Balanced contributors is minimal, as the current Worker Token model was designed with diminishing incentives in mind. Large-scale upgrades and cross-chain endeavours will require additional funding, so if any community members see an opportunity, please share it on the Balanced forum. The DAO Fund could also be utilised to fund Balanced's cross-chain expansion, much like the proposal to upgrade the marketing site and Stats page.

Funded or not, our passion for Balanced is as strong as ever. We continue to brainstorm revenue opportunities, seek funding, have regular calls, fix bugs, make minor enhancements, discuss governance proposals, and plan for the future.

In practice, this means that app updates will be less frequent and work may be a bit slower, so a quarterly approach to roadmap updates made more sense going forward. There will still be plenty of activity in Discord and on the forum, and all important updates will be shared on Twitter. Make sure you're following to stay up to date.

Project updates

Smart contracts

- Began scoping out the ICON SCORE architecture using xCall to support cross-chain plans

- Began scoping out a proposed security upgrade to enable a swift shut down in case of emergency

- Opened a discussion with the FYEO audit firm for an additional smart contract audit

Front end / back end

- Launched the ICON Bridge interface

- Added BTCB as a quote currency for liquidity pools

Quality of life and code improvements

- Updated the unstaking message in the ICX wallet entry

- Fixed rates in the Holdings section on the Performance Details page

- Updated the calculation for total fees earned

- Added BUSD to the Stability Fund section on the Performance Details page

- Updated the Stats page APYs to reflect the outcome of live voting

- Updated the estimated rewards in the app based on live voting

- Improved the live voting interface

- Fixed an issue that prevented the Loan section from loading the correct data

- Refactored the Liquidity Pools section to allow LP token staking for newly incentivised pools

- Changed the slippage value to red when it's 2.5% or above

- Added more decimal precision for high-price assets like BTCB and ETH

- Fixed an issue that limited wallet functionality on smaller screen sizes

- Added BUSD to the default token list

All Balanced development progress can be tracked in real-time by following our pull requests, open/closed issues, and commits in the Balanced Github repo.

Governance updates

Balanced governance discussions continue at a rapid pace, with many ideas being floated by community members. We'll summarise the proposals in each roadmap update, but to make sure you don't miss a thing, keep an eye on the forum, Discord, and/or Twitter, and look for the vote notification badge in the app.

Add ETH/bnUSD and BTCB/bnUSD to live voting

Now that ETH and BTCB are approved collateral types for bnUSD, it was important to increase their liquidity on the exchange. To incentivise people to bridge assets from BNB Smart Chain, the DAO voted to add ETH/bnUSD and BTCB/bnUSD to the list of pools supported by live voting.

At the time of publishing, both pools receive around 8.5% of the BALN liquidity incentives. If you'd like to participate, you can bridge your assets from the Trade page. See Learn how to transfer between blockchains for more info.

Add protocol-owned liquidity to the sICX/bnUSD pool

To increase Balanced's earning potential, the community voted to send 1.25 million sICX and ~216,000 bnUSD from the DAO Fund to the sICX/bnUSD liquidity pool. The sICX/bnUSD pool is currently the second-highest earner, receiving ~28% of the daily liquidity incentives.

The BALN earned by Balanced's position in this pool can be claimed via smart contract, and will be locked for 4 years.

Another protocol-owned liquidity discussion is ongoing to boost the liquidity of ETH and BTCB using Karma Bond.

Add BUSD to the Stability Fund & limit IUSDC to 250K

To further diversify the assets backing the Balanced Dollar, the DAO voted to add BUSD (from BNB Smart Chain) to the Stability Fund, with deposits capped at 2 million.

The IUSDC limit was also reduced by 90% in order to decrease Balanced's reliance on assets maintained by another bridge provider. The maximum limit is now 250,000 IUSDC – 41.5K less than is currently in the fund. The Stability Fund won't accept any IUSDC until it gets below the limit.

DAO performance

Over the month of January, Balanced earned $22,717 from fees:

- 4,897 bnUSD from loans

- 721 bnUSD from the Stability Fund

- $16,226 from swaps

$13,106 of that was distributed to bBALN holders, which gives bBALN a 30-day trailing APY of 19.54%.

Balanced also earned 6,084 BALN ($862) for its protocol-owned liquidity, which it locked to receive $10 of network fees.

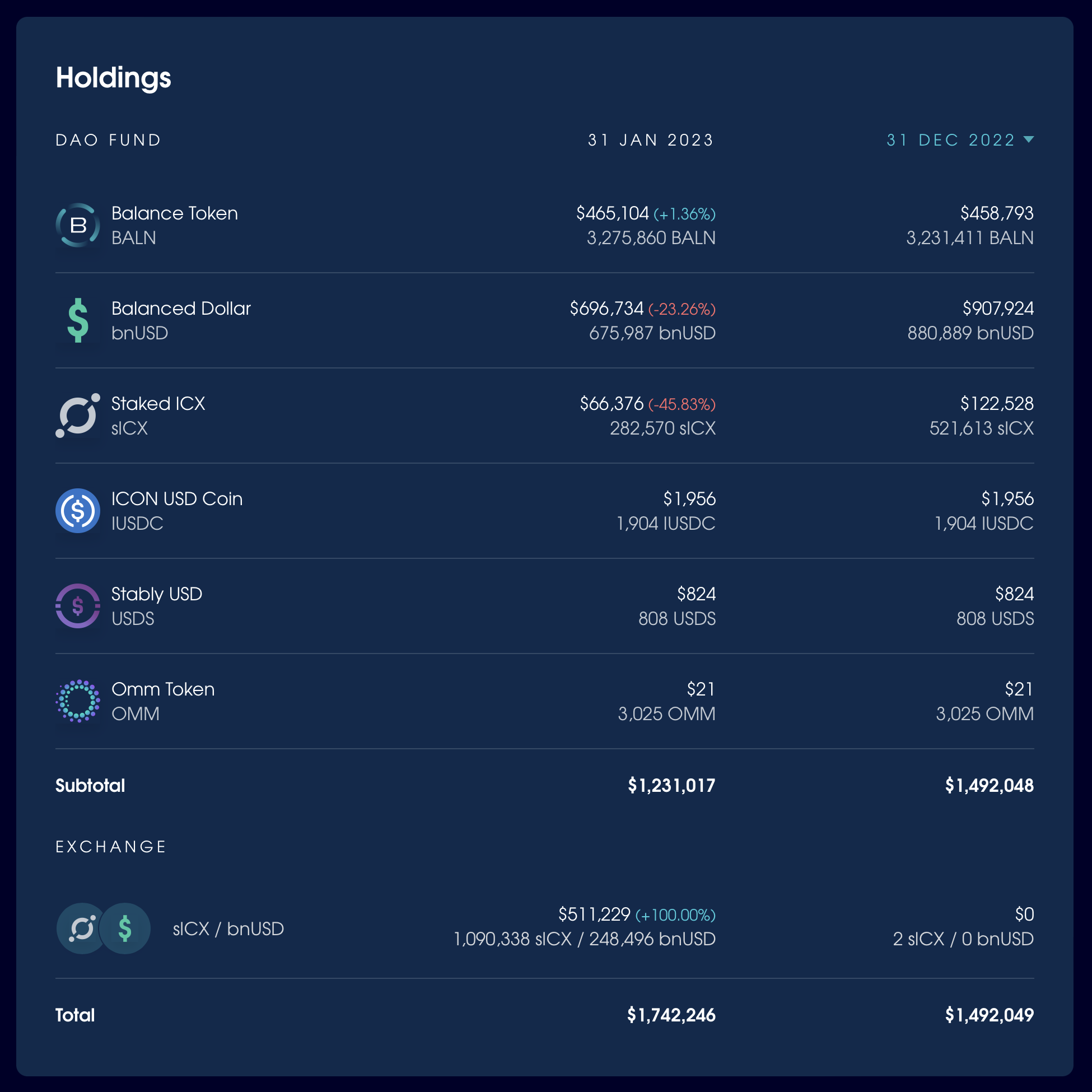

Over the last month, Balanced's holdings have increased by $250,197. A large portion of the sICX and bnUSD was also relocated to the sICX / bnUSD liquidity pool:

And since the launch of bBALN, 12,066,441 BALN have been locked in 911 wallets. There are 5,671,718 bBALN, giving an average lock-up time of 1.88 years:

Balanced wallpapers and NFTs

The cover for this roadmap update, Birth, has been added to the collection of Balanced wallpapers.

The animated version has been added to the Balanced NFT collection on Craft.

If you’d like a chance to win the Birth NFT, retweet the roadmap announcement on Twitter and tell the community which cross-chain opportunities you think Balanced should explore first.

The winner will be announced 7 days after publishing.

Plans for Q1 2023

During the remainder of Q1, the Balanced contributors plan to:

- Work with FYEO to conduct a security audit of the Balanced smart contracts

- Discuss and implement safety measures to react to emergency situations

- Further decentralise the contract ownership structure

- Continue governance proposals to actively manage and grow the DAO Fund / protocol-owned liquidity

- Replace rebalancing with a simple redemption mechanism

- Continue upgrading the Balanced website and Stats page

- Continue exploring funding opportunities for cross-chain efforts and larger feature upgrades

If you have any questions or want to discuss these updates, start a discussion on the Balanced forum or in the Balanced Discord channel.