Roadmap update | April 2022

Java smart contract progress, a new stablecoin page, and a look at what's coming in the Balanced pipeline.

The main focus for the Balanced contributors continues to be the Java smart contract migration. Many features the community has been eagerly waiting for, like continuous rewards, multiple collateral types, and Boosted BALN, have been put on hold until this work is complete, but as we enter April, we can now see the light at the end of the tunnel.

Here's what was accomplished in March:

- Published a webpage dedicated to bnUSD: balanced.network/stablecoin

- Developed a multi-call smart contract to reduce API calls by the Balanced frontend (currently in review)

- Began work on multi-language support for the app, starting with Korean and French

- Began implementing advanced TradingView functionality

- Added the FIN token to the Statistics page

- Fixed a critical issue with the Staking Management contract that would periodically prevent ALL sICX transfers

Java smart contract migration:

- Loans - Translation complete, pending review

- Rebalancing - Review complete, pending deployment

- DEX - Translation in progress

- Rewards - Translation complete, pending review

- Governance - Translation in progress

- Emergency Reserve - Deployed to mainnet

- Token contracts - Review complete, pending deployment

- Router - Review complete, pending deployment

- Fee Handler - Review complete, pending deployment

- DAO Fund - Review complete, pending deployment

- Dividends - Translation complete, pending review

- Staking Management - Deployed to mainnet

Quality of life and code improvements:

- Prevented the entire app from reloading when you switch pages

- Refactored the Ledger code and fixed some bugs that caused the confirmation to appear in multiple places

- Added an error message to alert users if a transaction failed due to the wallet and app being set to different networks

- Fixed bugs on the supply liquidity panel

- Added keyboard controls to the swap/supply liquidity asset selectors

- Hid pools with tiny values in the liquidity details section

- Fixed the logic for claiming network fees, so it now only switches to “1 of 2” if fees haven't been claimed for 50+ days

Monthly performance

A new addition to the Balanced roadmap updates, this section will make it easier for community members to see how well Balanced has performed compared to the previous month.

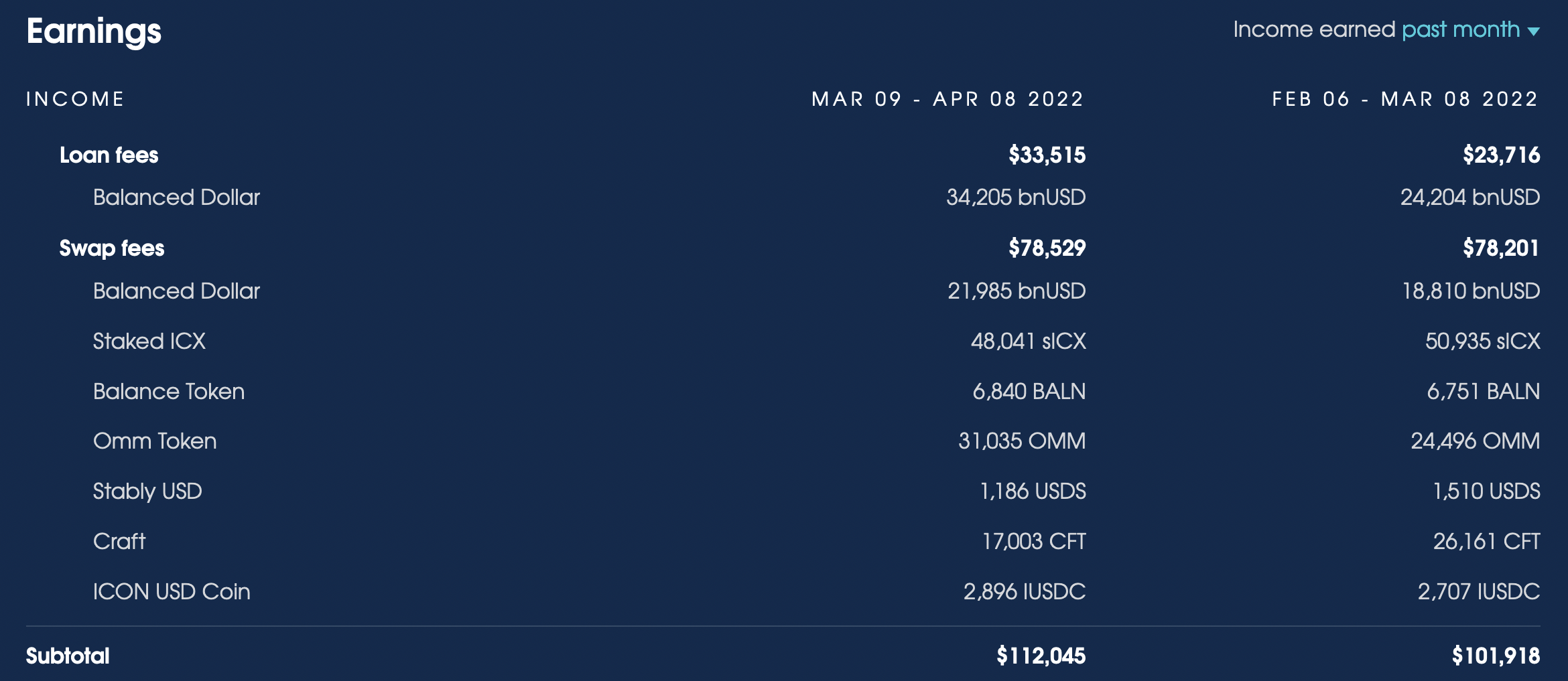

In the month from 9 March - 8 April, Balanced earned $33,515 from loan fees, an increase of 41.32% over the last month. Swap fees remained steady at $78,529, an increase of 0.42%.

Overall, Balanced earned an additional $10,127 compared to February, an increase of 9.94%.

The DAO fund increased by $142,398, a 5.3% gain over the past month, to leave a total balance of $2,824,432.

Targets for April

- Finish multi-language support for the Balanced frontend

- Deploy all remaining Java contracts to mainnet

- Activate continuous rewards on mainnet

- Deploy the protocol-owned liquidity contract to mainnet (delayed because of COVID)

- Release advanced TradingView functionality for the Trade page

- Deploy the multi-call smart contract and integrate with the Balanced frontend

- Continue to work on a new landing page for the Balanced website

Looking ahead

While the smart contract developers have been focused on Java migration and running tests, other early contributors and community members have been thinking about Balanced's future and priorities post-migration. Here's a look at what's coming.

Multiple collateral types

New collateral types are essential to grow the Balanced community and bring more stability to bnUSD. With less volatile collateral types, like USDC, the DAO can enforce tighter rebalancing thresholds. This will provide clearer arbitrage opportunities, and significantly reduce the burden on borrowers who maintain the bnUSD peg with volatile collateral types, like sICX.

Balanced exchange v2

To increase both liquidity and volume on the Balanced exchange, two key features need to be added:

- A stableswap invariant pricing mechanism for like-kind assets (i.e. bnUSD and USDC). This will significantly reduce slippage on stablecoin trades, so the exchange can support larger trades and higher volume. Combined with stablecoin collateral types, this feature will help maintain the stability of bnUSD.

- The ability to lend Balanced liquidity on Omm to earn additional yield for liquidity providers. Liquidity pool assets that are also available on Omm will be automatically deposited into Omm markets to earn yield.

Boosted BALN (bBALN)

Boosted BALN has been on hold ever since the Java migration began. Pending some minor changes and testing, it should be available soon after the Java migration is complete.

Cross-chain strategy

Many community members have been discussing the best cross-chain strategy for Balanced. As some of them are core contributors to BTP, ICON’s flagship cross-chain solution, there are some tentative plans to deploy the Loans contract and bnUSD across all connected blockchain networks.

bnUSD would be compatible across all connected networks using a new token standard, which will need to be developed by the Balanced community, to allow minting/burning of bnUSD through BTP messages.

For example, someone could mint bnUSD on Binance Smart Chain with BNB collateral, and send the bnUSD to ICON. Instead of becoming a wrapped token, like USDC -> IUSDC, this bnUSD would be the exact same as ICON-native bnUSD. Balanced and bnUSD could then be used to settle all cross-chain trades in the BTP ecosystem.

While these features are dependent on BTP, it’s never too early to start planning a sustainable cross-chain strategy. This will continue to be ironed out and discussed amongst community members.

With so many great features in the pipeline, we’re also excited to share that another Java SCORE developer has joined our active community development team. We're still looking for one more dedicated Java contract developer to increase our capacity to implement and review code, so if you have any interest or possible leads, reach out to us on Discord.