Roadmap update | October 2022

BTCB was approved as a collateral type, and work is ongoing for Boosted BALN and a custom UI for ICON Bridge.

The multi-collateral upgrade was completed during September, and the community approved BTCB (bitcoin from BNB Smart Chain) as the first new collateral type. Since then, the Balanced contributors have been focused on Boosted BALN and a custom interface for ICON Bridge.

Boosted BALN is the final core feature to deliver from the white paper and early Balanced governance, so cross-chain efforts will become the main focus after bBALN is live. The cross-chain architecture design is almost finished, and the contributors are discussing resource requirements before they request support from ICON's Interoperability Incentive Fund.

Here’s what the Balanced contributors accomplished in September:

Smart contracts

- Continued to push commits for different features to the Boosted BALN pull request

- Deployed bBALN tokens on the Berlin testnet

- Deployed bBALN-based rewards on the Berlin testnet

Front end / back end

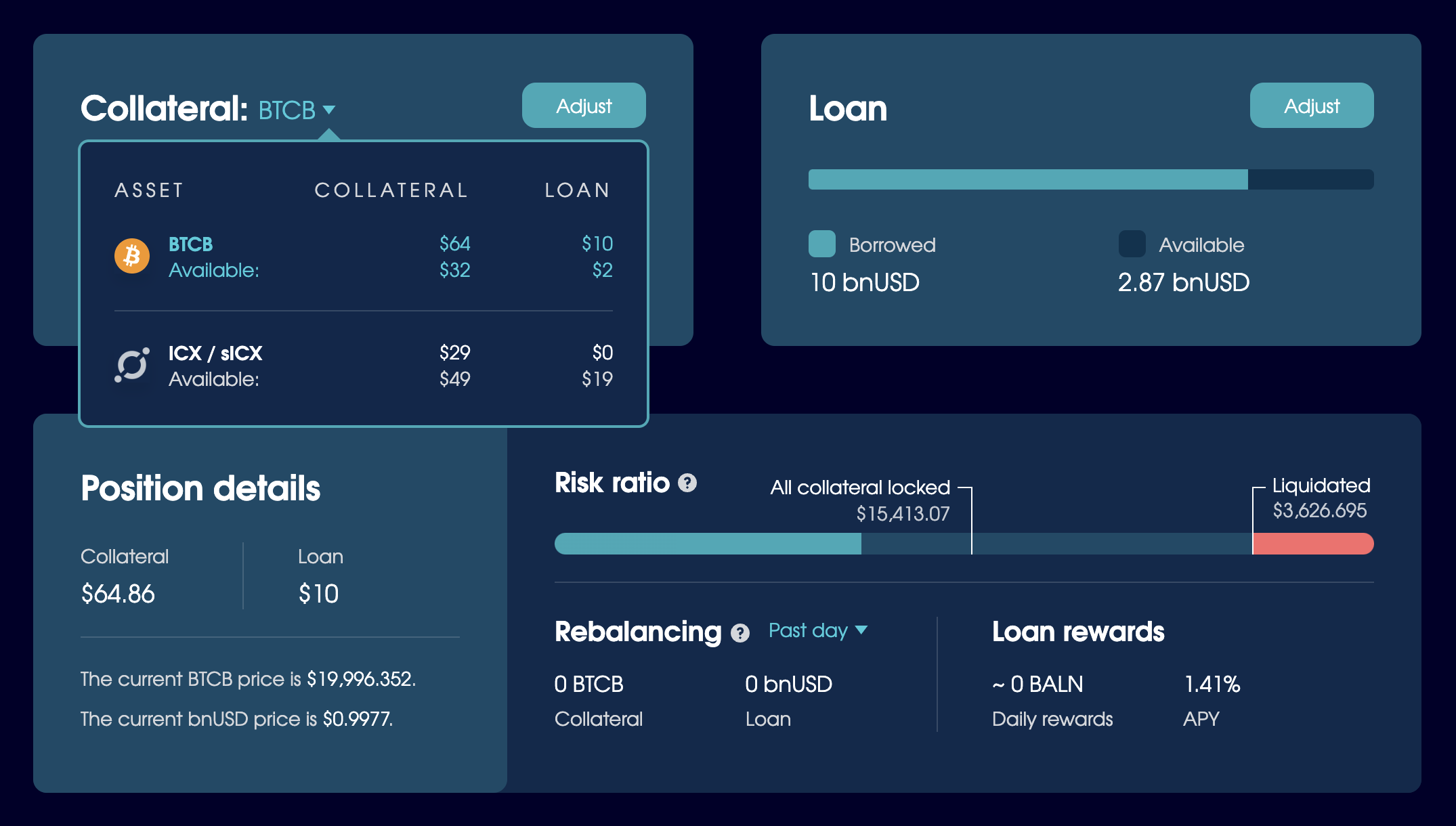

- Added support for BTCB as a collateral type

- Released a new Liquidity Pools section to highlight incentivised pools

- Resumed work on the ICON Bridge integration

- Organised additions for the back end service, including new APIs for the Stats page

Quality of life and code improvements

- Fixed a bug that prevented network fee claims after unstaking BALN

- Fixed several rounding issues

- Changed the transaction links to tracker.icon.community

- Updated the TVL calculation on Defi Llama

- Fixed an issue with claiming fees through app.balanced.network/claim

- Fixed an insufficient balance error on the Trade page

- Fixed the position details section to show BALN rewards for all active positions

- Fixed an issue with withdrawing all collateral or repaying all debt

- Updated the Stats page to use the borrowerCount API and contractMethods endpoint

Multiple collateral types

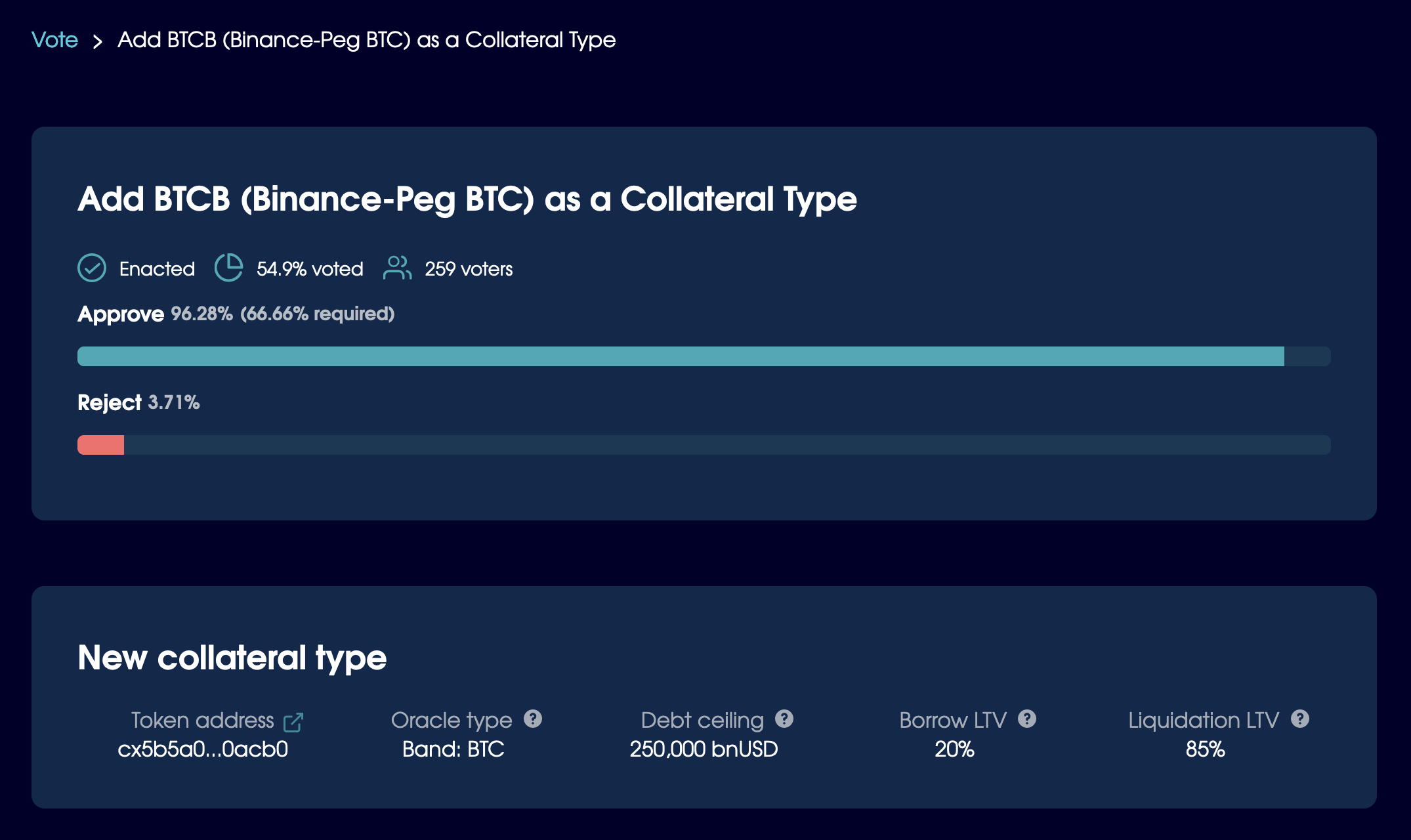

At the beginning of September, the smart contracts were upgraded to support multiple collateral types for bnUSD, and a New collateral type proposal was added to the Vote page.

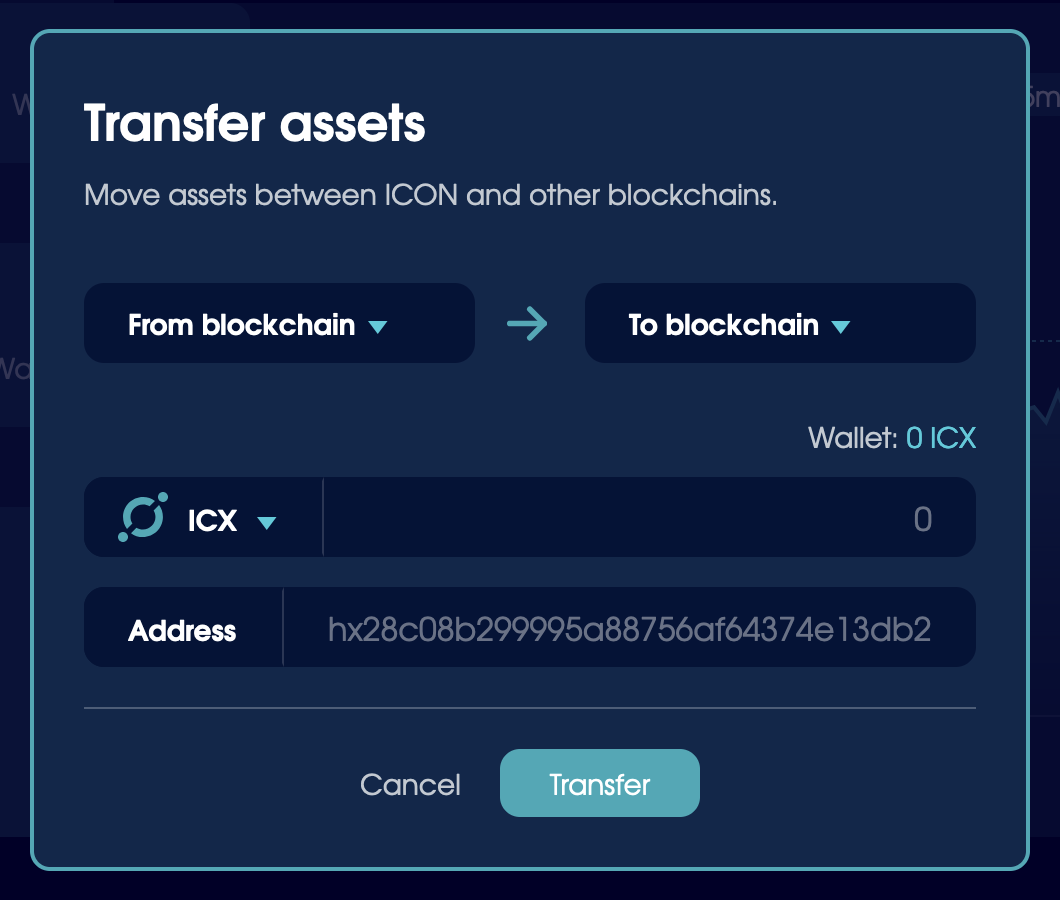

The Balanced community immediately began discussions to add BTCB as the first new collateral type. BTCB is bitcoin from BNB Smart Chain, and can be transferred to ICON via ICON Bridge and the Nexus interface.

The community approved the BTCB collateral proposal, so it can now be used to mint up to 20% of its value in bnUSD, up to a maximum of 250,000 bnUSD.

Soon after voting ended, the app was updated to support it:

ICON Bridge is still in beta, so only 11 BTCB transactions have been made through Nexus so far — all for the purpose of depositing as collateral on Balanced.

To make bridged assets more accessible to Balanced users, the Balanced contributors have resumed work on a custom interface for ICON Bridge, which will be added to the Trade page soon.

Boosted BALN

Progress on the Boosted BALN upgrade has been steady, so the contributors expect to have it on testnet by the end of October. bBALN has been in discussion since 2021 (delayed due to the Java smart contract migration), so here’s a refresher of what it is and what it means for Balanced.

Boosted BALN uses a vote-escrow model similar to Curve. Instead of staking BALN with a 3-day unstaking period, you choose a lock-up time for your tokens: 1 week, or up to 4 years.

The amount you lock up and for how long dictates how many bBALN you’ll receive. 1 BALN locked for:

- 1 week = 0.0048 bBALN

- 1 month = 0.0208333 bBALN

- 3 months = 0.0625 bBALN

- 6 months = 0.125 bBALN

- 1 year = 0.25 bBALN

- 2 years = 0.5 bBALN

- 4 years = 1 bBALN

After the upgrade, bBALN will dictate voting power, BALN rewards, and network fee payouts. Those who are committed to Balanced long-term will have more influence over its direction, and will benefit the most from its success.

BALN rewards for borrowing bnUSD and supplying liquidity will be determined by your position size and bBALN holdings compared to everyone else’s.

bBALN holders can also participate in “live” voting: the ability to allocate BALN to specific liquidity pools. Instead of formal proposals, people will be able to delegate bBALN to the pools of their choice, and Balanced will automatically adjust the BALN rewards every 2 weeks.

Live voting will introduce another utility for BALN, known as “bribing”: Projects can offer token rewards to bBALN holders who support a specific liquidity pool. For example, FRĀMD could offer rewards to everyone who allocates BALN to the FRMD / bnUSD liquidity pool.

Monthly performance

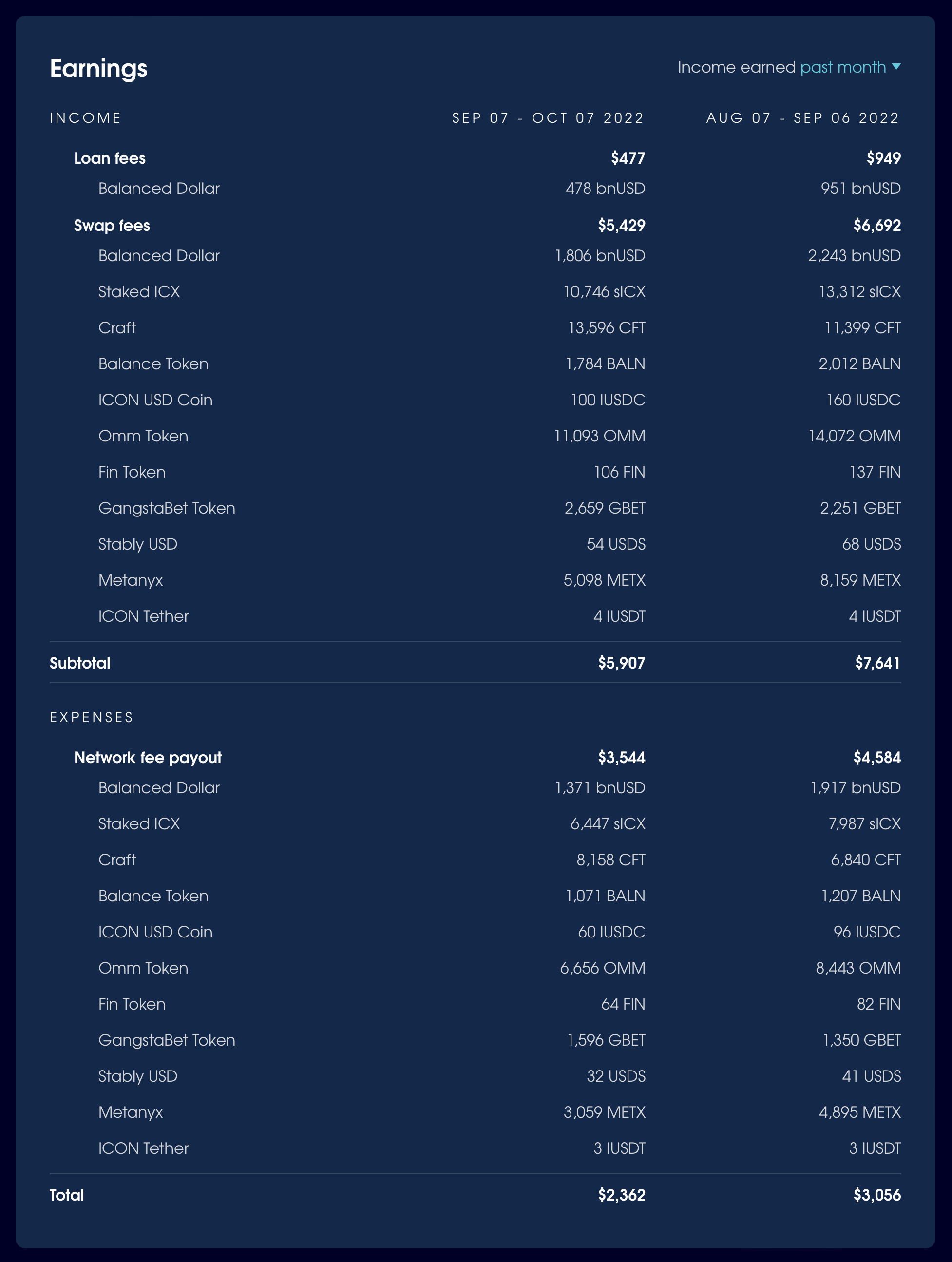

In the month from 7 September – 7 October, Balanced earned 478 bnUSD from loan fees and $5,429 from swap fees, for a total of $5,907.

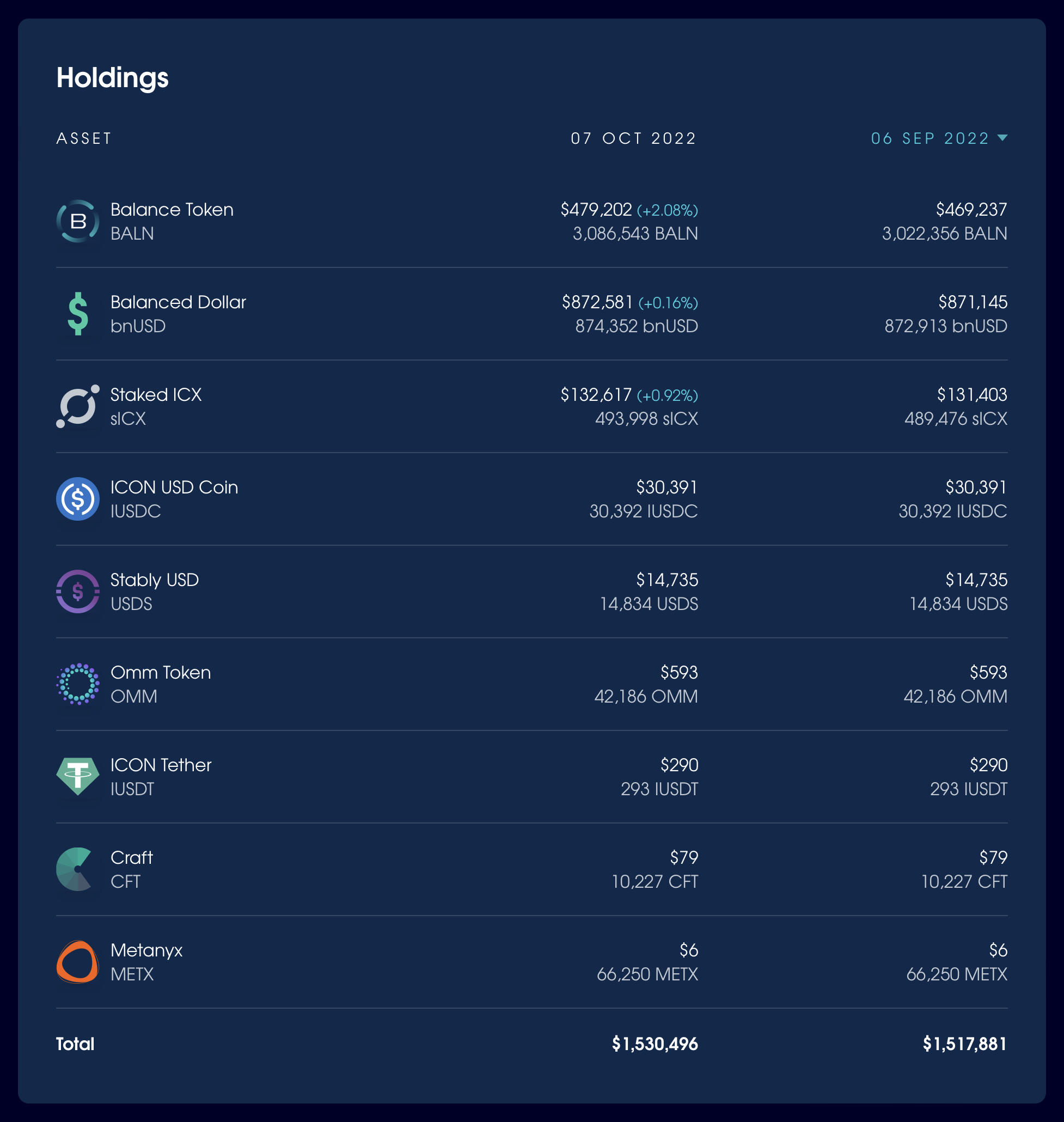

The DAO Fund increased by $12,615 to leave a total balance of $1,530,496 based on current market prices.

Balanced wallpapers and NFTs

This month’s roadmap design, Float, has been added to the collection of Balanced wallpapers.

The animated version has been added to the Balanced NFT collection on Craft.

If you'd like a chance to win the Float NFT, retweet the roadmap announcement on Twitter and tell us why you're excited for the upcoming launch of bBALN.

The winner will be announced 7 days after publishing.

Goals for October

The contributors’ main focus for October is to prepare for a smooth transition to the bBALN token economics. They expect to have bBALN on the Berlin testnet and integration testing almost complete by the end of the month.

Smart contracts

- Deploy and test the entire bBALN feature set on the Berlin testnet

- Begin bBALN integration testing

Front end / back end

- Add the bBALN APIs to the bBALN interface and launch on testnet

- Design and launch the bBALN live voting interface on testnet

- Launch the ICON Bridge interface

- Add parameter support to blockHeight-based API calls

If you have any questions or want to discuss these updates, start a discussion on the Balanced forum or in the Balanced Discord channel.